Readers Question: It has been suggested in a philosophy/economics class that I am taking that given the current state of income inequality between the 1% and 99%, that a period of stagflation might be an effective equalizer. I don’t see it. Any thoughts?

Stagflation is a period of negative economic growth (or very low growth) combined with inflation. Under stagflation we get several problems at once – rising unemployment, rising prices, falling real wages and lower economic growth. Stagflation poses a problem for policymakers because it has hard to both reduce inflation and boost growth at the same time.

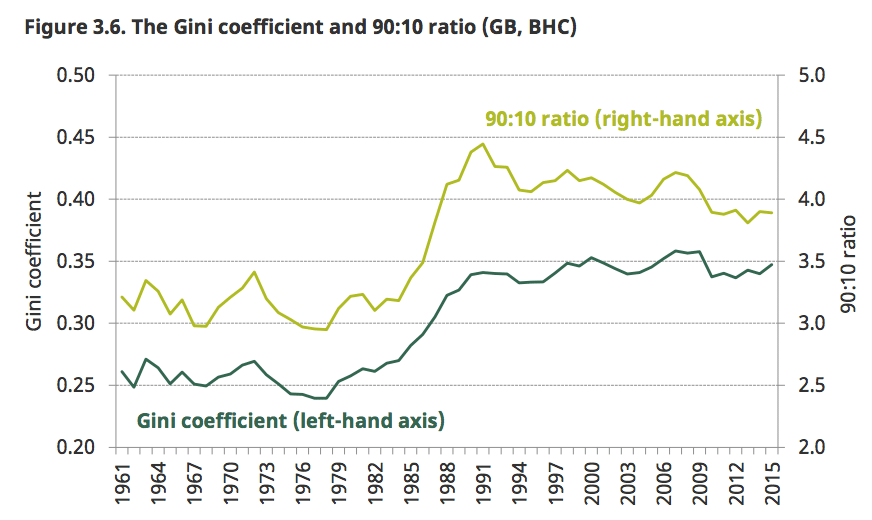

There is nothing to indicate that stagflation would reduce inequality between the richest and poorest. If anything, periods of rising unemployment, tend to increase inequality because unemployment is the most significant causes of relative poverty.

Stagflation 2008-17?

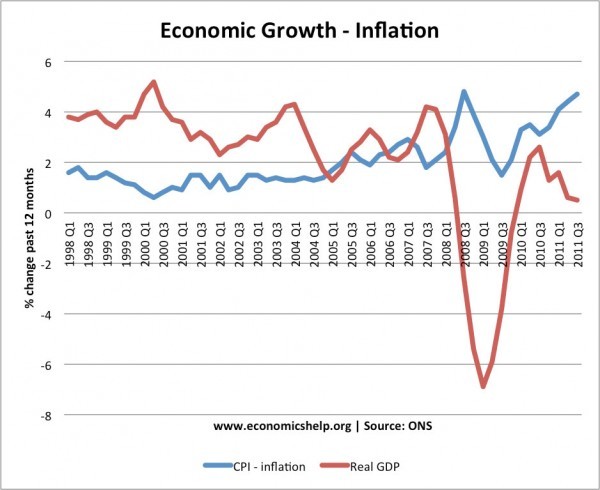

To some extent, the UK has had a degree of stagflation since 2008-17. We have had stagnant real GDP per capita, but periods of cost-push inflation which have led to lower real wages. The only difference is that unemployment has fallen since 2012. Although inflation has been relatively low compared to the 1970s, it has been quite significant because of low nominal wage growth and low-interest rates.

During this period, there has been no significant improvement in inequality. But, even if the gap was getting smaller, people see falling living standards – it would be small consolation that the gap between the rich and poor is falling.

Does inflation increase or reduce inequality?

Inflation can distribute income within society.

- Those with large debts may become better off as inflation can erode the real value of debt. It is possible, low-income earners with substantial debts could see a fall in their real debt burden and become better off.

- However, it depends very much on real interest rate). It is unlikely that lenders would give loans where interest rates didn’t rise to compensate for the inflation. In practice, it is rare for borrowers to become better off as a result of inflation – it would need inflation to be unexpected and lenders in fixed interest agreements.

- Inflation causes a fall in the value of money. Individuals with cash savings can see a fall in the real value of their savings. This has especially been true in period 2009-17, where interest rates have been close to zero.

- However, the very wealthy are usually the most protected from periods of inflation. The top 1% of wealth owners will have a substantial portfolio of wealth and assets. (housing, shares, bonds). These are largely protected from periods of rising inflation. In periods of inflation, the best way to survive is to buy real assets that you can.

- For example, in the 1920s hyperinflation of Germany – the main losers were middle-class savers. Wealthy industrialists were protected because their assets were in physical form. The poorest didn’t lose out by so much because they didn’t have any savings to lose. You could argue hyperinflation reduces the gap between the poorest and middle-class savers. But, everyone loses from the instability.

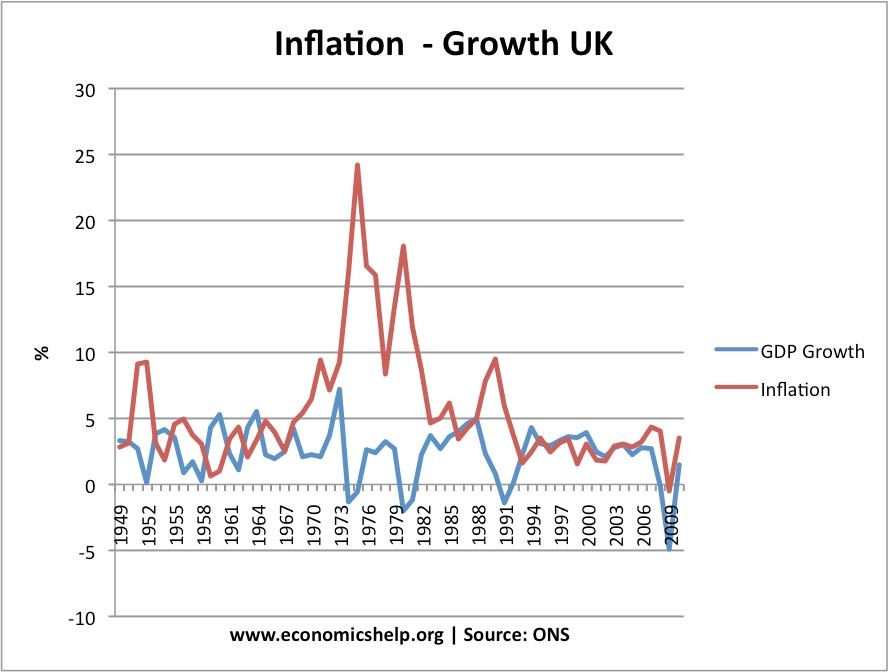

1970s stagflation and impact on inflation

One of the most prominent periods of stagflation was the 1970s. Rising oil prices led to higher inflation, but also lower economic growth and rising unemployment.

In the 1970s, society was generally more equal. There was a smaller degree of inequality. But, this was not due to stagflation, but the post-war economic consensus which involved

- Relatively influential trade unions able to bargain wage increases for workers

- Welfare state. In many ways more generous than current times. It was easier to have generous benefits during periods of relative full-employment.

- The existence of well-paid unskilled manual labour in manufacturing industries.

- Greater wage equality, especially lower pay for top earners Chief Executives compared to later decades

If anything the 1970s stagflation was a trigger for ending this period of relative equality.

- Rise in structural unemployment following 1970s recessions and process of de-industrialisation increased inequality

- Period of high inflation and break down of post-war consensus led to new economic orthodoxy, which stressed a more ‘free-market’ approach. In the UK and US, the 1980s saw a period of deregulation, privatisation, lower taxes on high earners, and a widening of wage inequality.

Conclusion

Stagflation causes a decline in economic welfare, but if anything the richest 1% will be protected from the effects more than others in society. Any rise in unemployment will inevitably increase inequality. Furthermore, stagflation harms government tax revenues which can put more pressure on reducing welfare payments and social services such as healthcare and education.

Related

In Ray Dalio’s book “Economic Principles” (http://www.economicprinciples.org/) on page 150 there is a table, presumably extracted from one of the scholarly works he cites, giving wealth distribution in Germany in 1913 and at the end of 1923 after the great inflation. I calculated the GINI coefficents from this data. For 1913 it is 0.62 and for 1923 it is 0.56. A big fall – but ending with a still very unequal society. The table is not too easy to interpret – but it seems to show that it was not just the middle that lost massively but also the rich. Skilled workers found their wage depressed towards the subsistence level where they met up with the unskilled. Less inequality there. Some comfort!