Readers Question: Does anyone know if it is still true that £120bn is lost through tax avoidance/evasion.

There is a big difference between tax avoidance and tax evasion

- Tax avoidance involves legal means to reduce your tax bill.

- Tax evasion involves illegal means to reduce your tax bill.

Examples of Tax Avoidance

A perfectly legal way to avoid paying taxes in the UK could include:

- Putting shares in your wife’s name. If your wife pays a lower income tax bracket, the family will pay fewer capital gains tax than if you are eligible for paying the higher rate of income tax.

- Avoiding inheritance tax by giving money/assets to your children more than 7 years before your passing.

- Setting up a company and paying yourself dividends rather than paying income tax and national insurance.

- Moving to another country (or the Channel Islands, Isle of Man) and spending more than half the year living abroad. This avoids paying income tax

- income paid in the form of offshore assets.

Examples of Tax Evasion

- Not declaring money earned. e.g. if builder gets paid in cash, he could probably avoid declaring this income to tax man leading to lower tax paid. This is called tax evasion because it is illegal to report your income falsely.

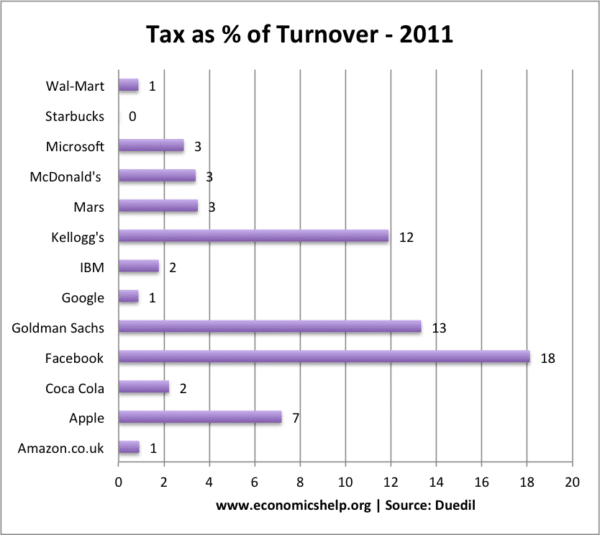

Companies and the Tax they actually pay

Source: Guardian data via Duedil

Tax avoiding companies in the UK

Cost of Tax Evasion to Taxpayer

The Home Office Annual Fraud Indicator, suggested in 2011, tax evasion cost the taxpayer £15bn (Annual Fraud Indicator) This compares to benefit fraud of around £3.8bn. Of this £15bn,

- An estimated £7 billion a year due to ‘Evasion’ where individual or corporate taxpayers have deliberately omitted, concealed, or misrepresented information in order to reduce tax liabilities;

- An estimated £5billion a year due to ‘criminal attacks’ on the tax system involving coordinated and systematic attacks by organised criminal gangs.

- An estimated at £3billion a year due to ‘Hidden Economy’ fraud consisting of undeclared economic activity from sources deliberately concealed from HMRC. (Criminal tax evasion)

Cost of Tax Avoidance

The cost of tax avoidance is much harder to quantify because there are so many different ways that people can legally reduce their tax bill. However, the figure would be much higher. I couldn’t find any research for the figure of £120bn, but it is certainly feasible.

Related

Good insightful write-up, you generally write the most useful content

& Cost of Tax Avoidance / Evasion in UK | Economics Blog is no exception to this rule