We tend to consider the impact of immigration on our own country. – How do immigrants affect UK unemployment? UK housing? UK labour markets? and GDP (e.g. economic impact of immigration). However, the flip side of the coin, is how does migration affect developing economies? Recently, the World Bank reported that migrants working in developed economies sent a record breaking level of remittances back to the developing world.

- In 2012, the World Bank estimates that migrant workers sent $406 billion in savings to their families in developing countries. (World Bank blog)

- The World Bank expects this to reach $534 billion by 2015.

- Remittances sent to all countries in 2012 (developing and high income) was $534 billion.

- These remittances were three times greater than aid budgets to the developing world.

- The figures for remittances underestimate the actual total because they only include money sent through official channels.

- The World Bank state that banks and transfer unions are taking an unfairly high commission (up to 20%) with the average transfer fee being 9%. Sub Saharan Africa has one of highest costs of sending money to. Reducing commission fees would substantially improve the benefit of remittances.

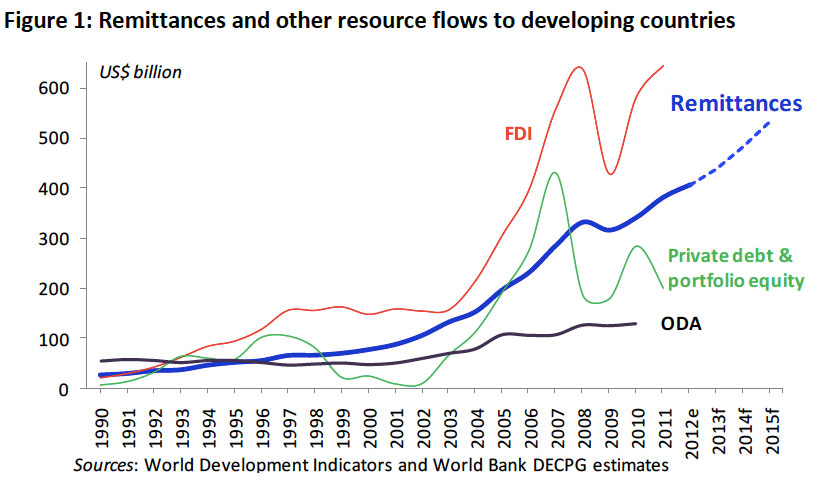

Remittances and other Transfer Flows to Developing Economies

source: World Bank Migration and Development Brief, pdf

Remittances growing faster than overseas development aid ODA. Remittances are less cyclical volatile than FDI (Foreign Direct Investment) and portfolio equity.

Top Recipients of Remittances

- India ($70 billion)

- China ($66 billion),

- Philippines ($24 billion)

- Mexico ($24 billion)

- Nigeria ($21 billion)

As a percentage of GDP, the top recipients of remittances in 2011 were

- Tajikistan (47%),

- Liberia (31%),

- Kyrgyz Republic (29%),

- Lesotho (27%),

- Moldova (23%)

- Nepal (22%),

Economic Impact of Migration and Remittances

For some countries, money sent back in the form of remittances from migrant workers comprises a substantial portion of GDP and their balance of payments. For very poor countries like Tajikistan, remittances make up nearly 50% of GDP so clearly it is very important for increasing GDP and living standards.

This money can be used to reduce relative poverty and fund capital investment. It counts as a credit in the balance of payments current account (net transfers) and so enables a higher standard of living. It can fund capital investment and small business

Remittances are sent to family members, therefore unlike aid, it isn’t siphoned off into corruption or misdirected arms projects. However, remittances may not be sent to the very poorest in developing economies meaning that remittances still leave a gap, which may need to be funded by aid.

One substantial drawback of remittances is that it means developing economies lose their best, most skilled young workers. It can lead to a situation where so many adults have migrated to a richer country, children are being brought up by grandparents (e.g. in Philippines – article at Guardian) This has both an economic and social cost. The economy loses because young workers are not available, society loses out by the displacement effect of young adults not being there. On the other hand, people wouldn’t undertake the upheaval of moving to other countries, if they didn’t think their families would benefit.

Migrants who work in developing economies, such as the US can also develop useful skills, such as the English language. The experience of working abroad may give them the skills and confidence to return home and set up a business. However, migrants often take the lowest skilled jobs, and migrants to the Gulf states of Saudi Arabia and Kuwait may have more limited opportunities to develop skills such as English. Migrants often face difficult working conditions and expressions of Xenophobia from domestic citizens who resent the migrants.

For the governments of developing economies, it is harder to tax remittances income, than it would be to tax labour income. However, if the remittances income is spent, governments could take a cut through VAT. Often tax collection is very low in developing economies anyway.

Overall, the sum of remittances is very substantial and goes some way to reducing global inequality. It could be seen as a positive demonstration of globalisation. The free movement of labour enables greater opportunities for people in developing economies and also helps developing economies gain important foreign currency revenue. Developed countries benefit from a more elastic supply of labour, enabling greater labour market flexibility.

With this level of Remittances is aid no longer necessary?

Remittances may still leave important gaps, for example, to regions where it is very difficult for workers to migrate. Some projects may not be funded by remittances because of market failure. However, the level of remittances can be seen as a complement to traditional aid.

In the debate on immigration, the remittances from migrants are rarely considered. If it’s good to give to charity, is it good to encourage migrants who do the job of aid for you? It’s a new argument in the immigration debate.

Perhaps the slogan

‘Trade not aid’, could be changed to

‘Trade, Remittances and effectively targeted aid can all contribute to improved living standards in developing economies’ not as catchy perhaps.

Related

1 thought on “Economic Impact of Migrants and Remittances”

Comments are closed.