The Bank of England set the base rate. The base rate is the rate at which they charge commercial banks to borrow from the Bank of England. In normal economic circumstances, this base rate will influence all the interest rates set by other banks and financial institutions.

- If the Bank of England cut the base rate, you would expect banks to also cut their mortgage and lending rates.

- If the Bank of England put up the base rate, you would expect banks to increase their mortgage rates.

The reason is that if commercial banks find it more expensive to borrow from the Bank of England, then they increase their lending costs to compensate. If it is cheaper to borrow from the Bank of England, they can reduce their mortgage rates and keep the same profit margin.

However, in the credit crunch, we see a greater divergence between base rates set by the Bank of England and actual bank rates that people in the real world face.

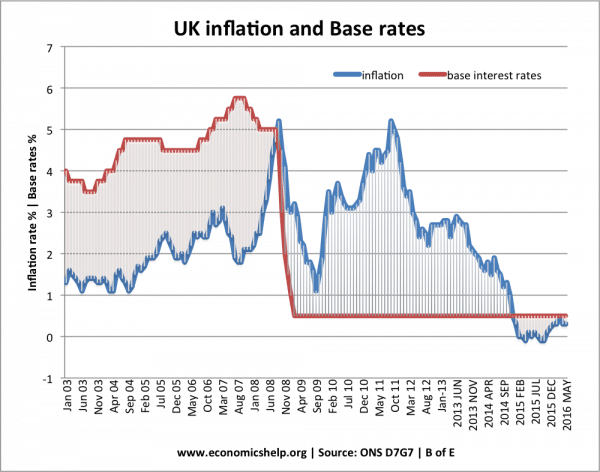

interest rates at the Bank of England

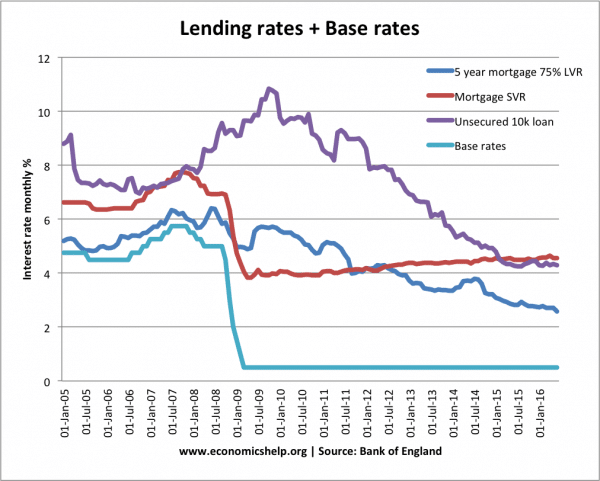

This graph shows the gap between base rates and the bank rates

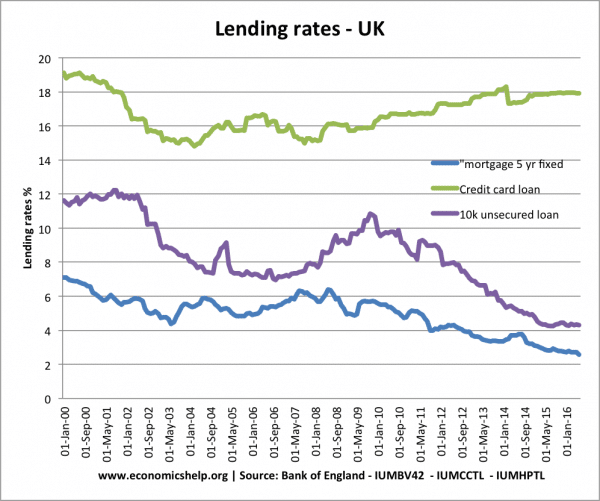

After 2008, we see the gap between base rates and bank lending rates increases from 2% points to close to 4%. It means that mortgage holders haven’t benefited from the cut in base rates as much as you might expect. The rate on credit cards is mostly unaffected by base rates.

Why the gap between bank rates and base rates increased

In 2008, banks were short of liquidity and they wanted to increase their deposits and improve their balance sheets. Therefore, they were reluctant to lend and keen to attract savings. Therefore, they didn’t want to cut mortgage rates and lending rates. In effect, they were making it more profitable; they could borrow from the Bank of England at 0.5%, but they were lending out at 4%.

Interest rates are quantity of funds

Another issue is that the quantity of funds is important. After 2008, it became much difficult to get a loan. Even if interest rates were low, people couldn’t always raise a sufficient deposit to get a mortgage.

Credit policy

This suggests that traditional monetary policy (which focuses on Bank of England base rate) may be insufficient, and we need to have more focus on actual real-life interest rates set by commercial banks. See: Credit policy with examples of interest rates in EU and Spain

Related

I love that last chart. It’s the final nail in the coffin of monetary policy, far as I’m concerned.

It has highlighted how the wider economy is heavily dependent on the banking sector.

Is this not evidence of Banks colluding to fix a market through anti competitive behaviour? Why are the banks not undercutting one another?