Q.E. for Greece and the Eurozone

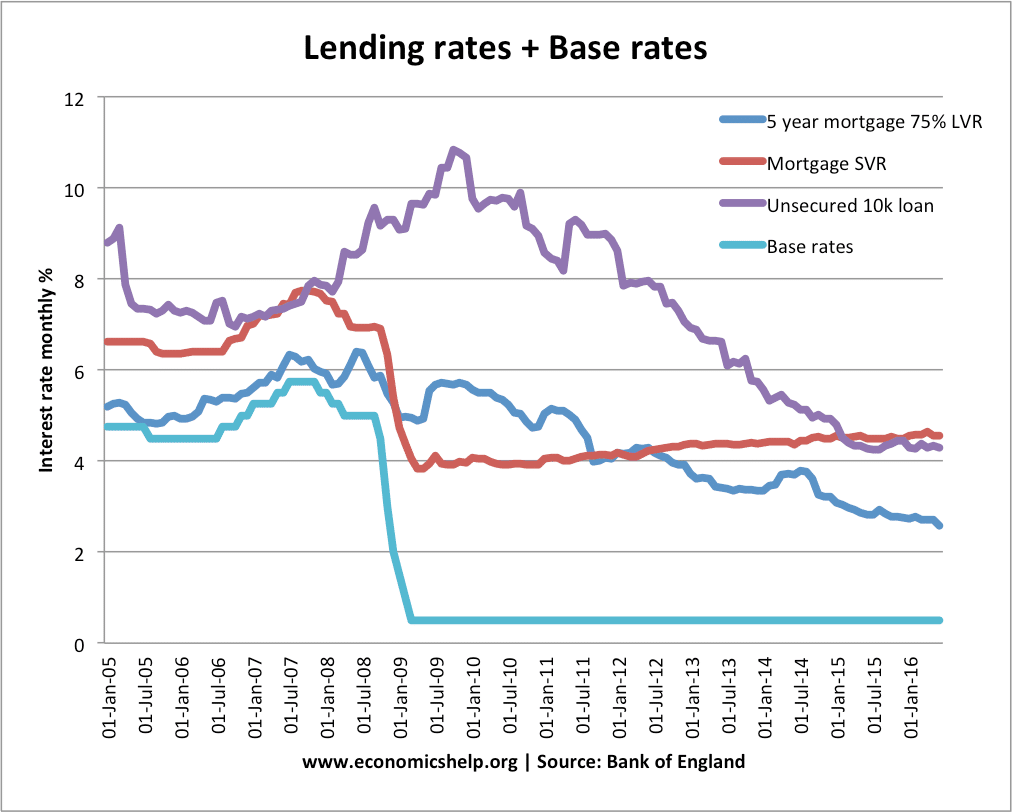

My Q: can you see any reason the ECB can’t do a version of QE for Greece? Not necessarily the US/UK way of buying bank bonds and hoping; there may be other ways? But if they could do it somehow, interest-free, so that the new money gets out into the economy, with the proviso that …