What are the advantages and disadvantages of monopolies?

Monopolies are firms who dominate the market. Either a pure monopoly with 100% market share or a firm with monopoly power (more than 25%) A monopoly tends to set higher prices than a competitive market leading to lower consumer surplus. However, on the other hand, monopolies can benefit from economies of scale leading to lower average costs, which can, in theory, be passed on to consumers.

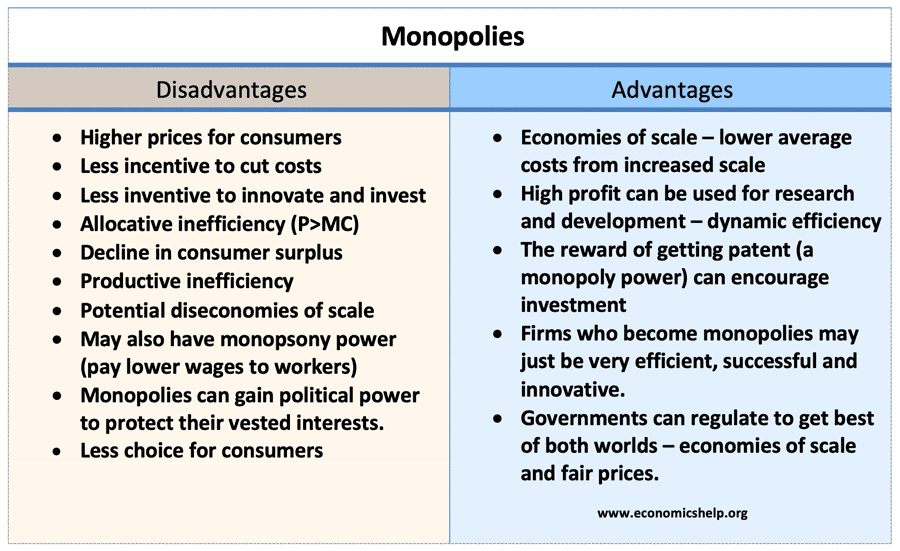

Disadvantages of monopolies

- Higher prices than in competitive markets – Monopolies face inelastic demand and so can increase prices – giving consumers no alternative. For example, in the 1980s, Microsoft had a monopoly on PC software and charged a high price for Microsoft Office.

- A decline in consumer surplus. Consumers pay higher prices and fewer consumers can afford to buy. This also leads to allocative inefficiency because the price is greater than marginal cost.

- Monopolies have fewer incentives to be efficient. With no competition, a monopoly can make profit without much effort, therefore it can encourage x-inefficiency (organisational slack)

- Possible diseconomies of scale. A big firm may become inefficient because it is harder to coordinate and communicate in a big firm.

- Monopolies often have monopsony power in paying a lower price to suppliers. For example, farmers have complained about the monopsony power of large supermarkets – which means they receive a very low price for products. A monopoly may also have the power to pay lower wages to its workers.

- Monopolies can gain political power and the ability to shape society in an undemocratic and unaccountable way – especially with big IT giants who have such an influence on society and people’s choices. There is a growing concern over the influence of Facebook, Google and Twitter because they influence the diffusion of information in society.

In the late nineteenth-century, large monopolist like Standard Oil gained a notorious reputation for abusing their power and forcing rivals out of business. This led to a backlash against monopolists. But, in the Twenty-First Century, there are new monopolies which have an increasing influence on people’s lives.

For more detail see: Disadvantages of Monopoly

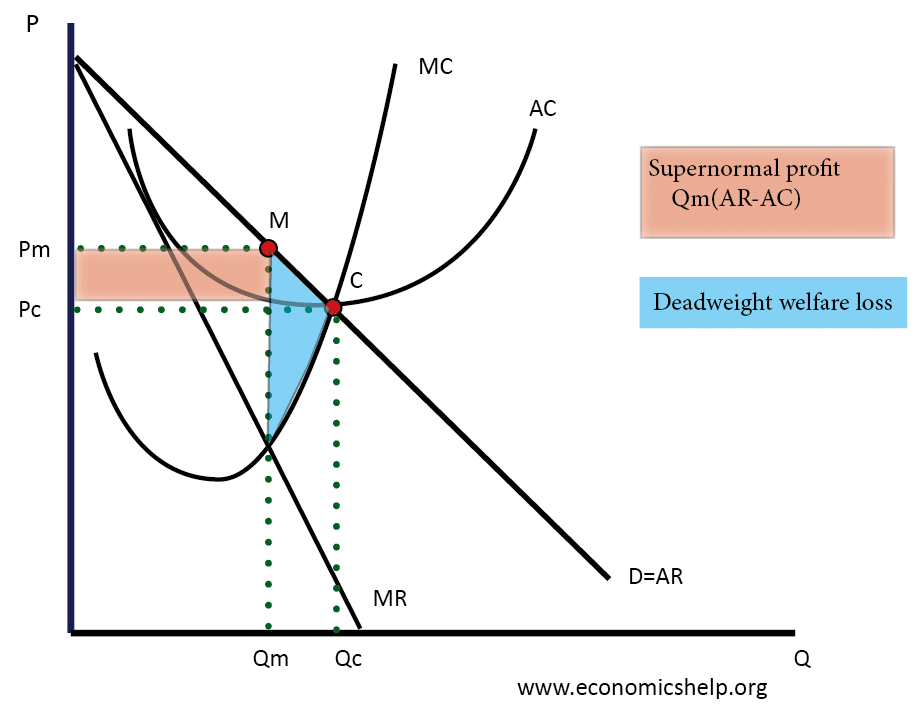

Monopoly Diagram

- A monopoly produces less (Qm) and charges higher price (Pm)

Inefficiency of monopoly

- Monopolies set the price of Pm – which is higher than Pc (allocative inefficiency)

- Monopolies produce at Qm (which is productive inefficient – not the lowest point on AC curve)

- Monopolies lead to deadweight welfare loss of blue triangle

Advantages of monopolies

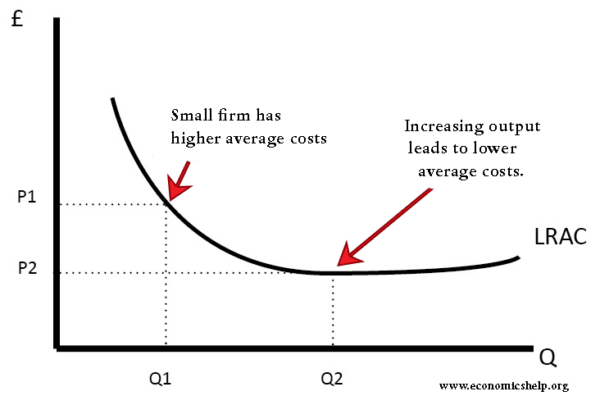

- Economies of scale. In an industry with high fixed costs, a single firm can gain lower long-run average costs – through exploiting economies of scale. This is particularly important for firms operating in a natural monopoly (e.g. rail infrastructure, gas network). For example, it would make no sense to have many small companies providing tap water because these small firms would be duplicating investment and infrastructure. The large-scale infrastructure makes it more efficient to just have one firm – a monopoly.

- Innovation. Without patents and monopoly power, drug companies would be unwilling to invest so much in drug research. The monopoly power of patent provides an incentive for firms to develop new technology and knowledge, that can benefit society. Also, monopolies make supernormal profit and this supernormal profit can be used to fund investment which leads to improved technology and dynamic efficiency. For example, large tech monopolies, such as Google and Apple have invested significantly in new technological developments.

- However, this can also have downsides with drug companies able to charge excessively high prices for life-saving drugs. It also gives drug companies an incentive to push pharmaceutical treatments rather than much cheaper solutions to promoting good health and avoiding the poor health in the first place.

- Firms with monopoly power may be the most efficient and dynamic. Firms may gain monopoly power by being better than their rivals. For example, Google has monopoly power on search engines – but can we say Google is an inefficient firm who don’t seek to innovate?

Evaluation of pros and cons of monopolies

- It depends whether market is contestable. A contestable monopoly will face the threat of entry. This threat of entry will create an incentive to be efficient and keep prices low.

- It depends on the ownership structure. Some former nationalised monopolies had inefficiencies, e.g. British Rail was noted for poor sandwich selection and some inefficiencies in running the network. However, this may have been partly monopoly power but also the lack of incentives for a nationalised firm.

- It depends on management. Some large monopolies have successful management to avoid the inertia possible in large monopolies. For example, Amazon has grown by keeping small units of workers who feel a responsibility to compete against other units within the firm.

- It depends on the industry. In an industry like health care, there are different motivations to say banking. Doctors and nurses do not need a competitive market to offer good service, it is part of the job. If we take the banking industry, the economies of scale in offering a national banking network are limited. If it was a merger of two steel firms, which has much higher fixed costs, the economies of scale may be greater.

If two pharmaceutical firms or aeroplane manufacturers merged, there could be a good case to say they would use their combined profit for research and development. - It depends on government regulation. If governments threaten price regulation or regulation of service, this can reduce the excesses of some monopolies.

- Environmental factors – A monopoly which restricts output may ironically improve the environment if it lowers consumption.

- It depends on how you define the industry. A domestic monopoly in steel may still face international competition – from foreign steel companies. Eurotunnel faces a monopoly on trains between the UK and France but it faces competition from other methods of transport – e.g. planes and boats.

Advantages of being a monopoly for a firm

Firms benefit from monopoly power because:

- They can charge higher prices and make more profit than in a competitive market.

- The can benefit from economies of scale – by increasing size they can experience lower average costs – important for industries with high fixed costs and scope for specialisation.

- They can use their monopoly profits to invest in research and development and also build up cash reserves for difficult times.

Why governments may tolerate monopolies

- It is difficult to break up monopolies. The US government passed a lawsuit against Microsoft, suggesting it should be split up into three smaller companies but it was never implemented.

- Governments can implement regulation of Monopolies e.g. OFWAT regulates the prices for water companies. In theory, regulation can enable the best of both worlds – economies of scale, plus fair prices. However, there is concern about whether regulators do a good job – or whether there is regulatory capture with firms gaining generous price controls.

See also: Advantages of Monopolies

Hi, I’m a first year economics student and just thought I’d add the theory of contestable markets to this discussion, as it provides another view on why monopolies might not always be ‘bad’.

The theory of contestable markets suggests that if barriers to entry and exit are practically non-existent (or totally non-existent in the case of a perfectly contestable market), firms can freely enter and exit the market at will. Therefore, there is a constant threat of so-called ‘hit and run’ competition, where rival firms can enter the market as soon as they see an opportunity to make supernormal profits.

So if a monopolist attempted to exploit its position in a perfectly contestable market, e.g. by raising prices, it would be undercut and would lose profit.

But there are few contestable markets in existence. I believe my A-level teacher said that local bus or taxi industries are two examples.

Source: John Sloman, “Economics” 6th Edition, p172

Very Good Point John, this would definitely get a few evaluative marks at A Level.

It is true, there are few perfectly contestable markets. But it is always helpful to think in terms of degrees of contestability.

e.g. I think you could say Online advertising has more contestability than say tap water

but a monopoly isnt a contestable market thus doesn’t belong on this part of the site

I think the formation of monopoly is very important , especially during the time of recession. They can push out infant firms and became internationally competetive.

The fact that they have an EOS can reflect cheaper prices of their products.

However they have to earn abnormal profits , therefore they have to minimise total costs , to do that they have to pay less to their employees. That is the only disadvantage.

Equal standards suggests that if monopolies are bad for private industry, they are also bad for public industry. Holding AT&T and Microsoft to one standard, and allowing it for others isn’t a fair administration of justice.

Further, capitalism that invokes competition as the reason for price controls and price reductions has been traditional in economics. Exclusive control isn’t competitive, and cannot therefore produce competitive pricing.

Government holding itself to the same standards expected of private industry with regard to competition for lower cost potential seems logical, but isn’t practiced, in a hypocrisy of sorts that should not be failed to be recognized as detrimental to democracy.

I present insurance coverage as an example of a service where a government regulated monopoly can provide more efficient service than a competitive market of private insurers can, for the following reasons:

– Insurance is a commodity service ( it provides cash in exchange for cash).

– Insurance is by its nature conservative and not subject to much innovation. Policies can be varied and complex, but the service provided is not essentially changed.

– A fair price for an insurance policy can be arrived at by a good mathematician (actuary).

The business of insurance is to redistribute wealth to those less fortunate. Redistribution of wealth sounds like a bad thing, but that’s exactly what insurance is all about: people pooling their resources together in order to equally distribute risk and redistribute wealth to those that suffer misfortune. In this system, the larger the pool of insured, the more efficient the redistribution.

This is why having the federal government (not state and local government or a private company) provide insurance makes so much sense. FDIC, Social Security benefit from a large single provider. The same would be true of halth insurance.

Technically speaking, I think monopolies are good and bad, but mostly bad.especially since the government does not intervene in their affairs of running their company unless they violate the consumers’ rights ,so they do what ever they like and that’s what make it a bad thing.

Regulate, regulate, regulate! Monopolies may have benefits, but he government should regulate price gouging and unfairness to consumers.

monopolies to some extend are beneficial in the sense that ,they engage in research and devekopment there by improving quality.also there is customer care since they are th sole producer however,the social welfare is eroded in the sence that they charge exobitant prices to customers.also customers are deprived of choice