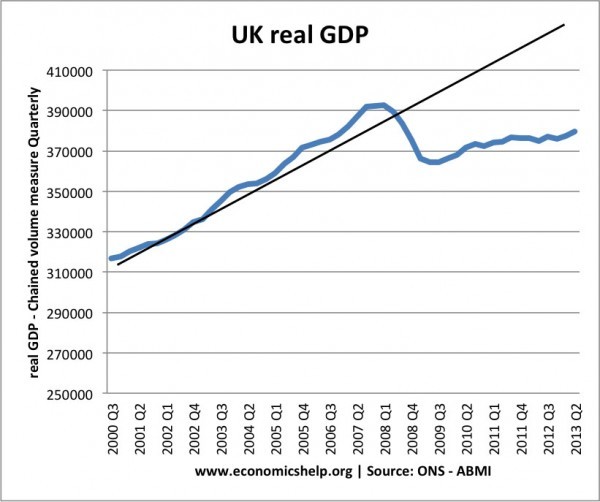

There are different ways of looking at the UK recovery. Firstly, we can look at the damage done to the economy since the peak in 2008.

The black lines suggests a possible pre-crisis trend rate of economic growth. A rough rule of thumb, suggests that had economic growth been maintained at the pre-crisis trend rate the UK would be looking at significantly higher GDP.

In Q3 2013 GDP was estimated to be still 2.5% below the peak in Q1 2008. From peak to trough in 2009, the economy shrank by 7.2%. This is an unprecedented length of economic stagnation – compare this recession to great depression of 1930s.

It is worth bearing in mind that economic growth pre-crisis was running close to the UK’s long run trend rate of economic growth of 2.5%. It wasn’t an unsustainable rate of economic growth like the late 1980s (when growth was running close to 5% a year) Of course, there were clearly elements of the economy that were unsustainable – financial sector, lending, housing market e.t.c. But, growth was surprisingly close to the long run trend rate of 2.5%

Could recovery have come earlier?

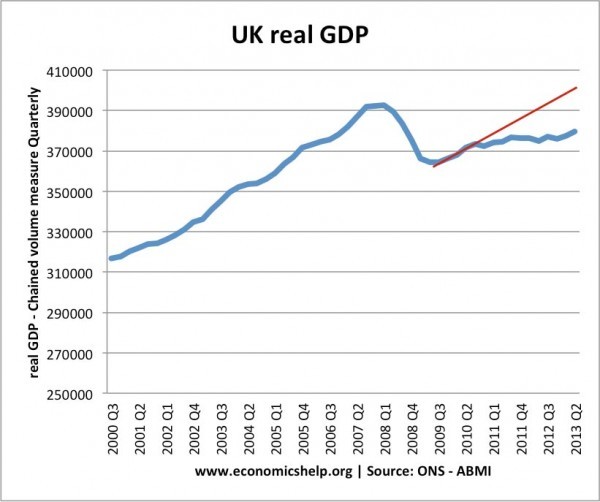

Another way of looking at the recovery is whether the first recovery could have been maintained in 2010 and through 2011. In many respects the size of the initial fall in GDP had a degree of inevitability. Despite slashing interest rates, the UK’s economy – heavily exposed to the financial sector crash fell in tandem with just about every major economy. The initial recession in the economy would have been very hard to stop during the actual crisis. But, there is a strong case that the signs of recovery in 2009/10 could have been maintained with more careful policy.

If the initial recovery had been maintained, we could be looking at real GDP 1-2% higher than the initial figure. In this respect, 2011 and 2012 were wasted opportunities with a government pursuing a misleading goal of fiscal consolidation.

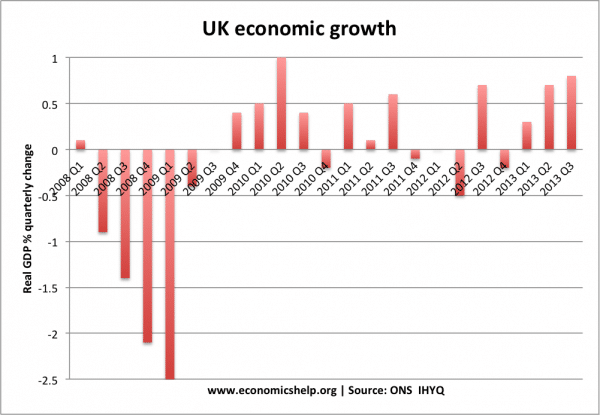

A strong bounce-back

Another way of looking at the recovery is to concentrate on 2013. This looks much more promising, with the economy expanding 1.8% in the first three quarters. After five years of declining GDP, this is a great relief. The government might use this ‘strong recovery’ as vindication for their policies of austerity.

It is not entirely without merit. If you look across the channel to Europe, it doesn’t take long to realise the UK economy could definitely be doing worse. It should also be remembered that to some extent, the government did pare back their own austerity rhetoric. There have been a lot of talk of spending cuts, in practise, they are substantially less than European style austerity.

In terms of economic recovery, there are many other factors at work.

- An economy bounces back eventually. No matter how steep the recession, economies are fundamentally resilient and do come back from recession. Often the deeper the recession, the stronger the recovery. If you cut output 10%, it is relatively easier to pick up the slack. You can get growth rates of 50% a year by slashing output to zero temporarily . It doesn’t mean that is a good policy.

- The recovery isn’t particularly strong. When there is slack and spare capacity, growth rates often are high The UK recovery in 1993 and 1994 was much stronger than this recession. (Growth was 3.7% 1993 and over 4% in 1994)

- Loose monetary policy. The Bank of England have been pursuing an unprecedented scale of monetary loosening. Interest rates at 0%, forward guidance suggesting low rates for a considerable time, quantitative easing and funding for lending. With this extent of expansionary monetary policy, it is surprising the economy has taken so long to recover.

- Devaluation. Another mystery is why the UK’s depreciation in Sterling of 20% did so little to boost exports. Eventually, it has made more of an impact on the economy. (does a devaluation really help?)

- Unbalanced recovery. The other ‘elephant in the room’ is that the UK economic recovery still looks unbalanced – relying to a large extent on the old favourites of buoyant London housing market, growth in consumer spending. Though provisional figures for Q3 do show promising signs of a broader based recovery.

Conclusion

To some extent, the important thing is that the recovery is finally coming. But, whether the recovery could have come earlier is important and significant for understanding of economic policy. It is also a good lesson in how you can get a very different picture, depending on which statistics you look at and how you view the overall picture.