Readers Question: Does inflation causes unemployment?

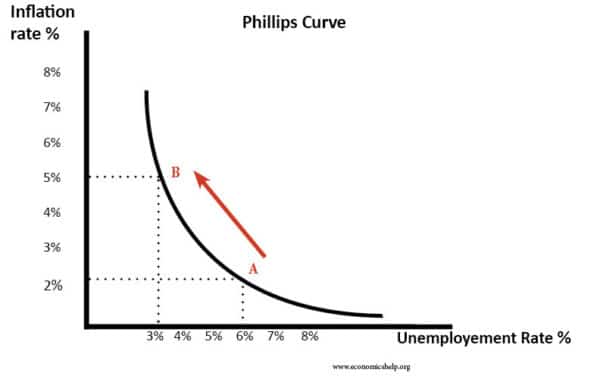

There are a few different scenarios where inflation can cause unemployment. However, there is not a direct link. Often we will notice a trade-off between inflation and unemployment – e.g. in a period of strong economic growth and falling unemployment; we see a rise in inflation – see Phillips Curve.

Also, it is important to bear in mind, (especially in the current climate) If the economy has deflation or very low inflation and the monetary authorities target a modest rate of inflation, then this may help boost growth and reduce unemployment.

Inflation can cause unemployment when:

- The uncertainty of inflation leads to lower investment and lower economic growth in the long term.

- Inflationary growth is unsustainable leading to a boom and bust economic cycle.

- Inflation leads to a decline in competitiveness and lower export demand, causing unemployment in the export sector (especially in a fixed exchange rate).

Inflation creates uncertainty and lower investment

One argument is that a period of high and volatile inflation discourages firms from investing. Because inflation is high, firms are less certain investment will be profitable. It is argued that countries with higher inflation rates tend to have lower investment and therefore lower economic growth. Therefore, if there are poor levels of investment, this could lead to higher unemployment in the long term.

It is argued that countries with low inflation rates, such as Germany have enabled a long period of economic stability which helps to attain a long-term low unemployment rate. Low inflation in a country like Germany also helps them to become more competitive within the Eurozone, which also helps create employment and reduce unemployment.

See also: costs of inflation

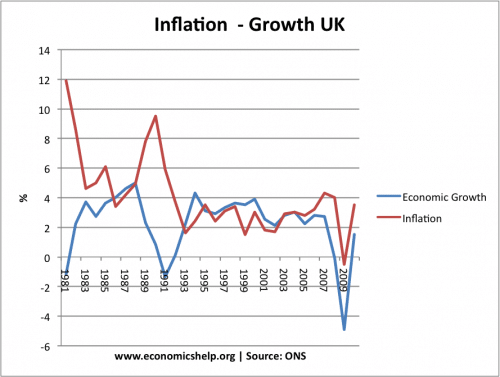

Inflationary booms cause recessions

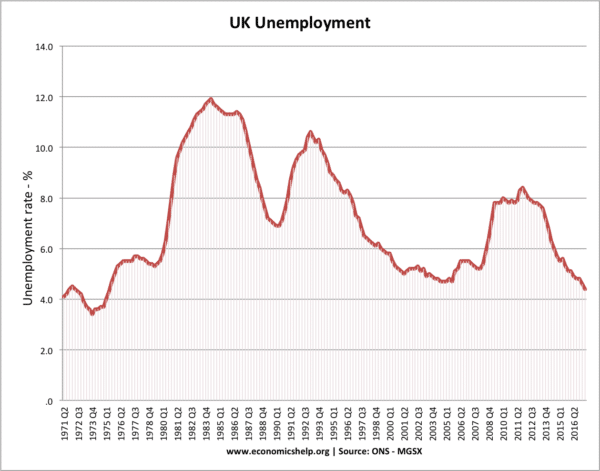

If the economy overheats; if the rate of economic growth is faster than the long run trend rate – then we will tend to get demand-pull inflation. Firms push up prices because demand is growing faster than supply. In the short term, this higher growth may lead to lower unemployment as firms take on more workers. However, this rate of economic growth is unsustainable – e.g. consumers may get into debt to increase spending, but as the economy falters they cut back on spending leading to lower AD. Also, if inflation increases, Monetary authorities will tend to increase interest rates to reduce inflation. A sharp increase in interest rates can cause economic growth to fall, leading to recession and unemployment. Therefore an economic boom with high inflation is often followed by a recession. The UK has had several ‘boom and bust’ economic cycles. An example is the Lawson boom of the 1980s. From 1986, we had high economic growth and falling unemployment. By the end of the 1980s, economic growth rates were over 4% a year, but inflation was creeping towards 10%. To tackle inflation, the government increased interest rates and joined the ERM. Higher interest rates led to a rapid fall in consumer spending and investment.

By 1991, the economic boom had turned into a deep economic downturn and the policies to reduce inflation led to higher unemployment.

If the government had maintained economic growth at a sustainable rate during the 1980s (e.g. 2.5% rather than 5%), the growth would not have caused inflation, and we would not have needed interest rates to rise so high. By keeping inflation low, we could have avoided the rise in unemployment in the 1990s.

UK Unemployment in the 1980s

Inflation and competitiveness

In the Eurozone, high inflation is more problematic because countries can’t devalue to restore competitiveness. If a country in the Eurozone (e.g. Portugal, Spain, Greece, Italy) has an inflation rate higher than the Eurozone average, their exports are likely to become uncompetitive. This will lead to a fall in Net (X-M) leading to a current account deficit, lower AD and higher unemployment. To restore competitiveness, they have to pursue internal devaluation (primarily lower wage costs) to restore competitiveness – but this can prolong a recession.

Higher inflation could help the Eurozone

On the other hand, if the Eurozone targeted higher inflation – e.g. increasing domestic demand in Germany, this would help to reduce the Eurozone’s high rate of unemployment.

Optimal rate of inflation

If an economy has a very low rate of underlying ‘core inflation’ e.g. 1%, then this is a sign that the economy is growing too slowly. This level of inflation means there is spare capacity and there is an output gap. Therefore, with slow growth, unemployment is likely to be higher. In this case, pursuing an expansionary monetary policy which involves a higher inflation rate could help to boost economic growth and lead to lower unemployment.

Arguably, the ECB’s policies which have kept inflation below 2% have contributed to higher unemployment within the Eurozone. If they allowed a slight increase in inflation, then unemployment could fall without causing an inflationary boom.

A key issue is what rate of inflation and economic growth causes unsustainable growth. If the economy experiences deflation (like in the 1920s and 1930s), then a positive inflation rate will help reduce unemployment.

But, if growth is already close to long-run trend rate (2.5%) and there is no output gap, then expansionary monetary policy that leads to higher inflation will be unsustainable and we will be liable to experience a boom and bust that leads to higher unemployment.

Students be careful

Some students will write – higher inflation means consumers can’t afford to buy goods – so demand falls and unemployment rises. But, this is usually an incorrect analysis.

It depends on the type of inflation – Often inflation is caused by rising wages. If nominal wages are rising faster than inflation, then real wages are rising and consumers can afford to buy more. It is the growth in consumer spending which is causing inflation.

However, if inflation is higher than nominal wages, then real wages will fall and in that case, consumer spending may fall.

Phillips Curve: inflation-unemployment trade-off

Related

Are we in a situation of inflation or deflation? Is there a term called biflation? If the prices of food is rising and prices of property is falling, does that mean overall we have deflation, and that the fed is correct in printing money?

If central banks collectively and continuously print money, does this mean there will never be a financial crisis and recession? How will this financial crisis end? Is there any scenarios where collective central banks action will be useless, since they have essentially unlimited supplies of money to print at essentially no cost?

Is it possible for central banks to fail in devaluing their currency since they can print unlimited amounts of money e.g like in the Swiss bank intervention. Do their losses matter, since they can write off their losses at essentially no cost?

Why is it easier for a central bank to devalue instead of strengthening their currency?

What is the effect of future contracts, CDOs, on the prices of shares, commodities, and currency?

In this current market, many people recommend buying hard assets like properties, gold and oil, because quantitative easing will increase the prices.

However without knowing how many off market futures contracts, and these contracts are not based on actual demand and supply, is it fair to say it is dangerous to speculate on these commodities, and even these prices will fall in a deflation due to forced liquidation?

What is the effect of a collapse in the US dollar on China? Since the Central Bank of China holds trillions of USD treasuries, if the USD collapses, the central bank will suffer massive losses. However, this will also mean the Yuan will be higher relatively to the USD. How do we calculate the net effect to China in terms of currency gains to the country and its citizens?