Fall in historical interest rates – and what it means for future rates

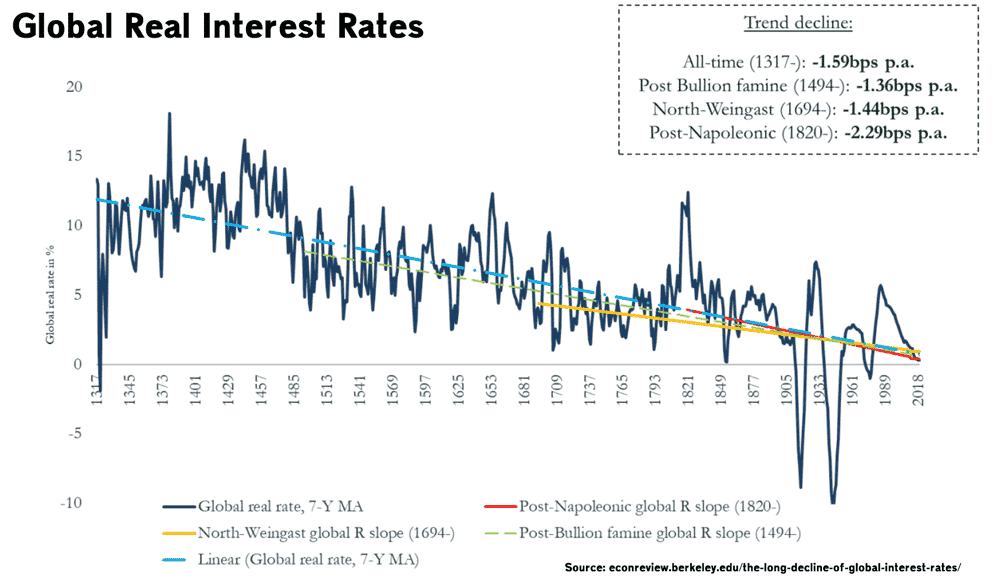

Research shows that historical interest rates have been consistently falling, ever since the first interest rates could be measured in the medieval ages. Although there are cyclical fluctuations, there is a consistent long-term trend for real interest rates to fall at a steady rate. The interesting thing is that this phenomenon has been noticed in …