Global economic imbalances refer to an unfair distribution of resources between different countries or it may refer to a one-sided trade situation.

Global economic imbalances include

- Balance of Payments. Unbalanced trade between different economies, e.g. US trade deficit with China

- Unemployment levels, e.g. high unemployment in southern Europe versus low unemployment in US, UK.

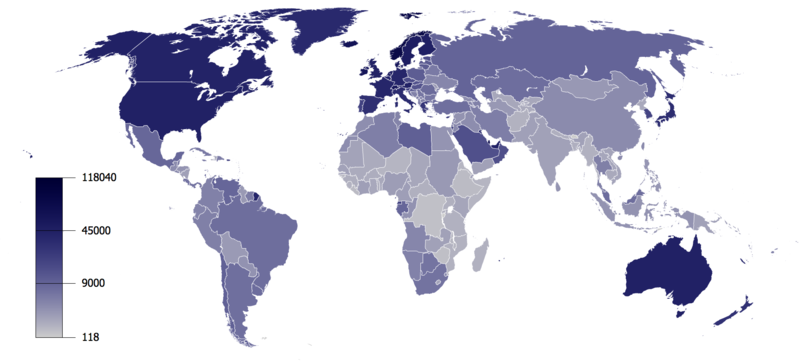

- Poverty levels between the developing world and developed world

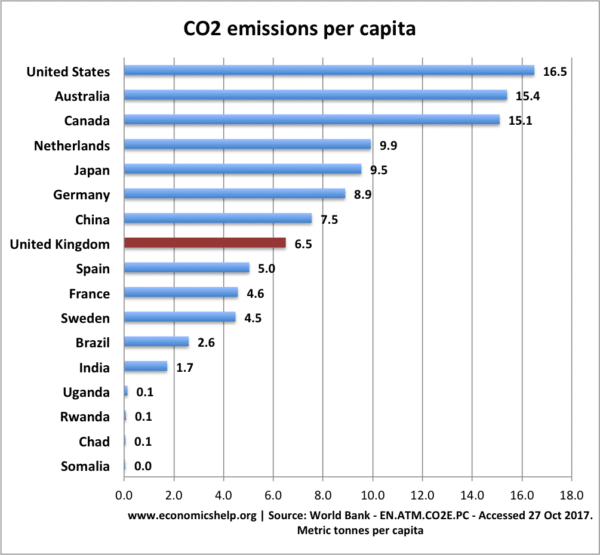

- Imbalance in consumption and production of CO2 emissions.

- High saving levels in East. High consumption in West

- Developing countries heavily indebted to developed world banks.

National economic imbalances can include

- High consumption/low saving v low consumption/high saving.

- High government borrowing

- High personal debt and personal borrowing

- Large current account deficit/surplus.

- Demand greater than supply leading to inflation.

- Monopoly power by firms or monopsony power by employers

- Geographical unemployment.

More details on these economic imbalances

Costs to the environment

Poverty

Top 10 GDP Per Capita($)

1. Qatar 88,222

2. Luxembourg 81,466

3. Singapore 56,694

181. Burundi $412

182. Liberia $396

183. Congo, Democratic Republic $ 329

There are huge variances in income. These statistics of GDP per capita do exclude PPP, but still poverty levels vary significantly across the globe.

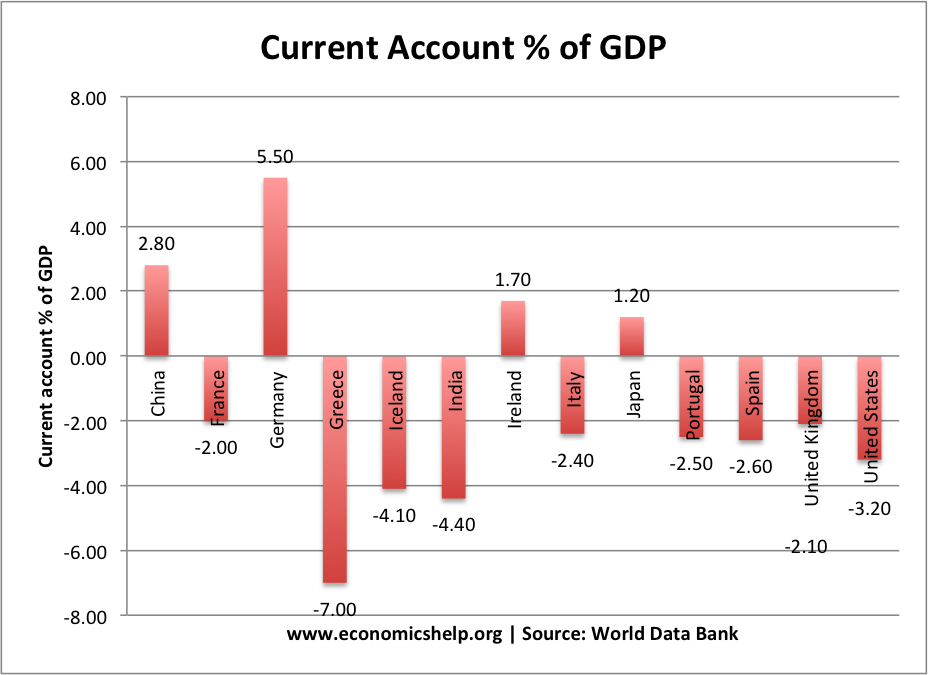

Current account imbalances

Selected Current account balances from different countries in 2012.

It shows Greece had a large current account deficit – compared with Germany with a surplus of 5.5% of GDP. It reflects the fact in the Euro, Germany exports are much more competitive than Greek goods.

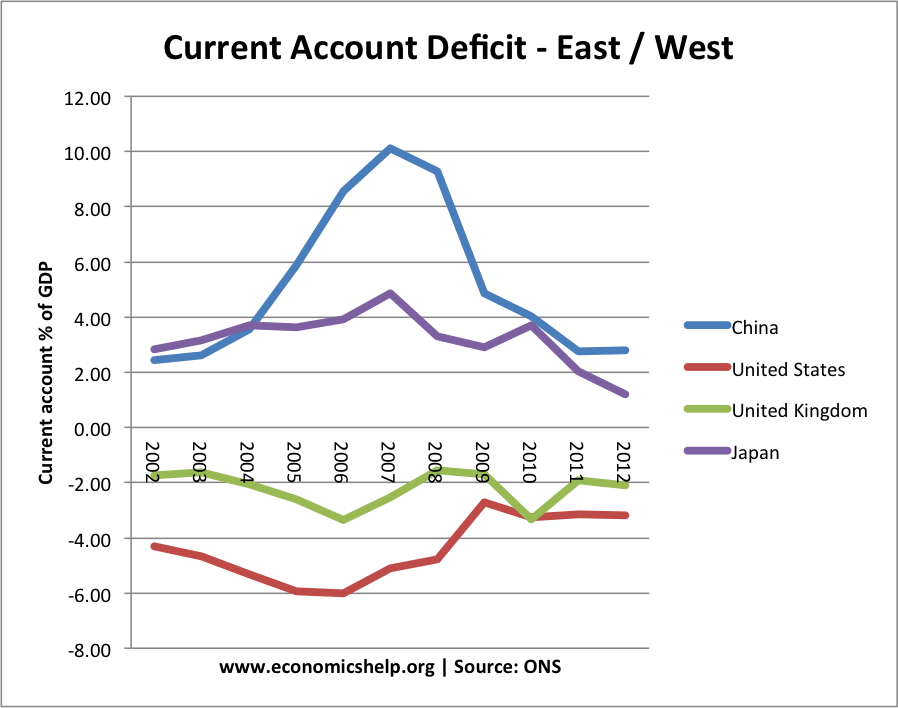

Imbalance between east and west

This shows in 2007, global imbalances were greater between China and the US.

- This was because China ran a large current account surplus, accumulated foreign reserves, kept Yuan undervalued and relied on export growth.

- The US had relatively higher levels of consumption, whearas China and Asia had higher levels of saving, investment and an export-led economy.

Reasons for Global Imbalances in trade

1. Because the US dollar is the world’s reserve currency, there has been a large demand for US securities like Treasury bills. These capital flows have effectively financed the US current account and explain why the US has been able to run a larger current account deficit than most other countries.

2. Low Long Term Interest Rates. The high demand for US securities such as US Treasuries and mortgage-backed securities helped keep US interest rates low. For example, the real yield on ten-year inflation-indexed U.S. Treasury securities averaged about 4 percent in 1999 but less than 2 percent in 2004. The real U.S. interest rate (interest rate – inflation), showed a similar pattern, falling from about 3.5 percent in 1996 to about 1.5 percent in 2004 (source: Fed Reserve)

It made borrowing for the US cheaper. There was great demand for savings in the US. This encouraged a US banks to offer increasingly sophisticated forms of investment. It explains why there was so much high demand for US mortgage securities even though the risk was very high.

3. Undervalued Yuan. China has tried to keep the Yuan undervalued to boost its exports. This undervaluation of the Yuan has made Chinese exports cheaper and boosted the Chinese Trade surplus.

- The US have blamed China for the imbalances pointing to the undervaluation of the Yuan. This has been at times a political football, with US politicians deriding the ‘protectionist’ exchange rate policies of China.

- China have defended themselves saying the global imbalances were caused by the US decision to pursue low interest rates and lax standards in lending criteria. They argue it is their right to pursue their own exchange rate policy. Before, China, the US used to blame Germany and Japan.

4. Emerging market economies experienced sharp rise in current account surplus.

- e.g. oil producing countries benefitted from rising oil revenues due to higher oil prices.

- Asian countries reduced investment and increased savings after South East Asian crisis of 1997

The aggregate current account position of developing countries swung from a deficit of about $80 billion in 1996 to a surplus of roughly $300 billion in 2004, a net move toward surplus of $380 billion.

Problems of Global Imbalances

To summarise, higher demand for bonds pushes interest rates lower. See: (why higher price of bond leads to lower interest rate)

In the mid 2000s, the global economy could be characterised in a few ways. This is a simplification, but it should help to understand.

- US had strong economic growth, led by consumer spending. US had large current account deficit (imports were greater than exports)

- China had strong export sales. China had large current account surplus (exports greater than exports)

- With a current account surplus, China was receiving increasing foreign currency reserves. Therefore, China used these export revenues to buy US securities.

- One reason China wanted to buy US securities is that by buying dollar assets, it increased the value of the dollar and reduced the value of the Yuan. This made Chinese exports more competitive and increased Chinese growth.

- This increase in demand for US securities (e.g. US Treasury Bills) increased the price of US Treasury bills. When the price of bonds increase, it reduces the interest rate on bonds. See: explanation of (bond prices and bond interest rates)

- Thus the flow of money into the US kept interest rates low. With low government bond yields, it also kept down other interest rates, e.g. on mortgage bundles and corporate debt.

- With low interest rates in the US, this encouraged Americans to keep borrowing and spending. This contributed to the rise in US house prices and the continued US current account deficit.

If China hadn’t bought US Treasuries, there would have been lower demand for the price of bonds. This would have kept bond yields in the US higher. Higher interest rates may have moderated the economic expansion.

Also, if China hadn’t bought US treasuries, the dollar would have been weaker and the Yuan would have been stronger. This would have reduced the US current account deficit. It would have been good for US exporters, but led to lower demand for Chinese exporters.

Overcoming Global Imbalances

China’s growth is currently based on export demand. However, if there was an increase in consumer spending by the Chinese, they would be buying relatively more US exports. This would reduce China’s current account surplus.

Also, if the US saved a higher % of income, it would lead to Americans spending a lower amount on imports, which would also help reduce the US current account deficit.

Related

- Balance of payments

- Global current account deficits