Can you print money without causing inflation?

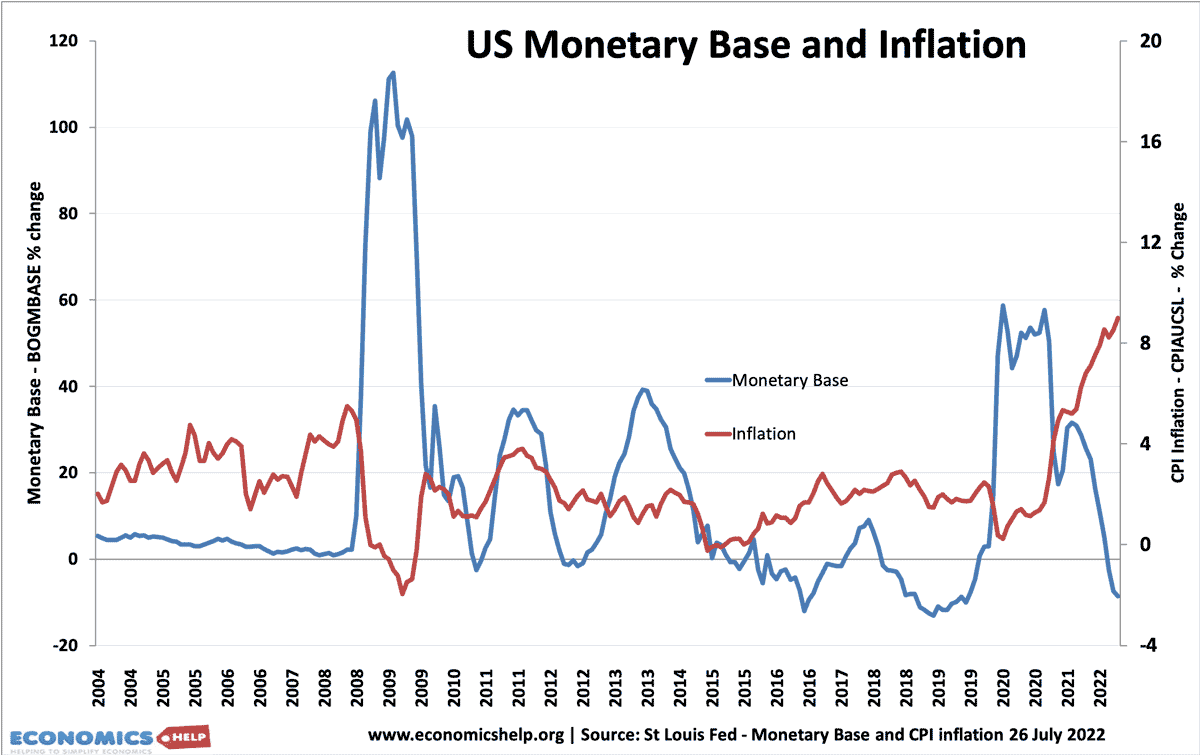

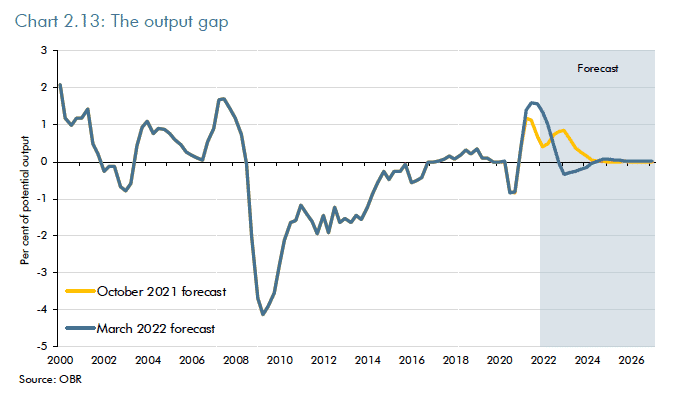

Readers Question: would you please explain to me how we can have no inflation, or low inflation if the government injects two or three trillion dollars in the US economy and output falls? This is an interesting question. Although printing more money tends to cause inflation, there are circumstances where you can increase the money …