Causes of the cost of living crisis explained

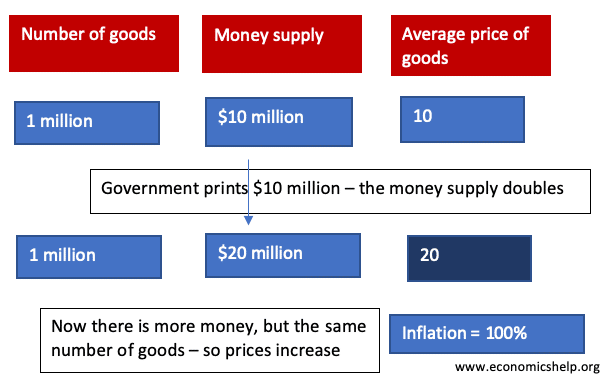

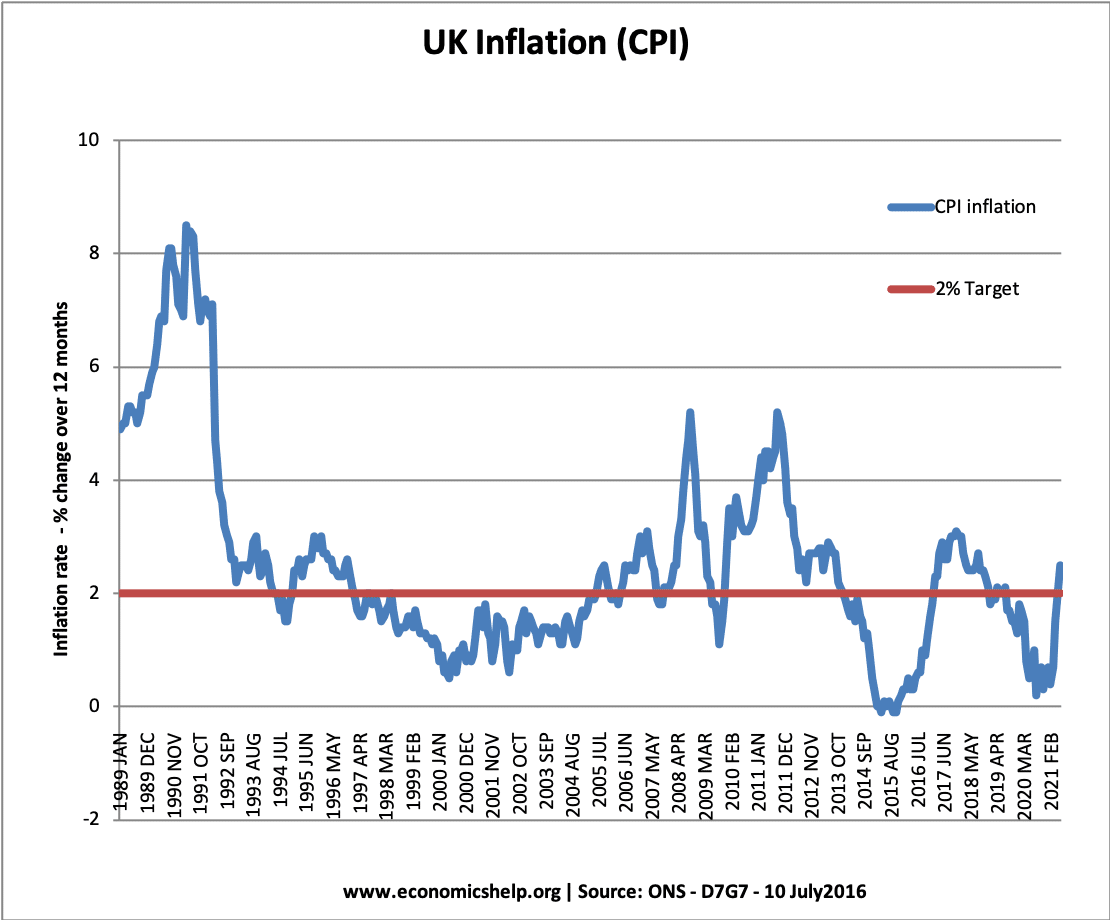

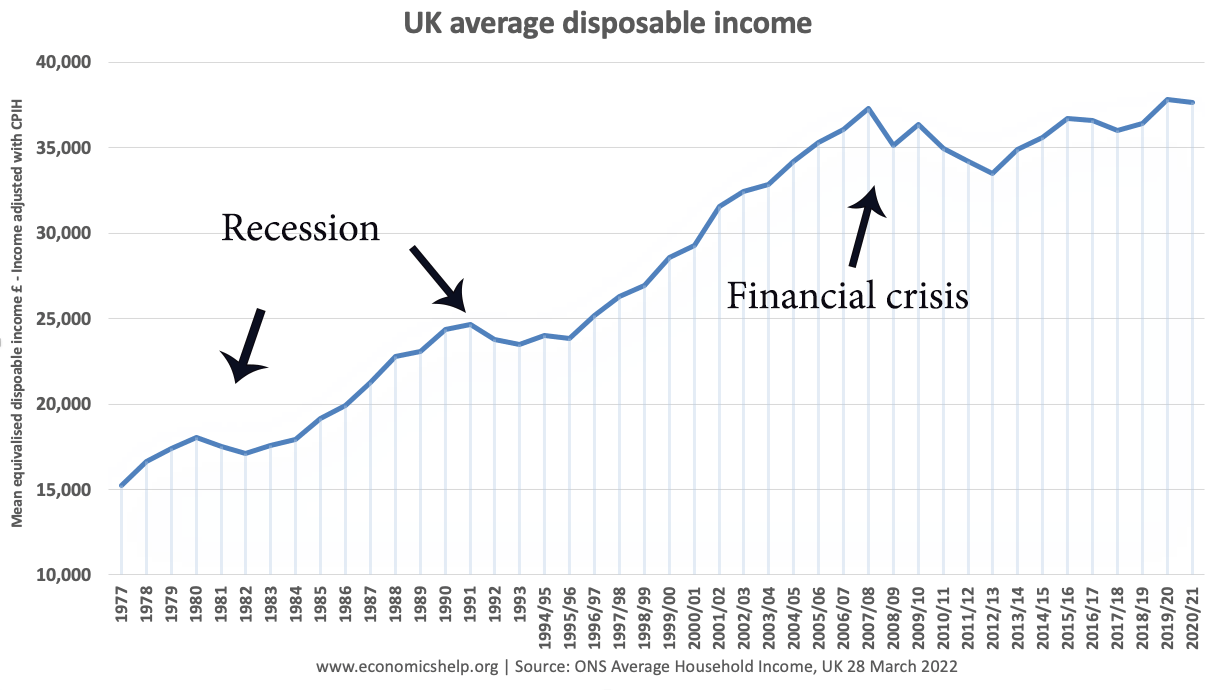

Rising petrol, food and energy prices have pushed many households in the UK and around the world into an unprecedented cost of living crisis. In the UK, in March 2022 the ONS reports that 23% of households found it difficult to pay their monthly bills. The cost of living crisis is fundamentally caused by higher …