Biflation – definition and explanation

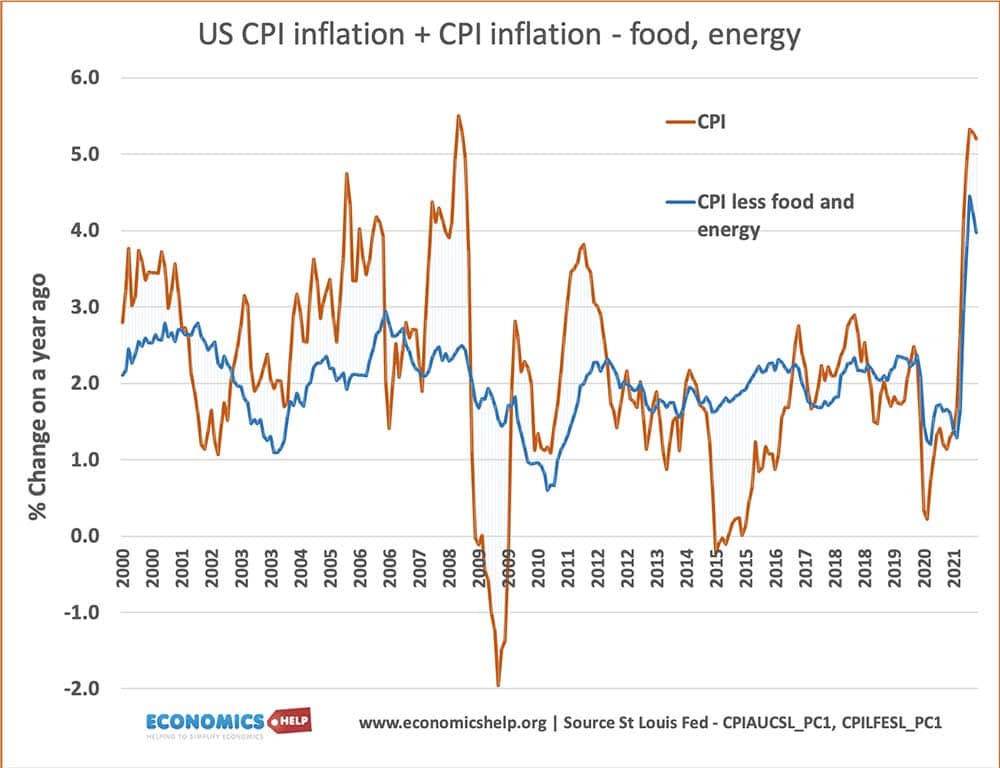

Biflation is a term used to describe a period where some prices are rising and some prices are falling. It can appear we have both inflation and deflation at the same time. CPI = Headline inflation rate CPI less food and energy = underlying or core inflation. In the above example, the headline rate is …