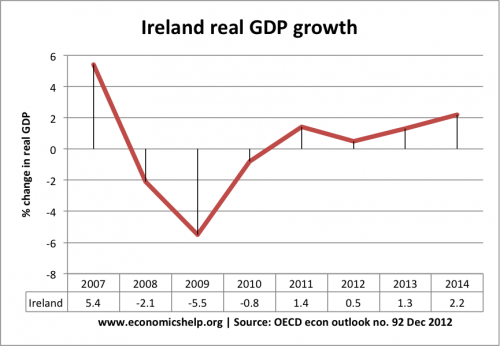

Ireland economic growth since the crisis

Source: OECD Stats Economic outlook no.92 Dec 2012 | Accessed March 2013 (2014 e)

Ireland GDP at constant market prices

Ireland economic growth since the crisis

Source: OECD Stats Economic outlook no.92 Dec 2012 | Accessed March 2013 (2014 e)

Ireland GDP at constant market prices

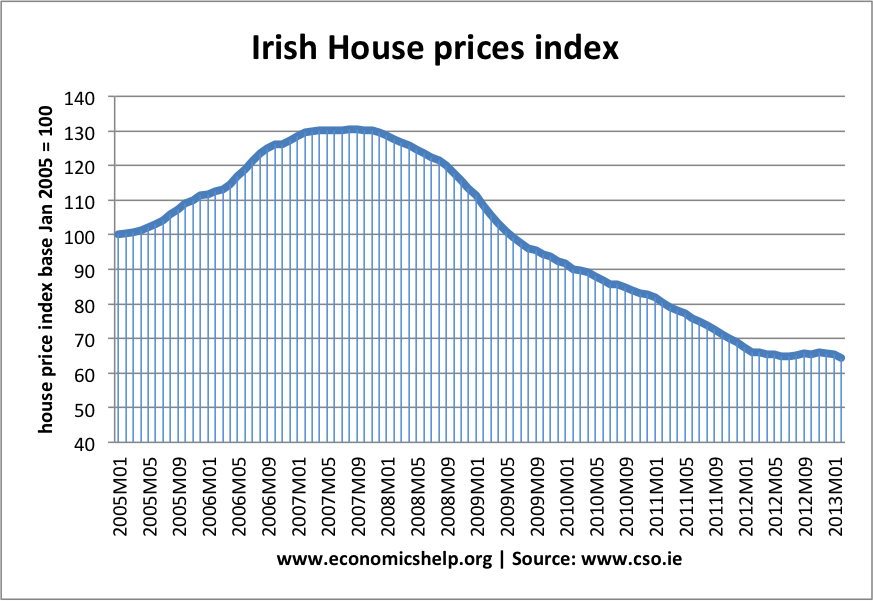

During the 1990s and first half of 2000, Ireland had one of the longest property booms on record. Between 1996 and 2006, the average price of second homes rose in Ireland rose by over 300%. The average price of new houses rose by 250%, according to the Department of Environment, Heritage and Local Government (DoEHLG). However, since the peak in early 2007, Irish house prices have fallen 50% – and there are few signs of promise for the Irish housing market.

The rapid rise in Irish prices was initially a reflection of economic fundamentals.

However, from the early 2000s, house prices increasingly reflected a boom period, with prices pushed higher by:

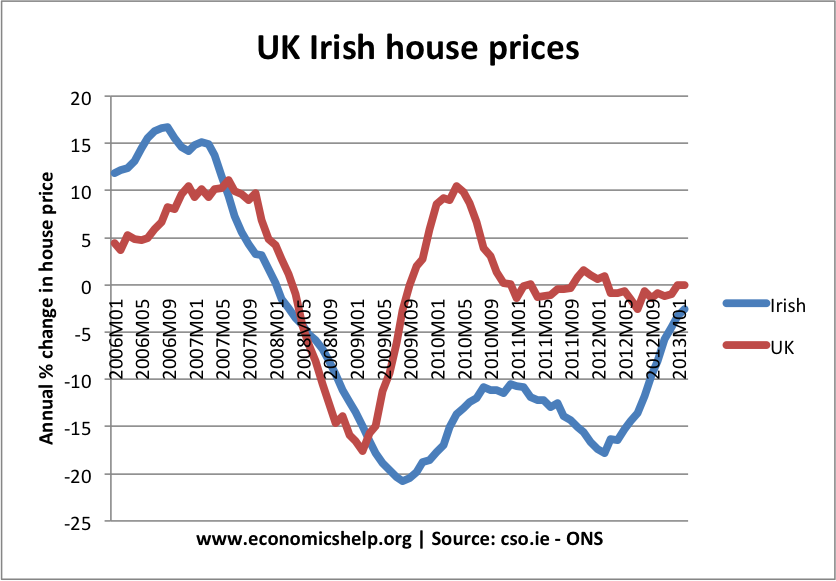

Both property markets see a sharp fall in house prices in 2008/09. But, whereas the UK property market stabilised, Ireland continued to see one of the longest continued periods of falling house prices – making it one of the biggest global property collapses.

Source: CSO