Readers Question: Explain what is meant by a balance of payments disequilibrium?

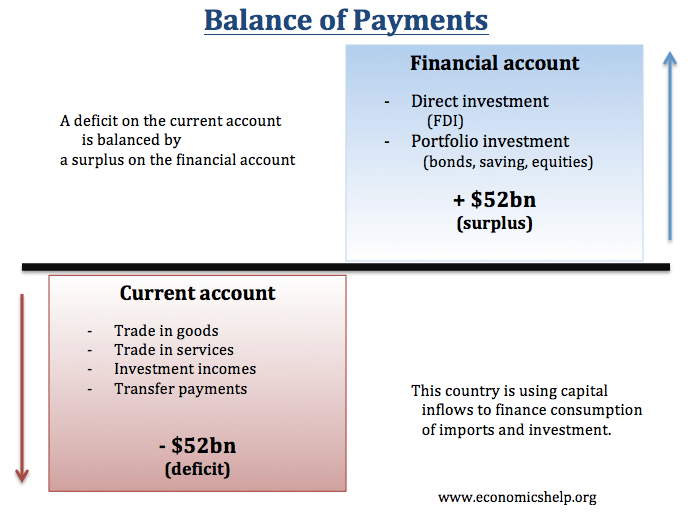

The Balance of Payments is comprised of two main components:

- The Current Account (trade in goods, services + transfer payments and investment incomes)

- The Financial Account (used to be called capital account; this is capital flows such as foreign direct investment)

If the UK imports more goods and services than we export – then we have a deficit on the current account. A significant deficit on the current account is generally referred to as disequilibrium. It will be matched by a surplus on the financial account.

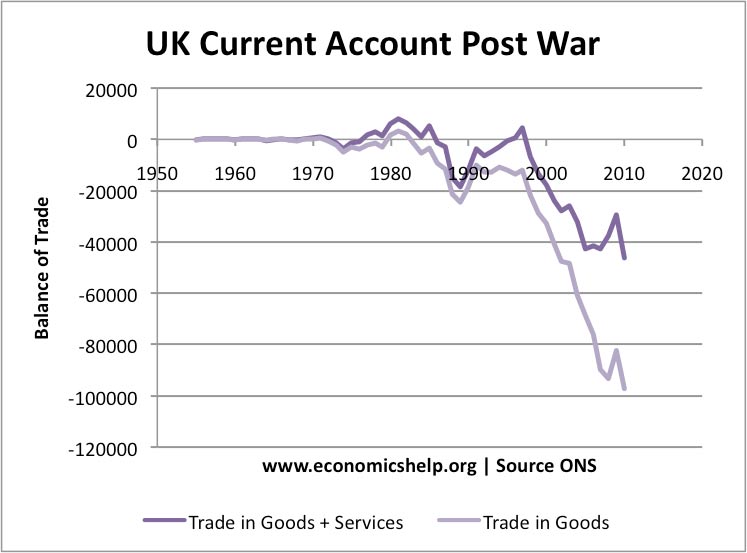

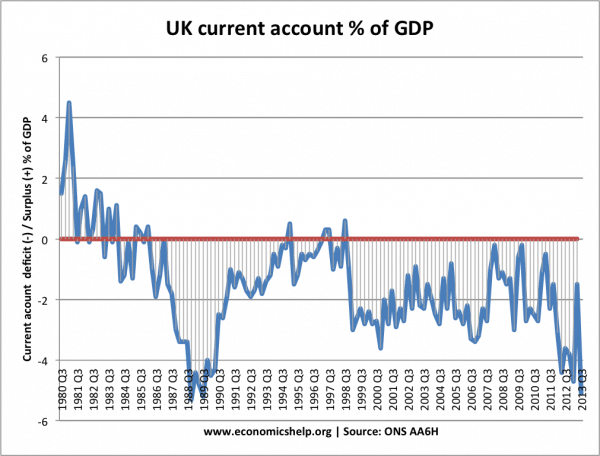

In the post-war period, the UK has usually had a current account deficit, apart from a brief surplus in the early 1980s and 2000s. The UK currently has a deficit on the current account.

Deficit in current account as % of GDP

See also ONS – balance of payments

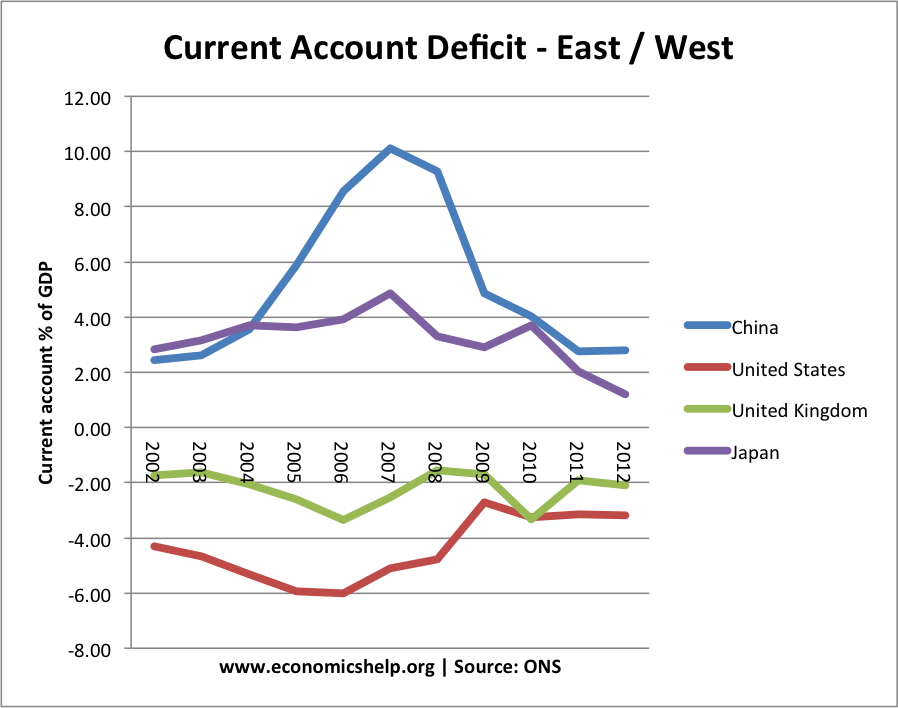

Note a large surplus on the current account would also be seen as a disequilibrium. – e.g. Japan or China have large current account surplus – current account surplus

Germany’s large current account surplus was seen as an imbalance within the Eurozone – see: German current account surplus.

Note, how if one country has a large surplus on the current account (Germany). Another country will have a similar deficit. Since 2006, the US deficit with China has narrowed. Similarly, China’s surplus has fallen too.

Current account deficit suggests wider disequilibrium in the Economy

- A large current account deficit may be an indication that the economy is too much geared towards spending (e.g. spending on imports) and too little on exports. A current account deficit can occur when the saving ratio falls and domestic consumers spend more on imports.

- A current account deficit may also be a sign of underlying inflationary pressures. As domestic goods increase in price, people buy imports instead. A current account deficit often occurs towards the end of a boom – when domestic demand is rising faster than domestic supply.

- It may also be an indication the country is losing competitiveness. This is especially important in a fixed exchange rates. Southern European countries experienced record current account deficits in 2008-10 due to becoming uncompetitive within the fixed exchange rate – the Euro.

- A deficit may also be a reflection that saving is less than investment and investment is being financed by capital inflows from abroad.

Overall Equilibrium in Balance of Payments

In a floating exchange rate, the two components of the Balance of Payments should balance each other out. If the UK has a deficit on the current account of £52bn. Then in a floating exchange rate, the financial account should have a surplus of £52bn. This is because financial outflows must be matched by financial inflows.

Example, if we buy more imported goods than exported goods, then we need financial flows (e.g. hot money, long-term capital investment to finance the purchase of imports)

Balance of Payments Disequilibrium and Fixed Exchange Rates

When a country has a fixed exchange rate, there is more likely to be a balance of payments problem. For example, in 2011, several Euro countries were relatively uncompetitive. However, because they are in the Euro, it is not possible to devalue against other European countries. Therefore, they are stuck with exports which are too expensive. Therefore, we tend to see a large current account deficit.

Portugal and Greece both have a serious balance of payments disequilibrium caused by a decline in competitiveness.

Global Imbalances

A balance of payments disequilibrium can be causes of global imbalances e.g. Large flow of capital from China to the US.

Some argue this was a factor in the credit crunch of 2008. Large flows of capital from China to the US kept yields on securities and bonds artificially low, creating a bubble in certain risky assets. See: Global imbalances

The current account can also be seen as an imbalance between domestic savings and domestic investment. If domestic saving is lower than domestic investment, then we will see a current account deficit. The excess domestic investment will be financed by capital inflows from abroad. See: Current account = Saving – investment

Related

help me solve the question

if balance of payment must all be balance while then do will still have balance of payment disequilibrium? support your answer with diagram and graph

if balance of payment must always be balanced .why then do we still have balance of payment diseqilibrium. support answe with illustrations and diagrams.

Disequilibrium will exist even if the BOP is balanced because while a country’s imports (expenditure) may be than its exports (revenue), it could still be getting revenue by some mean other than exporting its goods. Read up on on the capital & current accounts and what makes up these accounts and you will get the full gist of what I mean.

How BOP disequilibrium can be restored?

if balance of payment must all be balance while then do will still have balance of payment disequilibrium? support your answer with diagram and graph

international services are not used for file transfer protocol gopher and telnet .

plz help us

discuss how devolution helps in the correction of adverse BOP of a country. is this measures equally applicable to the developing countries exporting mainly primary goods?

discuss how devolution helps in the correction of adverse BOP of a country. is this measure equally applicable to the developing countries exporting mainly primary goods?

on what factors does the balance of payments depend?

suggest measures for improving balance of payments in India.

will you mail me the balance of payment of india and pakistan

mail me the measures to improve balance of payment.

measures to improve balance of payments include improving domestic industry.

balnce of payment is always deficit in developing countries .Why?

explanations are well but it is just based on uk. what about other countries. do the explanations remains same for all countries?