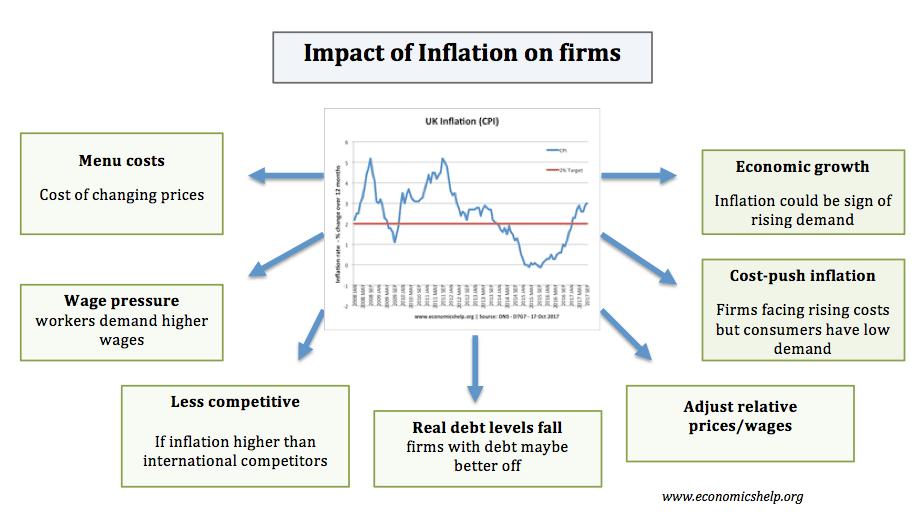

What are the effects of a rise in the inflation rate?

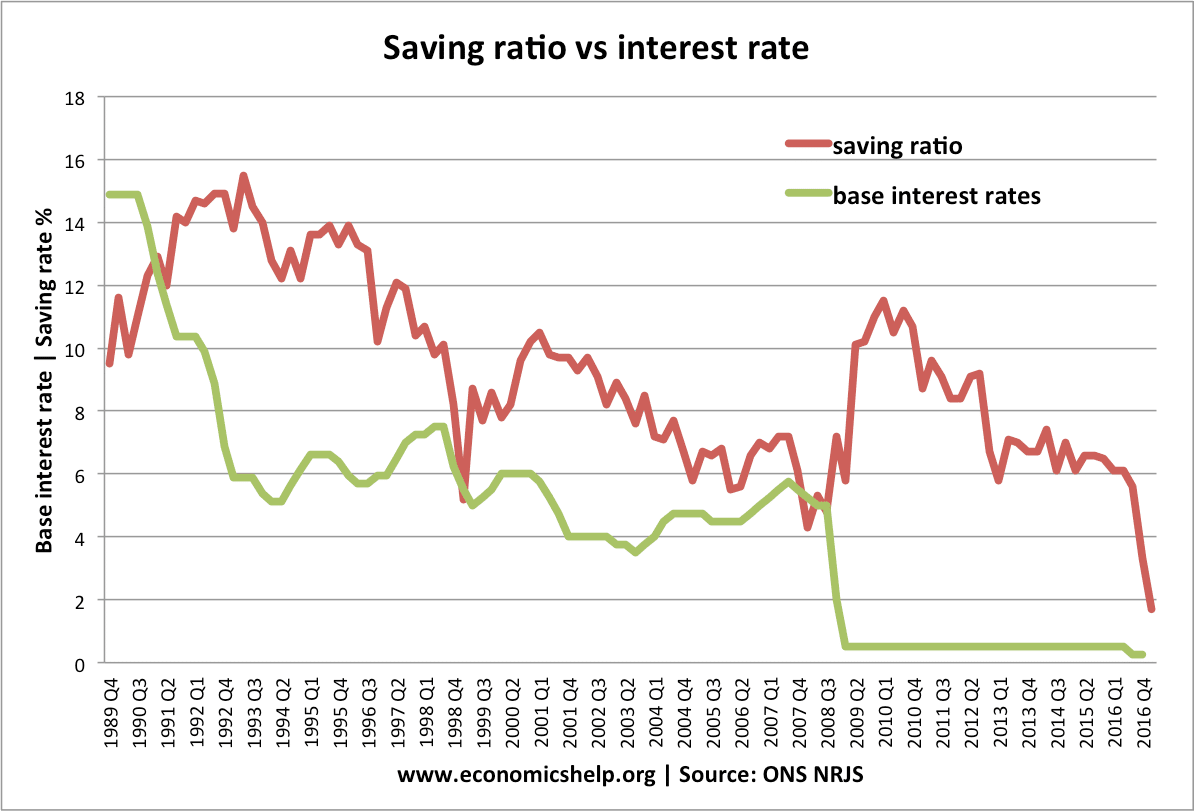

The inflation rate measures the annual percentage rise in the cost of living. (CPI) A rise in the inflation rate – means prices are rising at a faster rate. Summary of higher inflation In the short-run, it is more likely the Central bank will increase interest rates to moderate the inflation rate. Savers who have …