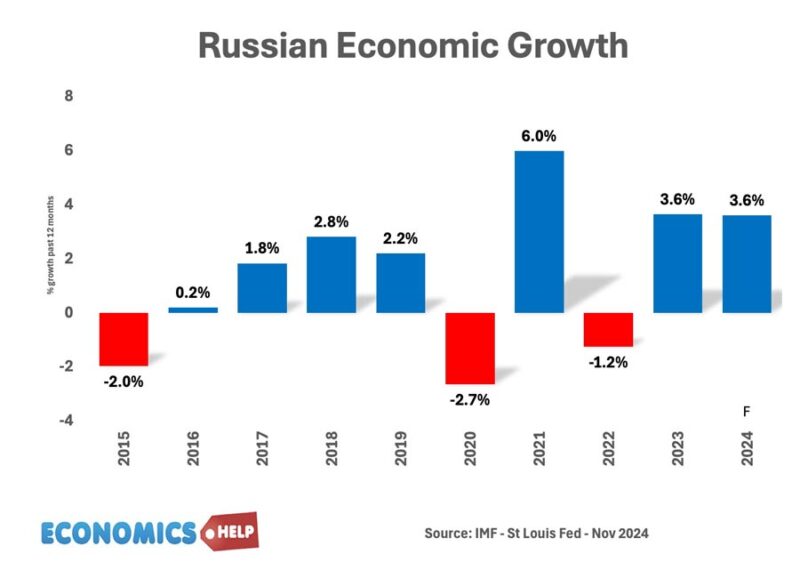

After the invasion of Ukraine in 2022, western countries imposed a series of sanctions on Russia. Some claimed this would cripple Russian economy and led to a deep recession. But, the Russian economy seemed to shrug this off growing at 3.6% in 2023 making it own of the fastest growing economies in the G20.

And in one sense, it’s not a surprise, war spending usually provides an economic stimulus. In the 50s and 60s, The US wars in Korea and Vietnam boosted GDP just as it often does.

However, war spending does come at a cost. At least 40% of all Russian government spending is now related to the military. This may provide a temporary boost to GDP but it also causes resources to be taken from elsewhere. With shortage of a capital, imports and labour, firms are pushing up prices.

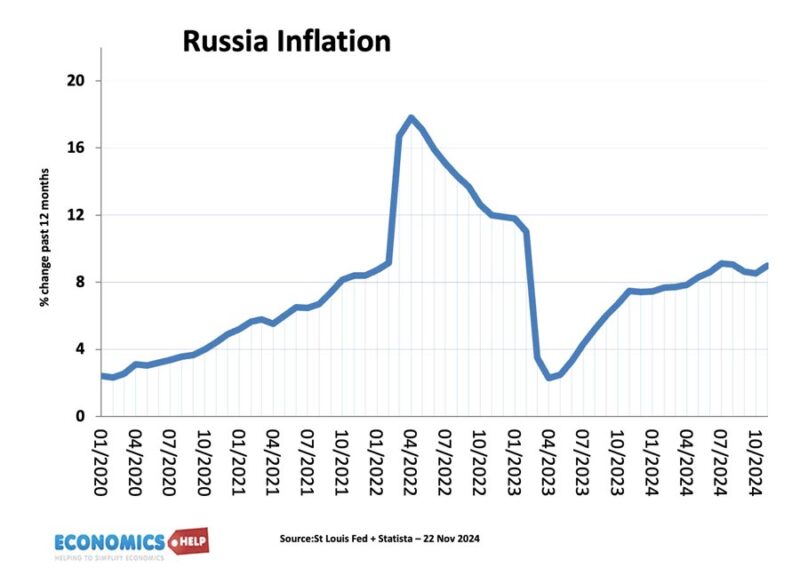

Russian inflation has been creeping up. The official inflation figure is 9%, but ordinary Russians are noticing bigger increases in items such as butter, fruit and potatoes. It’s the classic guns vs butter trade off. Rising food prices are due to the higher cost of raw materials, the rising cost of loans and the difficulty of paying for imports. The FT reports how delays to payments have led to firms resorting to barter – chickpeas for tangerines.

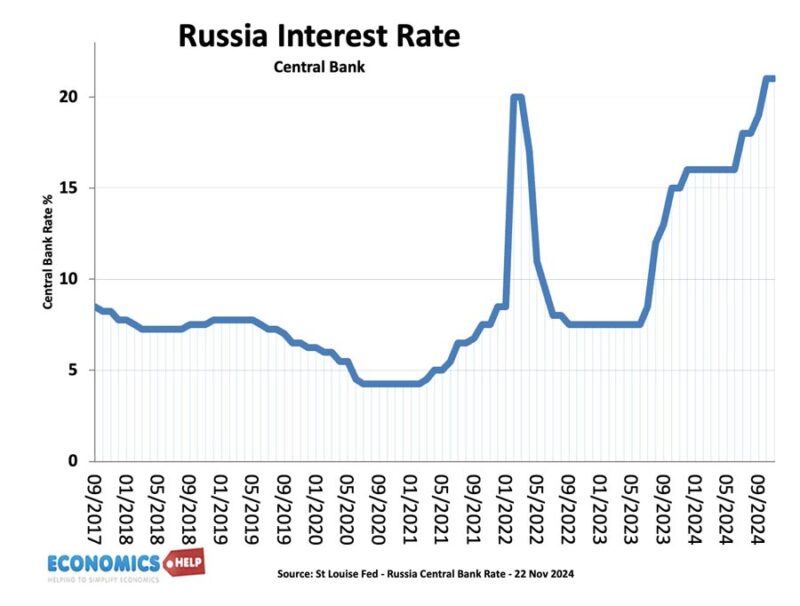

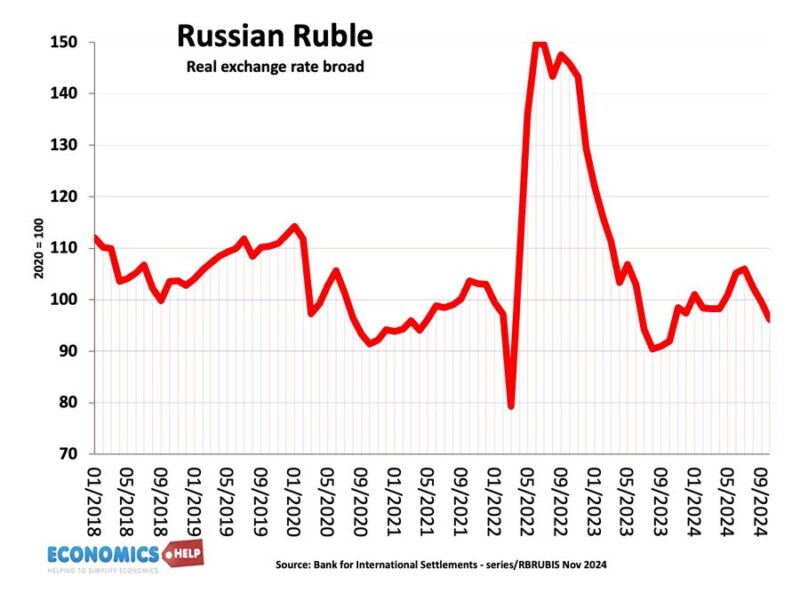

Inflation would be even higher if it wasn’t for record interest rates of 21%. And this is a big problem facing the economy. Super high interest rates are crowding out other aspects of the economy – especially hurting business with big loans and households with mortgages. The owner of a steel mill warned “At the current interest rate, it’s more profitable for companies to halt expansion and put money in the bank.” To avoid a property crunch, banks are lending US sub-prime style mortgages with fixed rates for two years before the rate will balloon upwards after. Many are banking on interest rates coming down. And if they don’t fall, household and corporate bankruptcy will rise. Central Bank head Elvira Nabiullina claims inflation is now set to fall without stagflation. But, with unemployment at a record low of 2.4%, the Ruble weak and the economy running into supply constraints, the underlying inflationary pressures are very real and may mean that higher interest rates prove to be a blunt tool for reducing inflation.

Sanctions and Imports

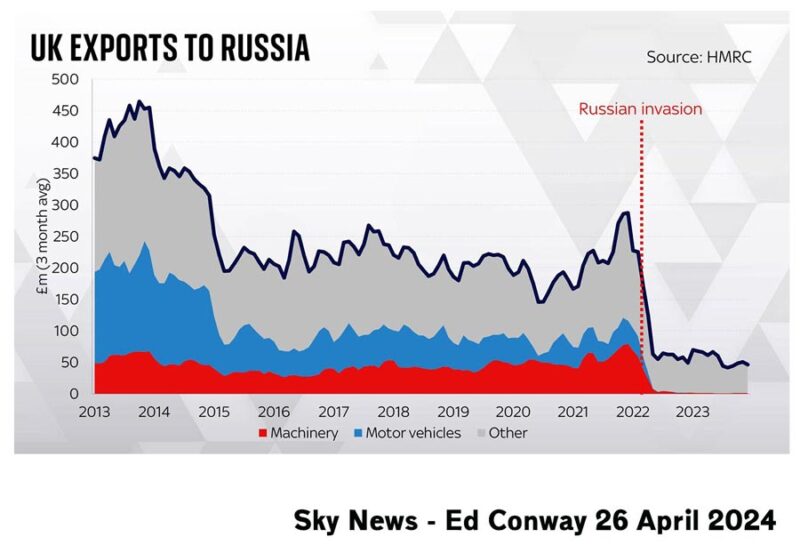

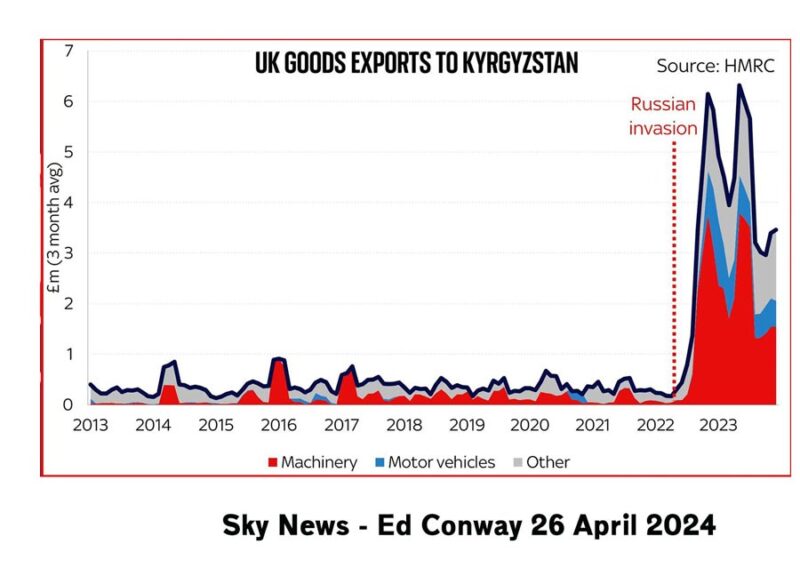

Another real problem Russia faces is the difficulty in importing goods. When the domestic economy struggles to produce enough, the solution is to import. But, here western sanctions are having an effect. Firstly, the direct sanction on military hardware. Secondly, blocking access to Swift international payments and third the immobilisation of Russia’ Central Bank foreign currency reserves. Now, in the aftermath of Western sanctions, UK exports to Russia plummeted, but at least some of this was illusory.

British exports to nearby friendly states like Kazakstan and Armenia saw an improbable surge.

So it is true sanctions are being avoided, but not entirely.

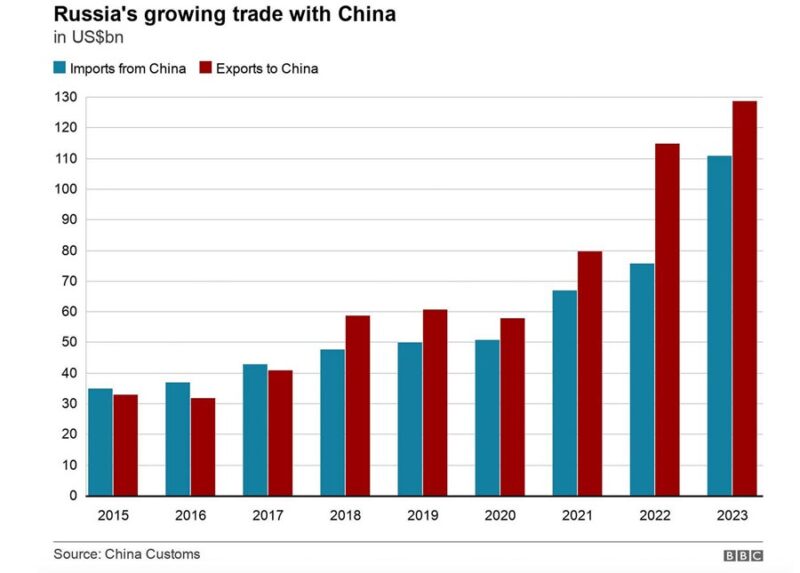

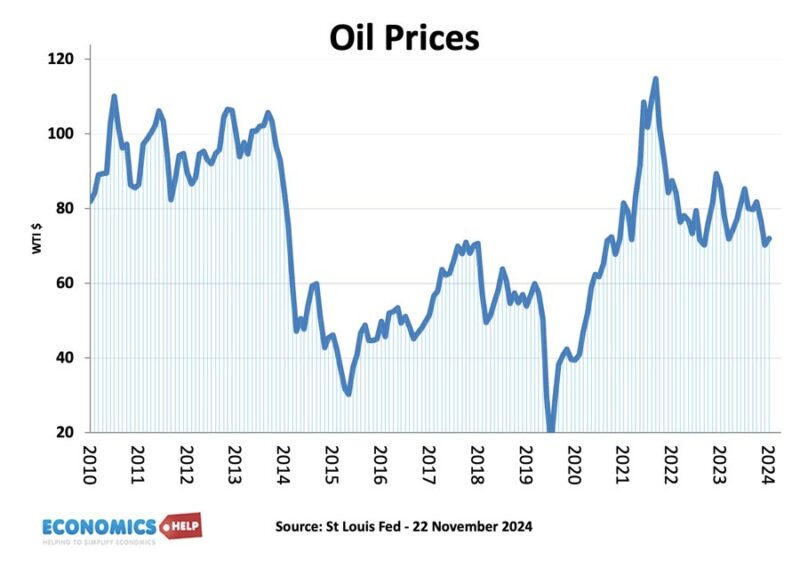

Russia is increasingly reliant on imports from China. 90% of Russian microelectronics now come from China. But, China is not doing this out of charity. It strikes a hard bargain. And the problem Russia faces is that sanctions, higher inflation, and falling oil prices have all been putting downward pressure on the Ruble.

The Ruble is now trading at close to 100 to $1 A fall in the Ruble against the Yuan is very damaging when you rely on imports from China. As the Ruble falls, it becomes more expensive to import, pushing up domestic inflation even more. This weakness of the Ruble is a major reason why the Russian Central Bank have increased interest rates so high to protect the currency. Capital controls have also played a role. But, the high-interest environment has led to a public rebuke from the head of state-controlled weapons producer Rostec that the Russian industrial sector will struggle to export high-tech goods because of the high rates and enormous demand for military hardware.

Oil Prices Slump

Another problem for the Russian economy is the trajectory of oil prices. The economy is highly dependent on oil for both export and government tax revenues. High oil prices in 2022 helped boost revenues, but since then a global slowdown has seen oil prices steadily fall. There was a brief effort by OPEC to increase prices, but Saudi Arabia seems to have given up on aiming for high prices, and now openly talks about flooding the market with cheap oil. $50 a barrel has been muted. This would hit the Russian economy, because Russian oil tends to be more expensive to produce and since the war, sells at a small discount to global prices. Falling oil prices would be bad for the economy.

Wasted GDP

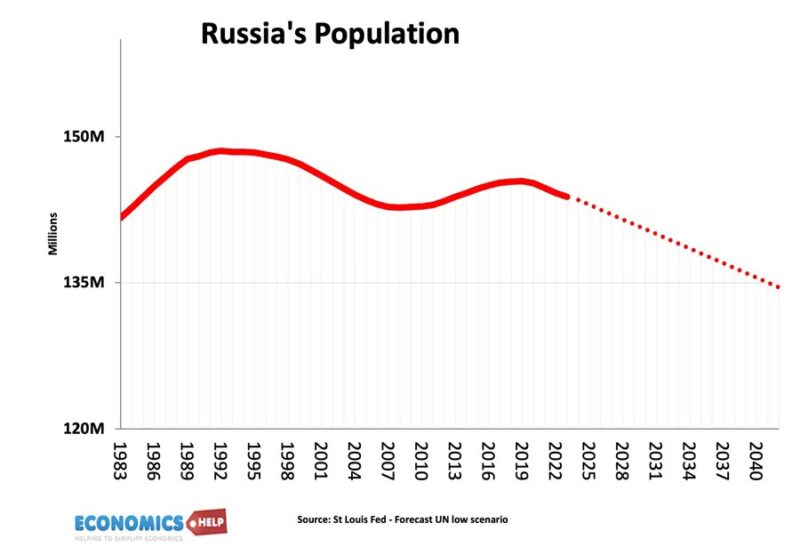

Recently, we looked at the limitations of GDP in measuring living standards, and nowhere is this more apt than in a war economy. Spending money on military boosts GDP and provides full employment, but comes at terrible human cost, but also damages the long-term prospects of economy. In the long-term, the war has accelerated Russia’s population decline. An estimated one million have left the country since the war began, often highly skilled and educated young people.

More pessimistic population forecasts suggest Russia’s population could fall to 135 million within the next few decades. The Russian population is aging. This is definitely not a unique phenomenon – it is a feature of all former Soviet countries, but the war is exacerbating manpower shortages in key industries.

High Borrowing Costs

When the UK fought in the Second World War, it spent a similar share of GDP on military spending. Government borrowing soared to over 200% of GDP. But, the big difference is that the UK with lend-lease financial support from America was able to borrow at just 3%. The Russian government is now facing financing borrowing for a war at 21% interest rates. At the start of 2022, Russian bond yields were 6%. Now they are 17% and likely to keep rising. It means debt interest rate costs will be significantly higher. However, there is no immediate crunch because Russian government debt is low by international standards after a decade of saving before the war.

The election of Trump in the US may change Russia’s fortunes with likely a more sympathetic US policy. The Russian economy will not collapse. But, rising inflation and a weakeneing Ruble do make the economy increasingly vulnerable. It can create the kind of negative feedback loop of permanently high inflation. Something like Turkey or Argentina. The effect of higher interest rates typically take 6 -12 months to have their full effect. And if 2025 sees continued inflationary pressures then it could lead to growing bankruptcy of firms affected by the higher interest rates.

Related

Sources