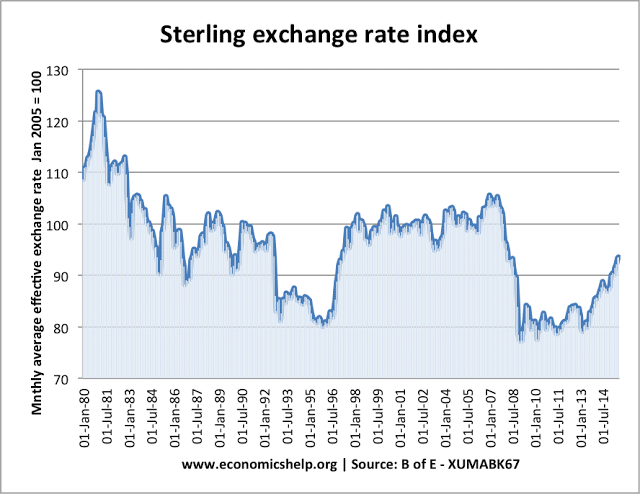

A summary for understanding exchange rates. Factors that affect exchange rates and the impact of exchange rates on the economy.

Terminology

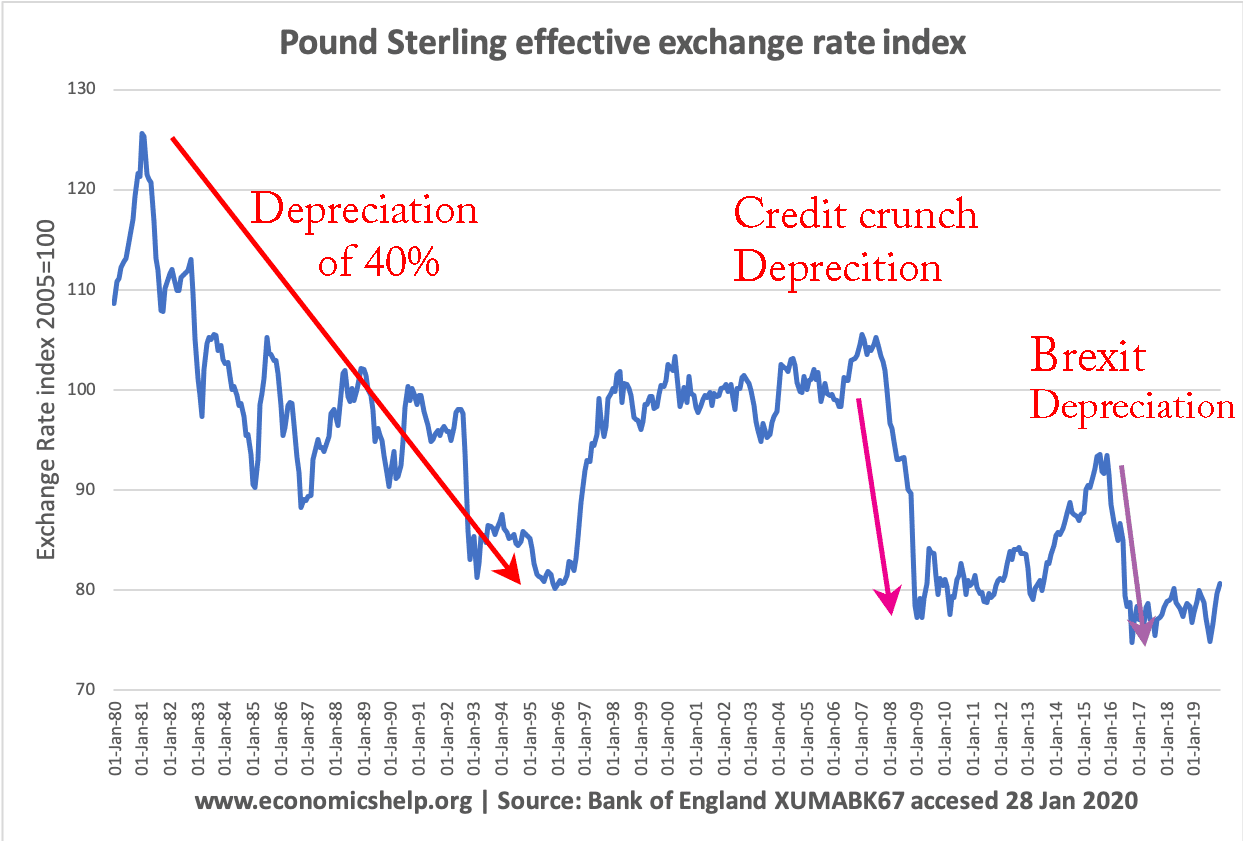

- Depreciation/devaluation – fall in value of exchange rate – exchange rate becomes weaker (see also: definition of devaluation and depreciation)

- Appreciation – increase in the value of exchange rate – exchange rate becomes stronger.

Example of Pound Sterling depreciating against the Dollar

- £1 used to equal $2.

- Now £1 is only equal to $1.75

Video on Exchange rates

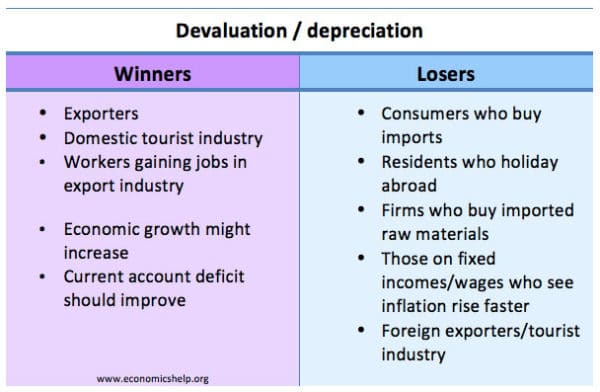

What is the effect of a depreciation in the value of the Pound?

- Buying goods from America becomes more expensive.

- If a meal cost $10, it used to require £5 (10/2) for a British tourist.

- But, now after the depreciation, the $10 meal will cost £5.71 (10/1.75)

- The depreciation in the pound may discourage British tourists to travel to the US.

- It makes US imports into the UK more expensive, so it may reduce UK imports

- UK exports will become relatively more competitive. It is cheaper for Americans to buy UK goods, so the quantity of exports should increase.

- UK inflation will increase. Imported goods are more expensive (cost push inflation). Also, British goods are more attractive causing a rise in demand (demand pull inflation)

Summary of depreciation

- A depreciation in exchange rate makes exports more competitive and imports more expensive

- A depreciation helps UK exporters and improves UK growth prospects, but causes higher prices and inflation.