One of the most common questions asked is, who owns UK National Debt?

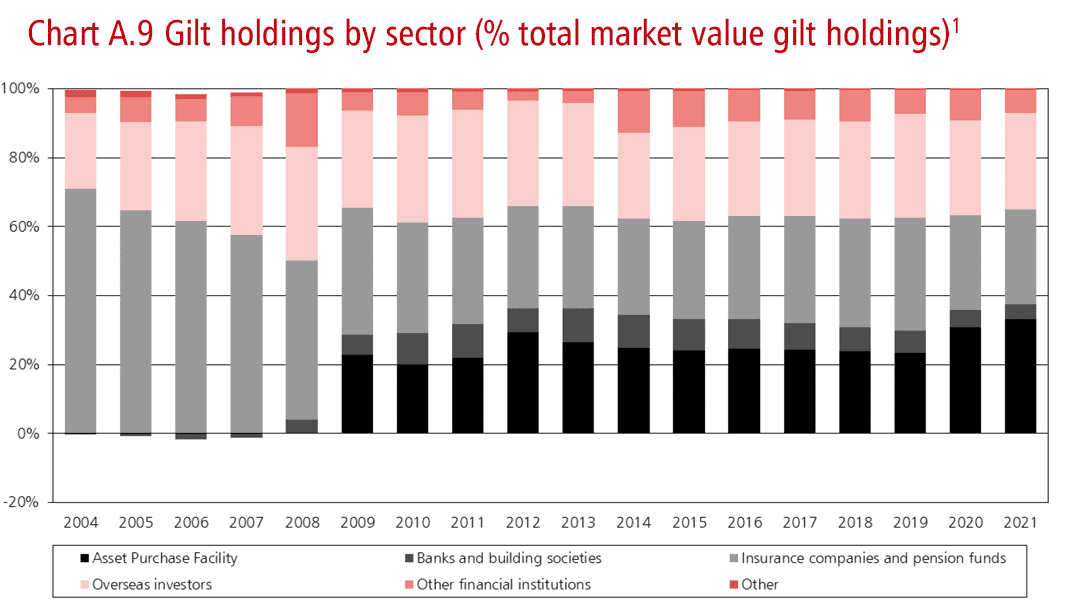

Often people assume that UK government debt is owned by foreign investors. However, foreign investors only hold about 25-30% of UK government debt. The rest is held by the UK private sector (pension funds, insurance companies e.t.c). Recently, the Bank of England has also been purchasing Gilts under the Asset Purchase Scheme.

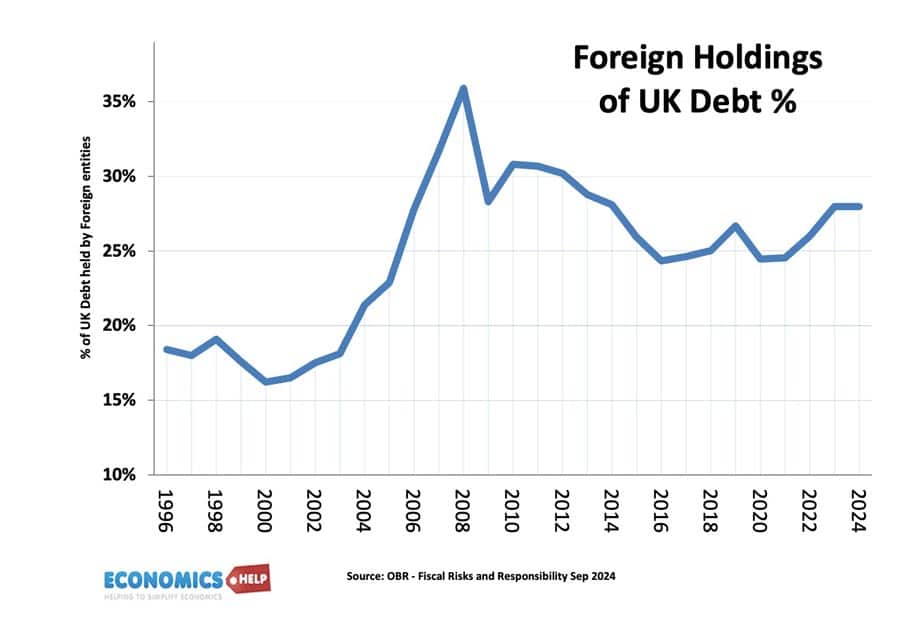

In the past few years, the proportion of UK government debt held by overseas investors has been about 30%.

Source: HM Treasury

For 2021, debt held by Overseas investors is 28% of GDP

The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

A different, but similar, concept is external debt. This is the total amount of UK debt (both private sector and public sector) held by overseas agents.

UK Debt Held By Overseas Investors 1996-2023

Source: OBR | Blog who does the UK owe money to?

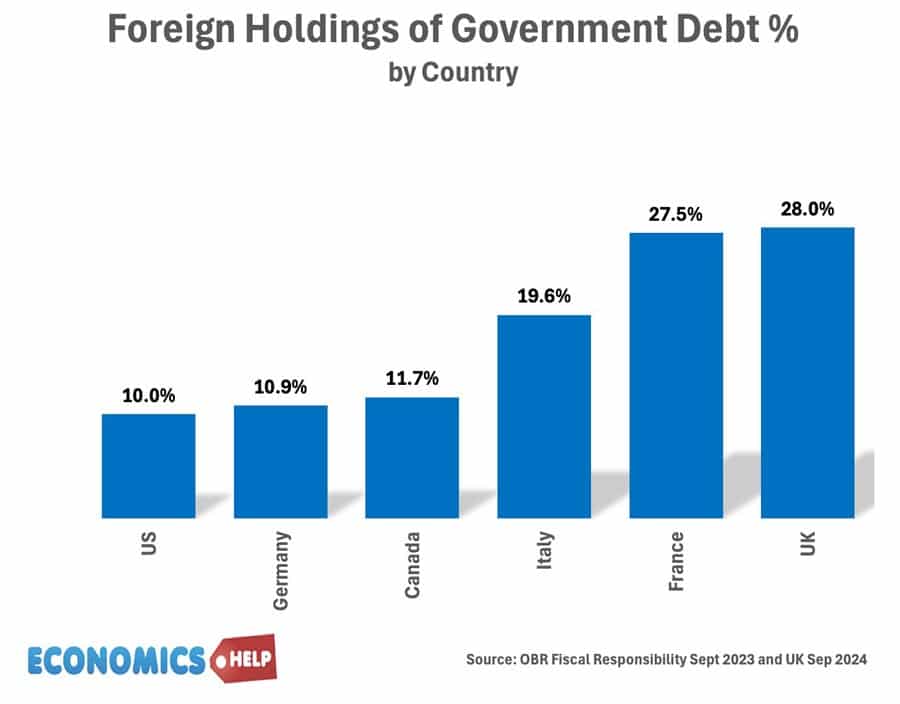

Foreign ownership of debt is relatively high in the UK