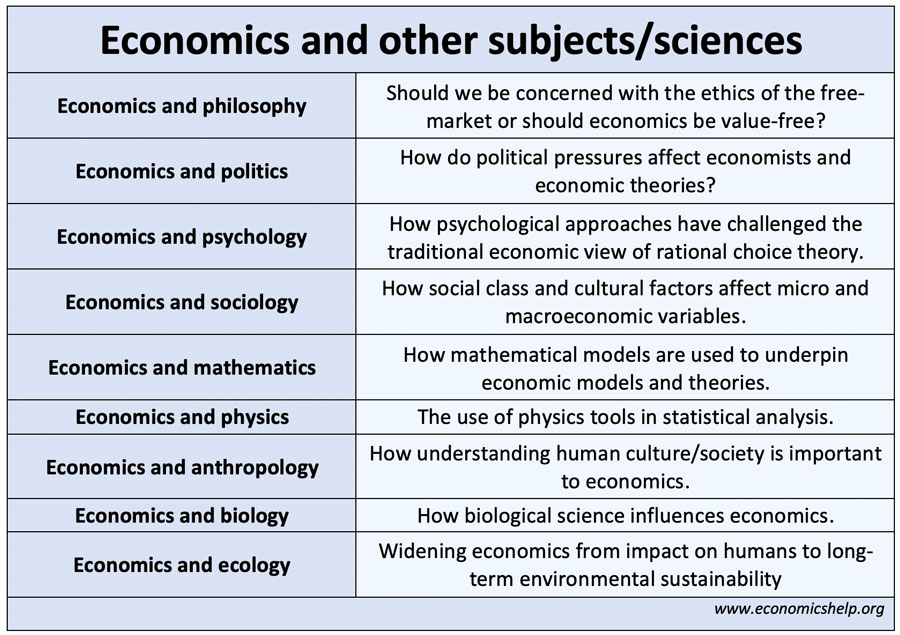

Sciences and subjects related to economics

This is a review of economics and its relationships with other social sciences and subjects, such as philosophy, politics, maths, physics, anthropology, psychology and sociology. Also, to what extent does economics benefit from expanding into other subjects? What is economics? Economics a social science that studies the production, consumption and distribution of goods and services. …