Reasons for rise in value of the dollar

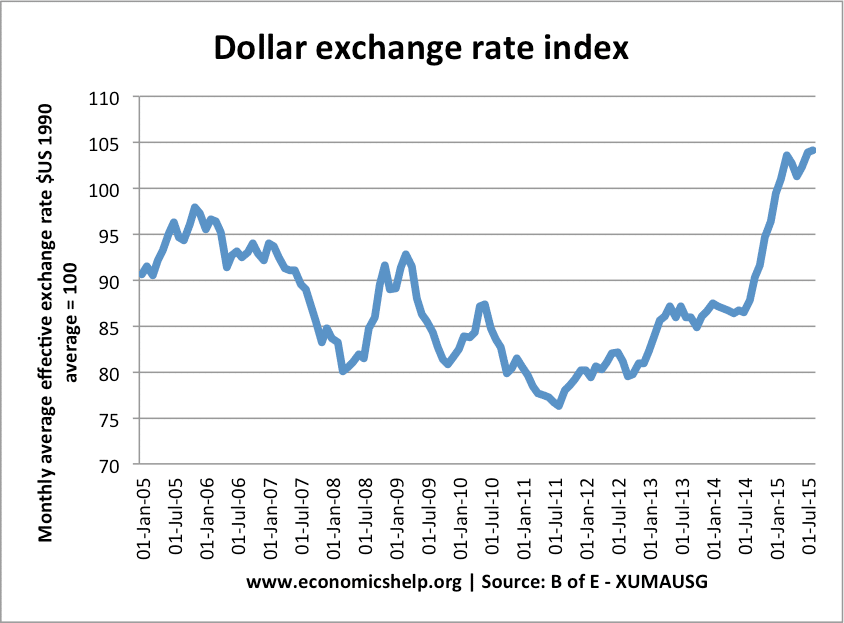

The past few months have seen a rise in the US dollar. The trade-weighted index has risen from 95 in 2011 to 111 in Jan 2011. There has been a near 10% rise in the value of the dollar since July of 2014. Against the Euro, the dollar has been even stronger. One Euro was …