Many Western economies face a demographic time bomb – an ageing population, which places strain on government spending and the welfare state. To deal with this situation, governments face several difficult choices –

- Raise taxes to pay for pensions,

- Shift the emphasis on to the private sector provision of pensions,

- Raise the retirement age

- Cut other forms of spending to be able to maintain pension commitments.

Recently, the UK chancellor George Osborne, has suggested that he favours a solution which involves automatically linking state pension to life expectancy; this could see the state retirement age, increasing to 70. It is estimated, this could save up to £500bn over 50 years; there would be a very significant opportunity cost to keeping the retirement age at 65.

However, others are more critical of increasing the retirement age. They argue that raising the retirement age will adversely affect low income workers who find it more difficult to save for a private pension. Also, some economists question whether we really have a demographic time bomb, and argue that the fears of an ageing population are exaggerated.

The extent of the problem

The dependency ratio is the ratio of people who are not of working age compared to those who are of working age. If there is a higher % of pensioners then the dependency ratio will rise. Basically a higher dependency ratio means a relatively greater number of benefit recipients to tax payers.

Source: Dept for work and Pensions

This graph shows that all Western economies face a rise in the dependency ratio (assuming a retirement age of 65). However, the UK’s demographic forecast is not as bad as other countries. This is partly because the UK has had significant levels of immigration and an increase in the population.

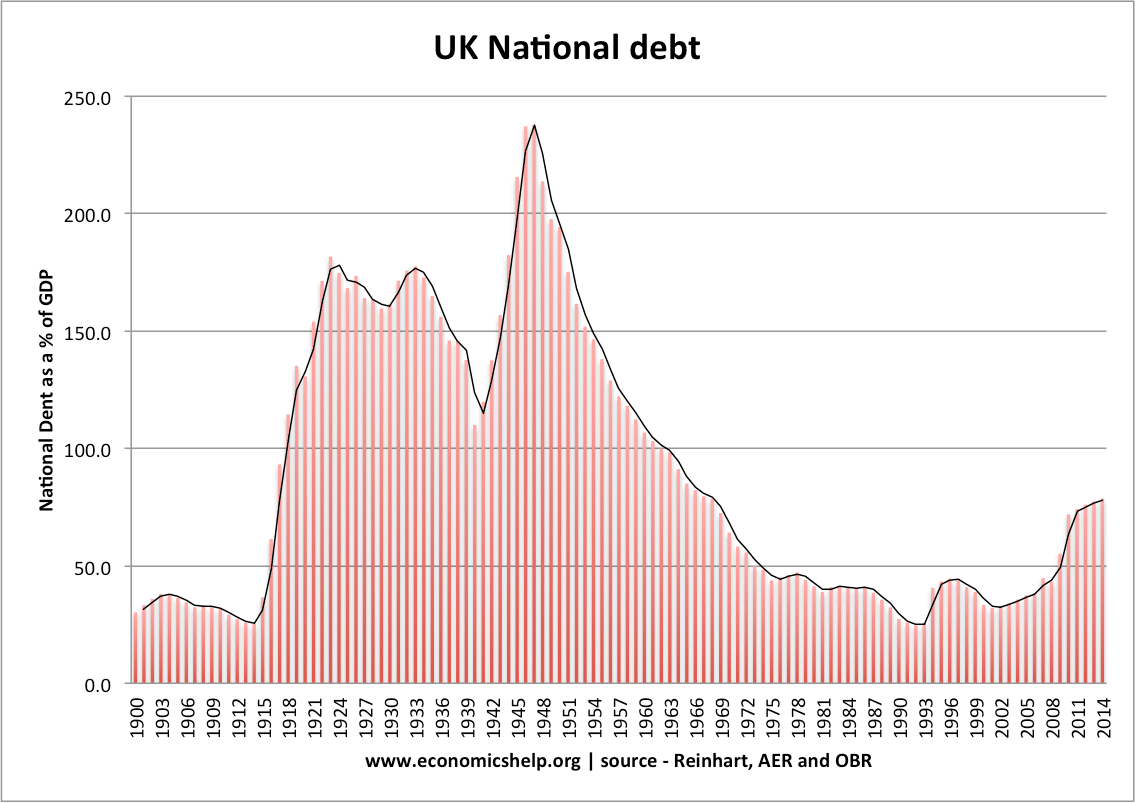

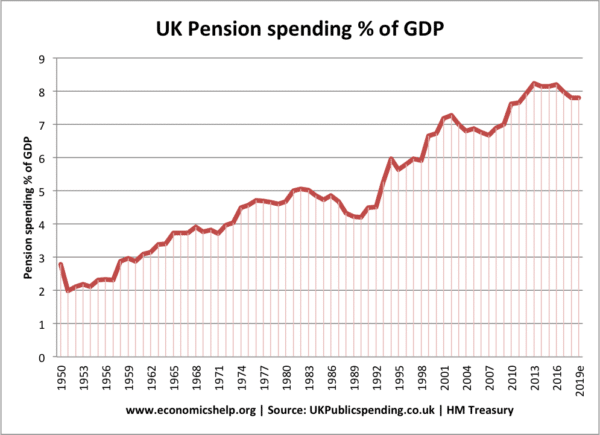

How UK spending on pensions has increased

Arguments for raising the pension age to 70

1. Increasing life expectancy . Increasing life expectancy means that it makes sense to raise the retirement age. When the first state pensions were introduced in 1908, the pension age was set at 70. It was later reduced to 65. But, since the start of the Twentieth Century, we have seen a rapid increase in life expectancy. It means that people are living for longer. If we keep the retirement age the same, we are trying to support an ever increasing % of people’s life in retirement. Rather than seeing it as a bad thing the retirement age is increasing, we should see it as a good thing we are enjoying greater life expectancy. Since 1981, longevity has increased 5.3 years

2. Higher tax revenue. As well as saving the government pension spending, if people work longer it will increase income tax revenues. Increasing the labour supply will also increase the productive capacity of the economy.

3. Will enable the government to increase the value of the state pension. If the retirement age is increased, the government will be able to afford an increase in the real value of the state pension. A higher basic state pension will help reduce poverty without creating disincentives to save that means tested top up benefits do. People may prefer a decent pension spread over a smaller number of years than a limited pension stretched over a longer time period.

3. More flexible labour markets. At the moment, several professions have a fixed retirement age; this means people have to retire at a certain age, even if they would prefer to keep working. Increasing the state pension age, will enable people to work longer. It may be that people work part time towards the end of their working life, but it will help increase the supply of labour. With jobs increasingly non-manual, there isn’t any physical barrier for people to keep working. It means the economy can benefit from highly experienced and highly skilled workers.

4. Better than the alternatives. The alternatives to increasing the retirement age are also unattractive. It would entail placing a higher tax burden on the working population; these higher tax rates could reduce incentives to work.