Does the UK need to return to austerity?

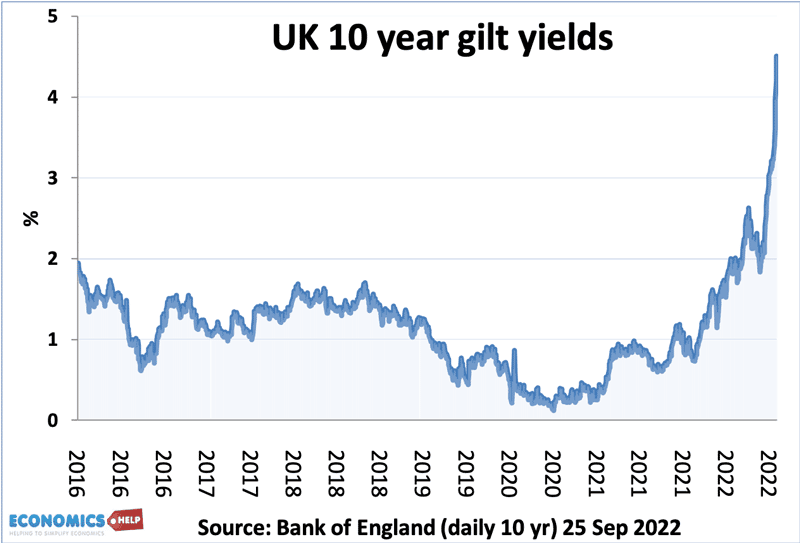

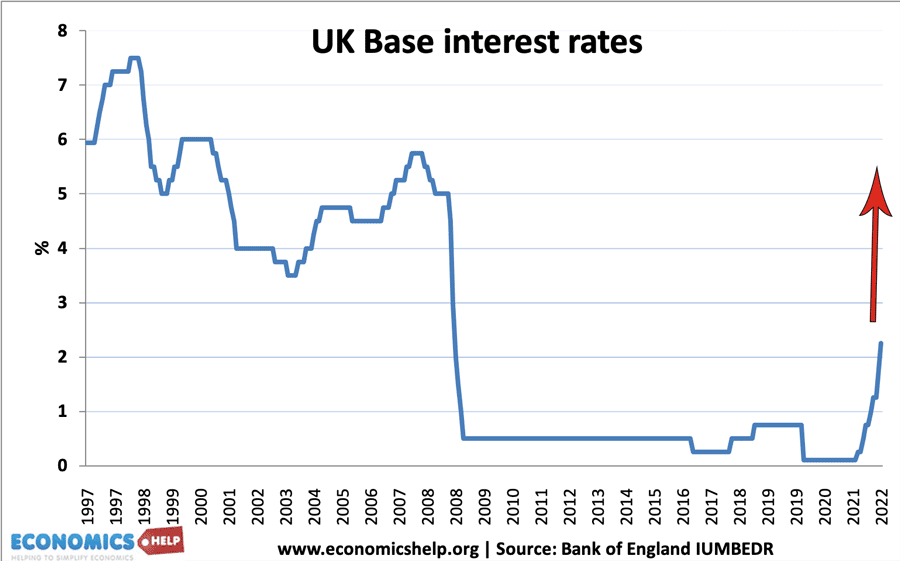

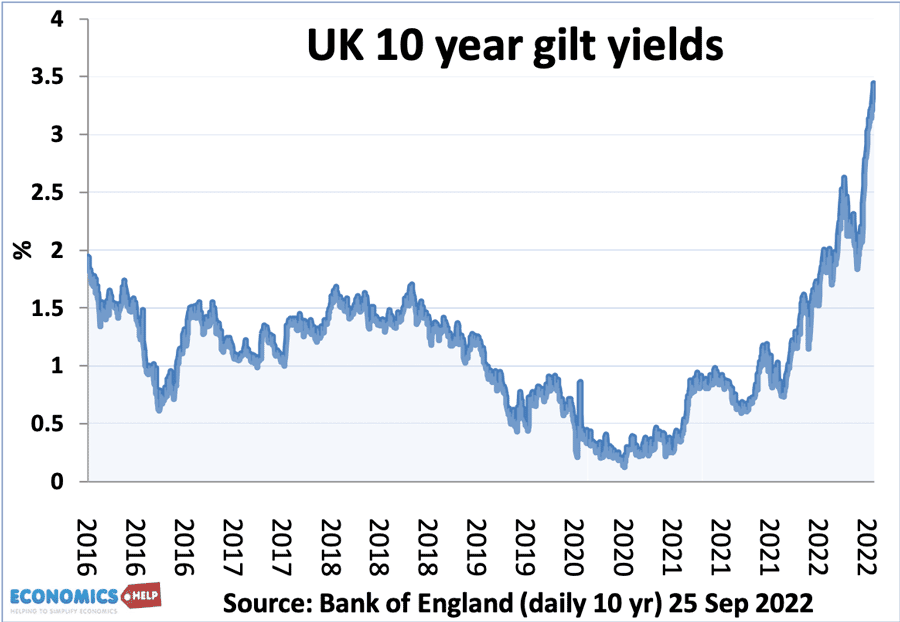

The recent surge in UK government gilts is a warning that unfunded tax cuts in a time of high inflation can cause markets to sell off UK bonds and make it harder to finance future government borrowing. After 15 years of ultra-low interest rates and little concern about rising debt, it is a reminder that …