Diminishing marginal utility of income and wealth suggests that as income increases, individuals gain a correspondingly smaller increase in satisfaction and happiness.

In layman’s terms – “more money may not make you happy”

Alfred Marshall popularised concepts of diminishing marginal utility in his Principles of Economics (1890)

“The additional benefit a person derives from a given increase of his stock of a thing diminishes with every increase in the stock that he already has”

– Alfred Marshall, Principles of Economics

Utility means satisfaction, usefulness, happiness gained. Utility could be measured by the amount you are willing to spend on a good.

Example of why increasing income leads to diminishing returns

Marginal utility of first £100

If you have zero income and then gain £100 a week. This £100 will improve your living standards significantly. With this £100 you will be able to pay for the basic necessity of life – food, drink, shelter and heating. Without this basic £100 a week, life would be tough.

Marginal utility of income increasing from £500 to £600 (6th £100)

However, if you already gain £500 a week, an extra £100 has a proportionately smaller increase in utility. You may be able to eat out at restaurants more often, but it doesn’t significantly affect your standard of living and happiness. At £500 a week, you can afford most things you need. But, most people would be happy to gain an extra £100 to spend on luxuries like going out.

Marginal utility of income increasing from £10,000 to £10,100

If you are earning £10,000 a week – you would hardly notice an extra £100 a week. You may not even have the time or ability to spend it; this extra income is liable to be just saved. Therefore, we say the marginal utility of an extra £100 at this income level is very limited.

Therefore as income increases, the extra marginal benefit to individuals declines.

Diminishing marginal utility of wealth

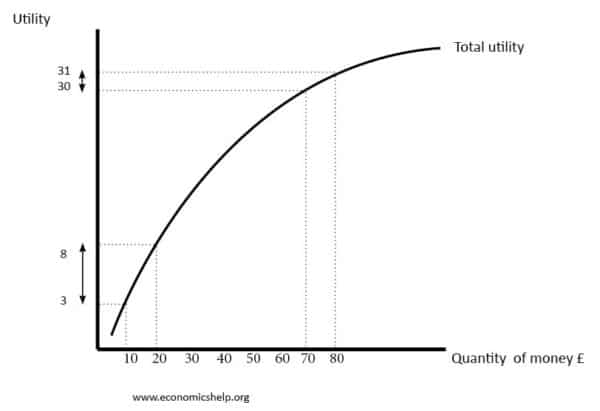

However, an increase in wealth from £70 to £80 leads to a correspondingly small increase in utility (30 to 31).

This concave graph shows a diminishing marginal utility of money and a justification for why people may exhibit risk aversion for the potentially large losses with small probabilities.

Diminishing marginal utility of wealth

Income is the amount of money received per time period. Wealth is a stock concept (the amount of savings, property owned)

It is a very similar effect with wealth. If you have savings of £10,000 – this can be useful for giving you insurance in periods of unemployment or the need to buy large items, like a new cooker. If you own one car, it can be useful for getting to work. Also, owning a house is a form of wealth, and it is important for giving you a place to live.

However, suppose your wealth increases. If you now own two cars, the extra benefit is much diminished compared to the first car. It might be useful to have two cars in case one breaks down, but you can only drive one at a time. If you have 7 or 8 cars like a collector, you may get some joy from having a collection, but the extra utility of that 8th car is significantly lower than the working person who has just one car to get to work.

Positional wealth

Some economists argue that wealthy people can use their wealth primarily to gain feelings of prestige and show their position in society. For example, the utility of a £100,000 car is not because you get anywhere quicker, but because it becomes a status symbol – a symbol to show other people your success. Therefore, the utility to society is very minimal.

The prestige effect does not enable a greater consumption of goods and services but is used to create a hierarchical effect where there are winners and losers. The net gain to society from prestige goods is very little. You could even argue it is negative because it cultivates feelings of pride and jealousy and a sense of social division.

Higher wealth pushes up prices of prestige goods

One way the rich may wish to use their wealth is to gain exclusive status – e.g. eat at the top 1% of restaurants, own the top 1% of artwork.

It is not the good per se, but it is having the best house, the best car, the best art. If you can gain these exclusive goods, you can prove you are in the top 1% of society – giving you prestige, power and influence.

Therefore, if the top 1% gain more wealth/income, the effect is simply to push up the prices of these ‘exclusive goods’ By definition the best 1% of art, houses are limited. If people gain more wealth, it will simply push up the price of this exclusive art/houses. Higher wealth doesn’t enable more people to consume these exclusive goods.

In this case, there is no gain in utility from the rich having higher wealth – because all the increase in wealth is effectively wasted on pushing up the price of exclusive goods.

For example, the price of the most exclusive art has increased far faster than inflation as an increasing number of wealthy collectors push up the prices of limited goods.

Negative utility of higher wealth

In an extreme case, you could argue higher income and wealth could actually make people less happy. If you inherit a lot of wealth from your parents, this may make you lazy and not appreciate working for an honest living. You may end up living a profligate lifestyle, wasting money on ‘high living’ which only gives very fleeting pleasure.

Often people who win the lottery and become instant millionaires have said they regret the experience because it caused an additional load of problems in their life; they began to fall out with friends and family who expected to gain money.

Socrates made an interesting comment

“Contentment is natural wealth, luxury is artificial poverty.”

This suggests that the desire to increase wealth and income can be negative for a person’s real happiness and satisfaction. Suggesting there is not only a diminishing marginal utility of wealth but a negative marginal utility of wealth, under certain circumstances.

Not all wealth is spent on positional goods

The above cases are perhaps extreme examples. Higher wealth and income can still have positive utility.

Not all wealthy people spend their money on positional goods. Some wealthy people may use their wealth for philanthropy or set up new businesses, which creates employment. This can have benefits for the rest of society.

Also, even if the wealthy save money, you could argue, this gives banks greater funds to lend to small business or mortgages.

Also, higher wealth and income will lead to higher demand for luxury services, such as chauffeurs, gardeners, teachers. Therefore, this will create employment and push up wages for those who work in the service sector. This will benefit other people in society.

Some wealth will trickle down to the rest of society. It depends on how the rich use their wealth and income.

However, there is still likely to be significant declining marginal utility of wealth.

The economics of happiness

This idea raises many important issues, not least the economics of happiness. Are the richest nations the happiest? Are people with the highest incomes and wealth happier than those on low incomes? Does an increase in income and wealth actually increase happiness?

For each individual, the question may be different. Pick a millionaire and their attitude to money may be very different. But, it does give a strong justification for progressive taxes and redistribution of income.

Economists and diminishing marginal utility of wealth

Hermann Heinrich Gossen (1810 – 1858). His first law [Gossen’s law, (1854)] states that marginal utilities are diminishing across the ranges relevant to decision-making.

Carl Menger Grundsätze der Volkswirtschaftslehre (1871) Menger developed the concept of diminishing marginal utility.

Other important economists in working on concepts of marginalism were William Stanley Jevons and Marie-Esprit-Léon Walras.

Related pages

External link

- The Financial philosopher – diminishing marginal utility of wealth

Thank you for explaining this concept with such easy to understand examples ! Really helpful!

Thank you for your insights and thoughtfulness. Enjoyed reading and did have a better understanding today than before.

Insightful and easy to understand. All examples are on point.

Thank you so much.