Readers Question: Why do monopolies occur in industries with substantial economies of scale?

Question: As a result of large-scale production, the long-run average cost of production falls. This means that a monopoly can emerge in time naturally because of the relationship between average cost and the scale of an operation (Why? I don’t understand)

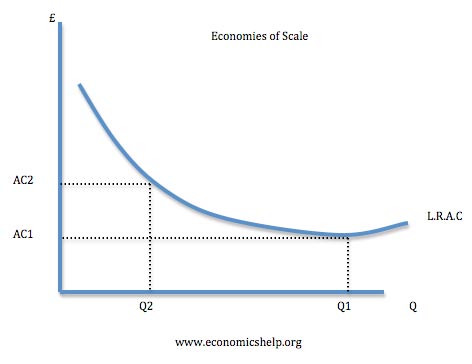

The diagram above shows an industry with economies of scale. This means as output increases, the long run average cost falls.

Imagine the steel industry. Suppose it costs £10 million to build a steel factory. With this high fixed (capital) cost, the more you produce, the lower the average cost per unit of steel.

If a firm increases output to Q1, it will have a low average cost of AC1 (e.g. £3). This means that smaller firms producing Q2 will have a higher average cost AC2 (e.g. £6)

This means the smaller firm is facing much higher average costs and is unlikely to be able to survive. The biggest firm producing at Q1 could sell goods for £4 – leaving a profit margin of £1. But, if the smaller firms face average costs of £6 when the price is £4 – it will make a loss, and therefore leave the business.