A few years ago, I looked at the arguments for and against a tax on ‘fatty foods‘. Generally, I supported the idea of a tax on unhealthy foods because it is a way to price the full social cost of the good. It is an example of a Pigovian tax. A tax which internalises the external cost of the good. Recently, the Academy of Medical Royal Colleges has produced a report stating 10 factors that could help reduce the UK’s obesity epidemic. One of these is an experimental 20% tax on sugary soft drinks.

A new study claims a 20 per cent tax on sugary drinks would reduce the number of obese adults in the UK by 180,000, bring in £276m to the Treasury and save the NHS millions.

The logic behind the new tax.

- Higher price will reduce demand and make ‘healthier alternatives’ more attractive.

- Over time, the higher price may change peoples spending and eating habits.

- The sugary soft drinks create an external cost – of contributing towards obesity. Since obesity has external costs, the tax is making people pay the full social cost. It is the same principle as taxing petrol so people pay the social cost of congestion and pollution.

- You could also argue sugary soft drinks and other unhealthy foods are a demerit good. People don’t know (or ignore) the damage to health. Making them more expensive discourages the consumption of these demerit goods.

- If the tax is on volume, it may encourage people to enjoy smaller sizes. Then people can enjoy without drinking to excess. e.g. the free refill is a popular marketing tool, but encourages consumption to excess. But, could a tax stop free refills?

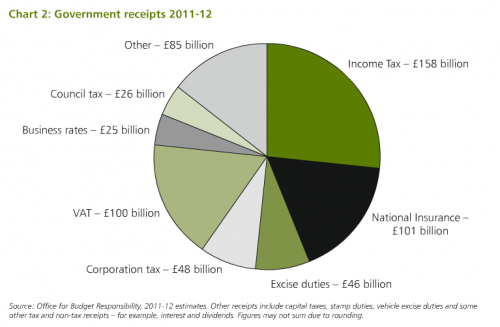

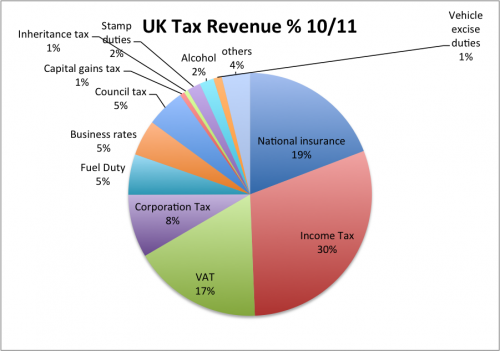

- It could raise up to £0.3 billion. This £0.3 billion could be used to lower other taxes, such as VAT or it could be used to increase spending on the NHS or specific obesity units.