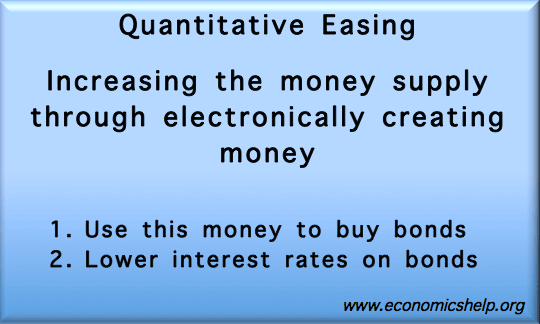

Problems of Quantitative Easing

A look at some problems and limitations of quantitative easing. Readers Question: I was wondering if anyone could help me with how Quantitative easing can possibly reduce a budget deficit? and what are the downsides of quantitative easing? The Bank of England has pursued a policy of quantitative easing. This has involved creating £275bn of …