Definition of Ricardian equivalence This is the idea that consumers anticipate the future so if they receive a tax cut financed by government borrowing they anticipate future taxes will rise. Therefore, their lifetime income remains unchanged and so consumer spending remains unchanged.

Similarly, higher government spending, financed by borrowing, will imply lower spending in the future.

If this theory is true, it would mean a tax cut financed by higher borrowing would have no impact on increasing aggregate demand because consumers would save the tax cut to pay the future tax increases.

Assumptions of Ricardian equivalence

- Income Life-cycle hypothesis – Consumers wish to smooth their consumption over the course of their life. Thus, if consumers anticipate a rise in taxes in the future, they will save their current tax cuts to be able to pay future tax rises.

- Rational expectations on behalf of consumers. Consumers respond to tax cuts by realising it will probably mean future taxes have to rise.

- Perfect capital markets – households can borrow to finance consumer spending if needed

- Intergenerational altruism – Tax cuts for present generation may imply tax rises for future generations. Therefore, it is assumed that an altruistic parent would respond to current tax cuts by trying to give more wealth to their children so they can pay the future tax rises.

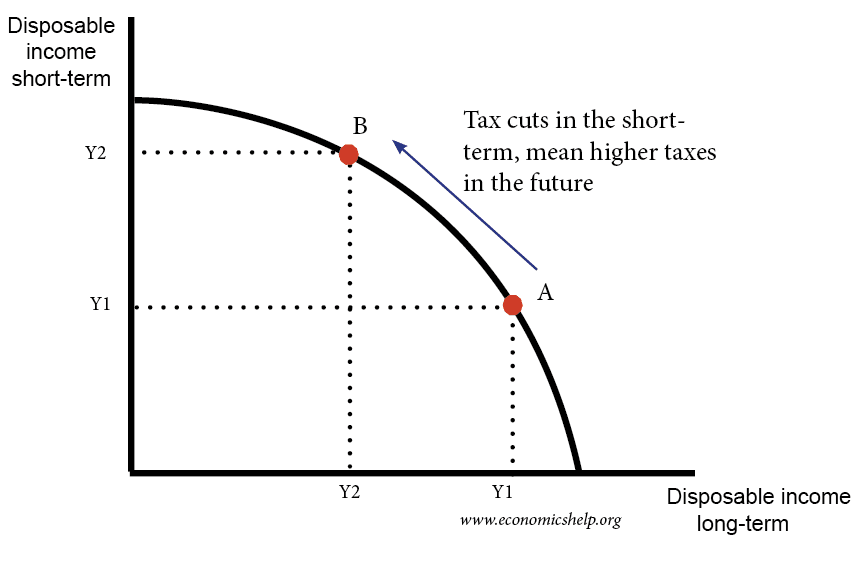

Impact of tax cuts under Ricardian Equivalence

If tax cuts, increase disposable income in the short-term, then it reduces disposable income in the long-term. Therefore, a rational consumer believes their lifetime income is unchanged by a tax-cut.

But, even Ricardo himself was suspicious of his findings.

Does it matter if governments finance spending through debt or taxation?

David Ricardo in”Essay on the Funding System” (1820) investigated whether it made a difference to finance a war through issuing government bonds or raising taxation. Ricardo concluded it probably made no difference.

In 1974 Robert Barro reinvestigated the idea and argued that under certain conditions, financing government spending by bonds was the same as raising taxes. He concluded public debt issuance and tax were largely equivalent

Problems with Ricardian equivalence

There are various problems with this theory of Ricardian equivalence

1. Consumers are not rational. Many would not anticipate that tax cuts will lead to tax rises in the future. Many households do not project future budget deficits and predict future tax increases.

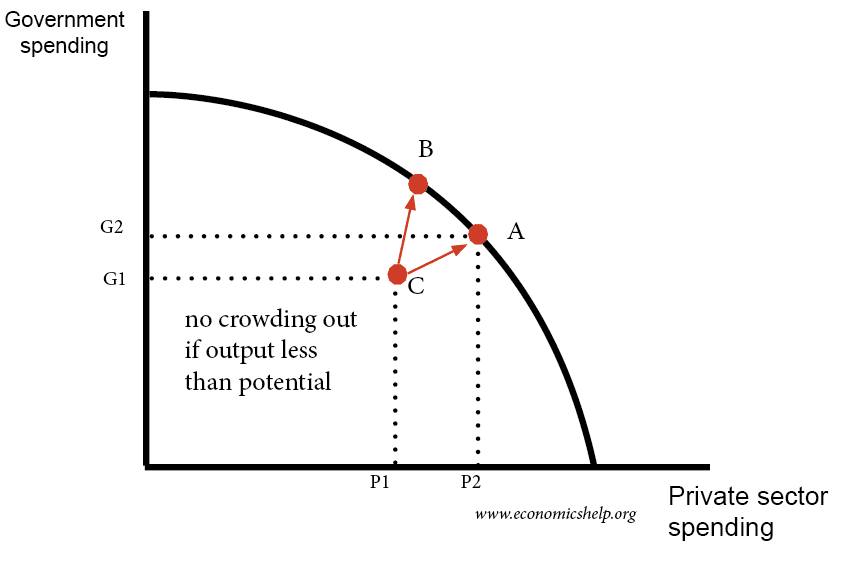

If the economy is at Point A – a rise in government spending can lead to a fall in private sector spending. There is crowding out. But, if the economy is at point C (inefficiency) Then it is possible to increase government spending without a fall in private sector spending.

2. The idea tax cuts are saved is misleading. In a recession, average propensity to consume may decline. But, this is different to the marginal propensity to consume. Evidence suggests that people do spend some of the tax cuts, even if their average propensity to save rises.

3. Tax cuts can boost growth and diminish borrowing requirements. In a recession, government borrowing rises sharply because of automatic stabilisers (lower tax revenue, higher spending on unemployment benefits). If tax cuts boost spending and economic growth, the increased growth will help improve tax revenues and reduce government borrowing. Therefore stimulus packages of say $800bn, do not necessarily mean taxes have to rise by $800bn. If growth is increased and the economy gets out of recession this will improve the government’s fiscal position.

4. No Crowding out in a recession. In a recession, private sector saving rises because of lack of confidence. Expansionary fiscal policy is a way of causing the private sector saving to be utilised. It is argued higher government spending financed by borrowing causes lower private sector spending. But, this isn’t the case. The government is not preventing private sector spending but using private sector savings to increase aggregate demand.

5. Multiplier effect. The initial increase in government spending may cause a further rise in spending in the economy causing the final increase in GDP to be bigger than the initial injection into the economy.

Ricardian equivalence is also known as the Barro-Ricardo equivalence proposition because Barro extended the use of this idea in the twentieth century.

Related

This is very helpfull… but it will be better if you include some references.

The counter argument to this is based upon an unproven Keynesian economic view point. The Recardian equivalence reveals an important underlying truth that an increase in government spending is ALWAYS bad for the economy.

Your argument to this fails to incorporate interest compounded when borrowing money period. If you need further proof of this look at the enormous debt the U.S. government has accrued over time, especially in the past three years. It has accrued 4 trillion dollars of debt in the past three years and a downgraded credit rating along with a 9% unemployment figure. Full employment (a good thing) is at 5% in case you didn’t know.

The multiplier effect contradicts itself period. The more money the government borrows, the more money they print and spend. Since you failed to bring in our floating currency which is based upon the governments ability to back the currency and scarcity. The more the government spends and prints money, inflation or the price of goods rises and interest rates go down. Thus devaluing our currency and decreases the consumer’s purchasing power. So what happens is what costed $10 when the monetary or fiscal policy was enacted now costs $12 or $13. The point is the government doesn’t adjust their stimulus or monetary policies to predicted inflation. Since you can’t really predict inflation accurately, the governments efforts are futile. In the end, only about 30 to 90 cents of every dollar is spent from these failed stimulus packages. Which means a deficit occurs and you need more than the borrowed amount to pay back the debt. This results in the citizens or consumers getting screwed in the long run because of this “good intentions not carefully planned and tested will cause a problem worse than the problem its trying to fix”.

As for references read Hunter Lewis’s “Where Keynes went wrong”. It will better explain everything I listed above and below.

This also a very myopic view point as well.

No crowding out?!!!! Are you kidding me? Look at the U.S. governments track record. People save their money because their are very few good investments or a lot of expensive investments in a recession. The government taking the money from citizens and spending it on bad investments is criminal which it does on a daily basis.

Example: Solyndra- This was a failing energy company whose focus was on solar power. President Obama visited the company and decided to “invest” tax payer money in a failing company despite the opposite advice given from many economists.

Result: Despite getting a half a billion dollar paycheck from the government, Solyndra employees were so horrible at managing money (like the government) they spent it all and failed to attract investors and wound up filing for bankruptcy. That is half a billion dollars we will never see again because of the blind belief in the multiplier effect. Now the employees that worked there have been allowed to receive “unemployment benefits” aka more tax payer dollars. In other words the government rewarded terrible management of money by giving more money to those who suck at smartly investing it.