Readers Question: explain how economists define ‘full employment’?

The first definition of full employment would be the situation where everyone willing to work at the going wage rate is able to get a job.

This would imply that unemployment is zero because if you are not willing to work then you should not be counted as unemployed. To be classified as unemployed you would need to be actively seeking work. This does not mean everyone of working age is in employment. Some adults may leave the labour force, for example, women looking after children.

But, in practice, we never see 0% unemployment, and this can make full employment hard to define. Generally, an unemployment rate of 3% or less would be considered to be full employment.

Optimal Unemployment Level

Another definition of full employment would be the ‘optimal’ level of unemployment. In practice, an economy will never have zero unemployment because there is inevitably some frictional unemployment. This is the unemployment where people take time to find the best job for them. Frictional unemployment is not necessarily a bad thing. It is better people take time to find a job suitable for their skill level, rather than get the first job that comes along. Generally, you may expect frictional unemployment to cause an unemployment rate of 2-3%. Therefore, some economists may claim that unemployment of less than 3% indicates ‘full employment’ – or at least very close.

Full Employment and Full Capacity

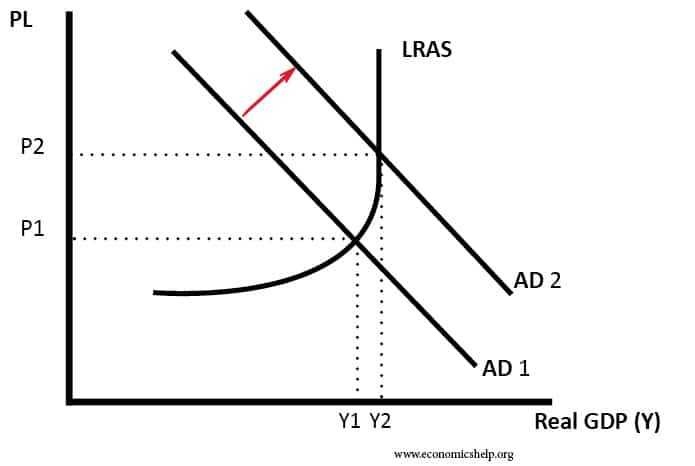

Another way to think of full employment is when the economy is operating at an output level considered to be at full capacity. i.e. it is not possible to increase real output because all resources are fully utilised. This would be a point on a production possibility frontier. It can also be shown in an AD/AS diagram.