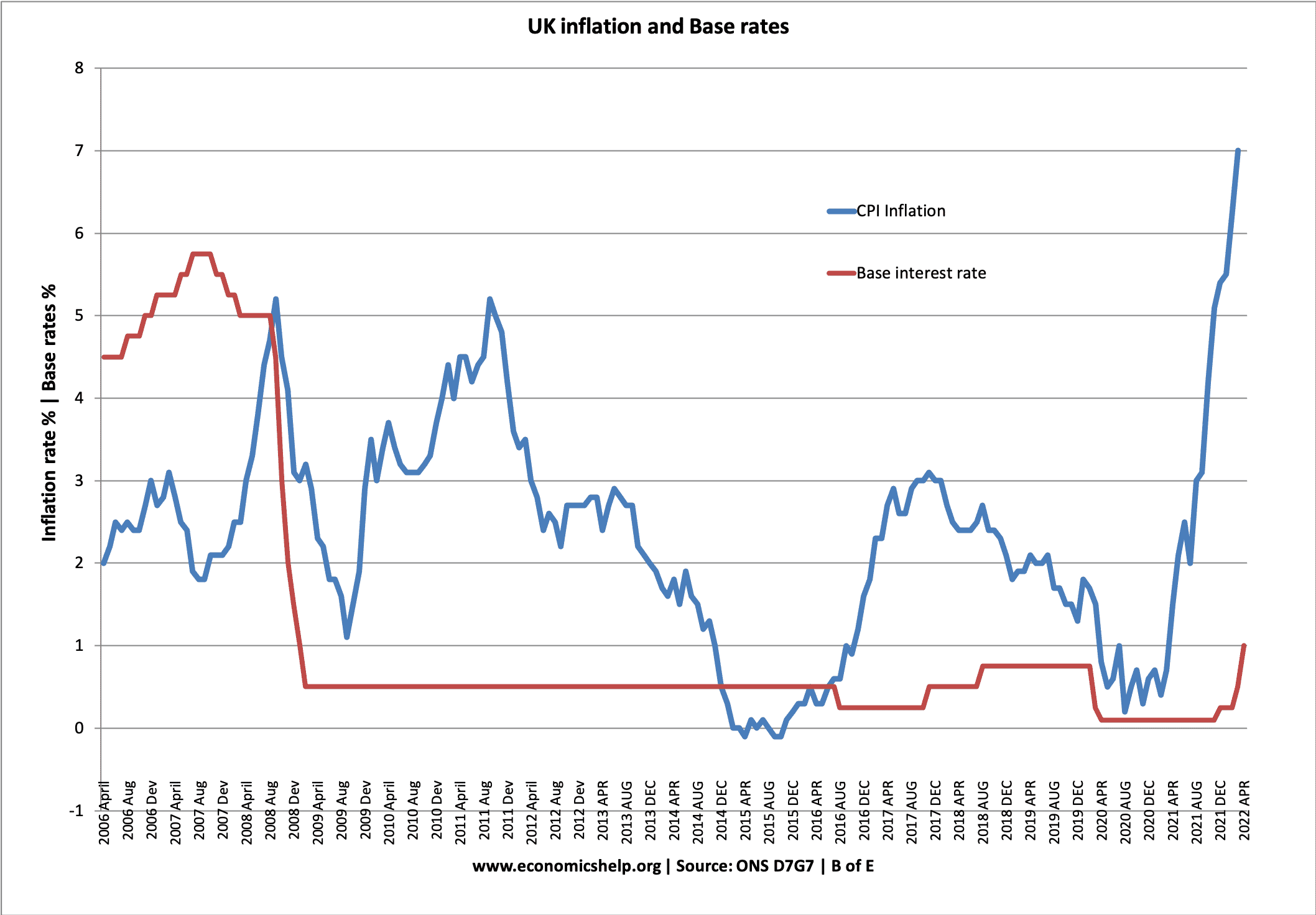

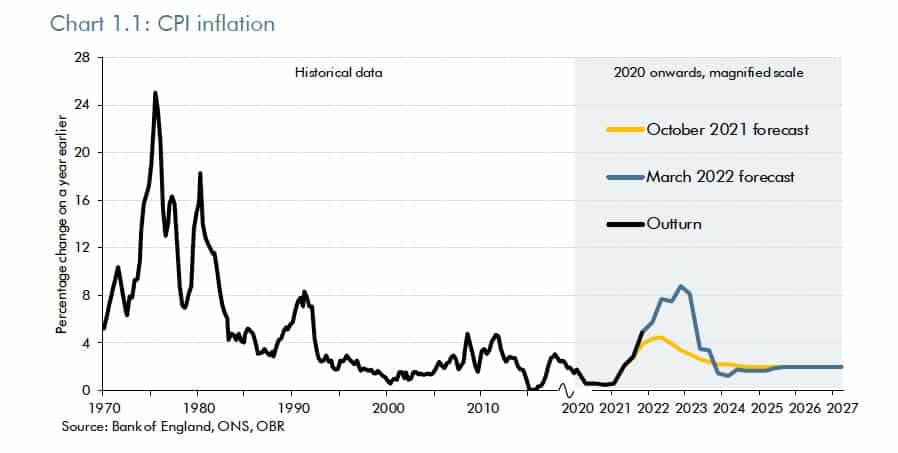

Effect of raising interest rates

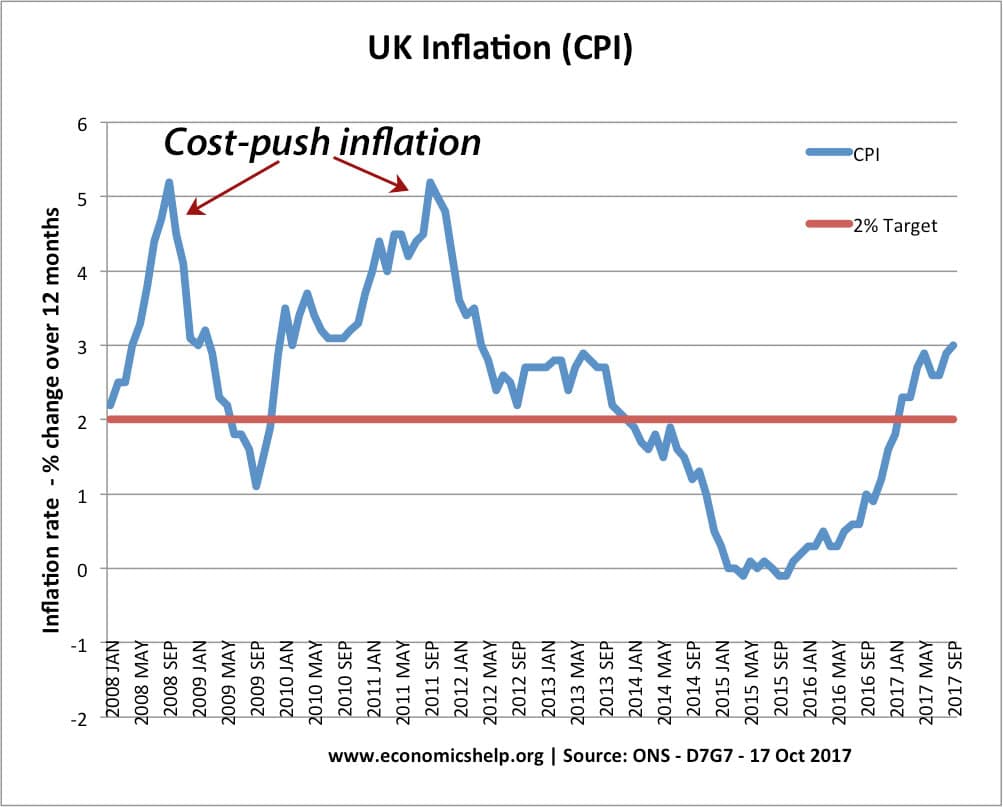

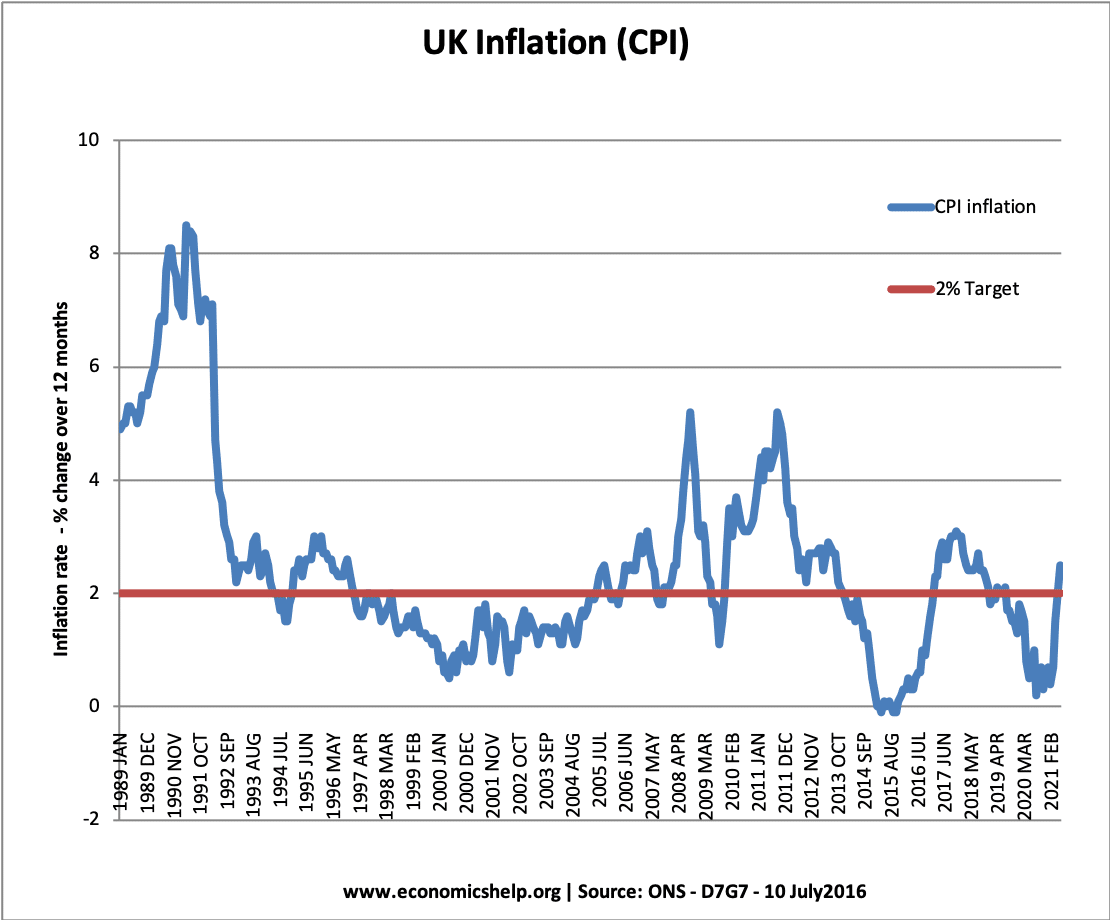

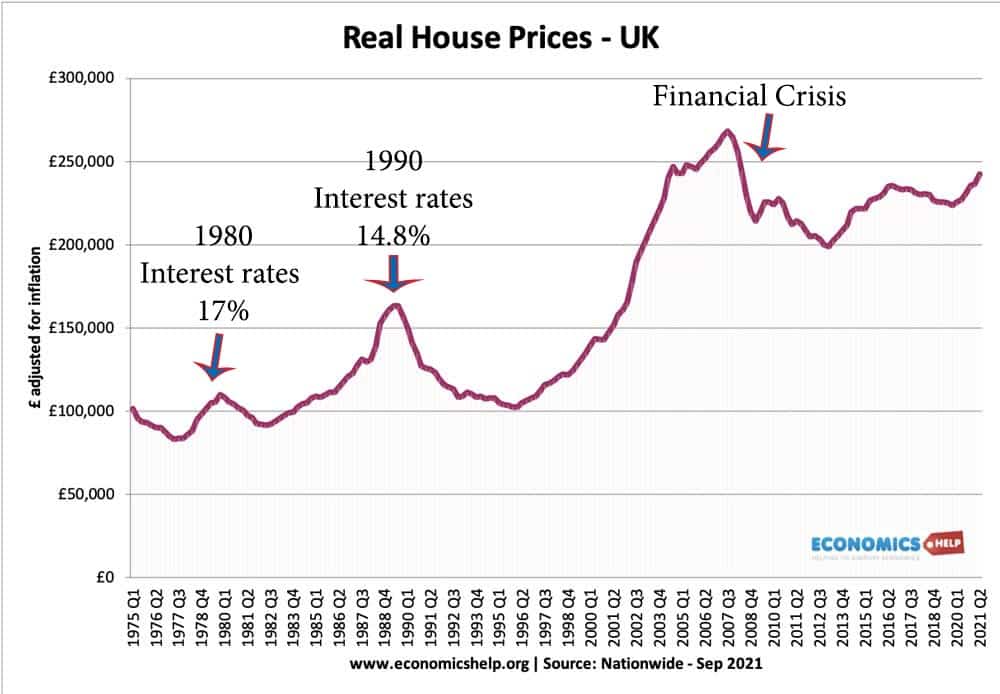

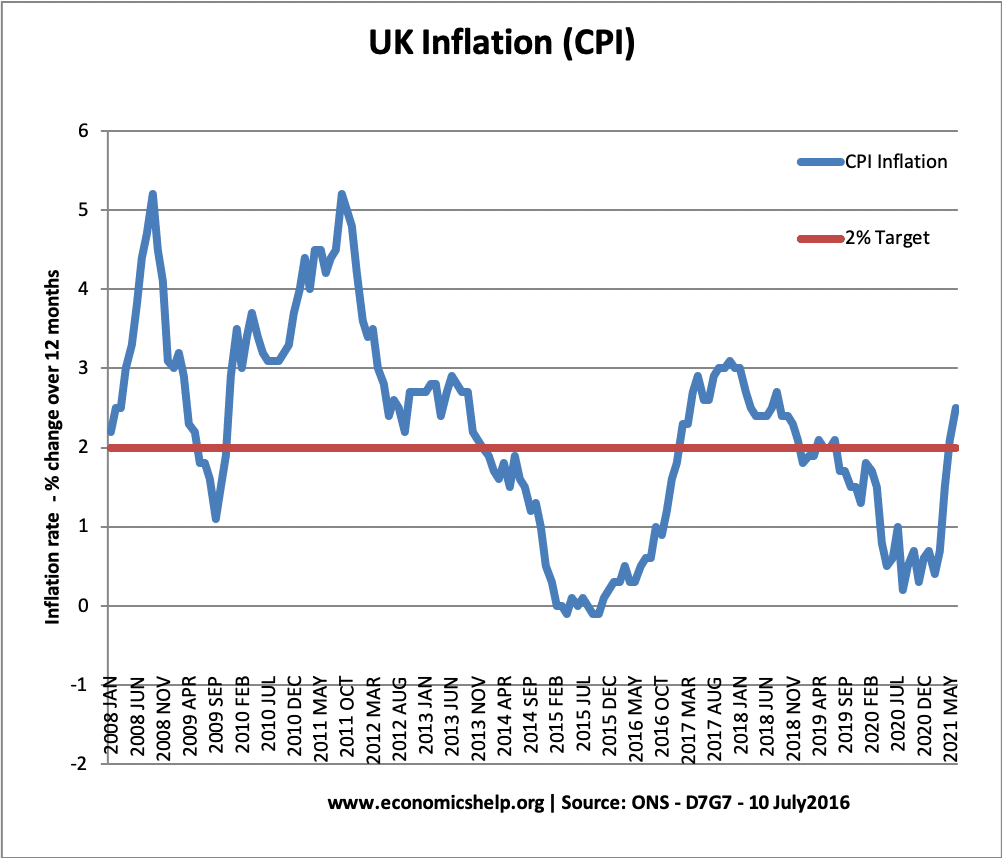

Higher interest rates increase the cost of borrowing, reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate. Higher interest rates have various economic effects: Effect of higher interest rates Increases the cost of borrowing. With higher interest …