Q. How does the Bank of England decide and set interest rates?

- The Bank of England set the repo rate. This is sometimes known as the ‘base rate’. It is the interest rate at which commercial banks (like Lloyds and Natwest) borrow from the Bank of England.

- The Bank of England can control liquidity and money supply, so commercial banks need to borrow short-term money from the Bank of England.

- This means this repo rate is important for commercial banks. Therefore, if the Bank of England increases their repo rate, commercial banks tend to increase their interest rates too.

- Note: banks are not obliged to follow the Bank of England rate decisions. (e.g. when the Bank of England cut interest rates to 0.5%, many mortgage companies didn’t cut their own interest rates)

- However, generally, the Bank of England base rate, determines all the main saving and borrowing rates in the economy.

What determines interest rate decisions?

- The Monetary Policy Committee of the Bank of England, meet every month to decide whether the interest rate should be changed.

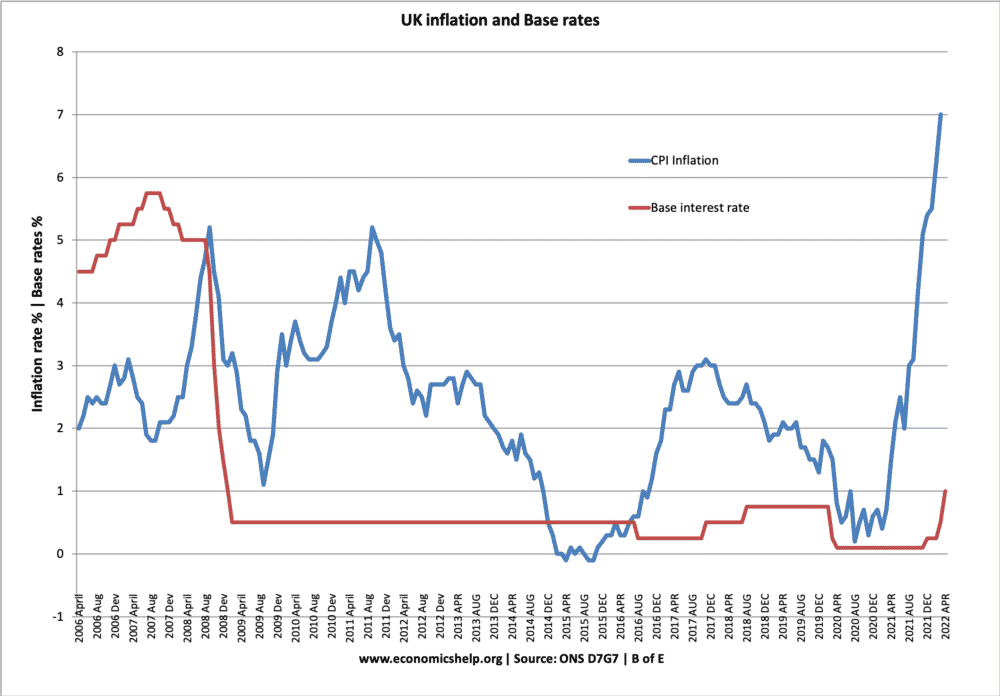

- They have an inflation target of CPI – 2%+/-1. This means they try to keep inflation close to 2% (between 1% and 3%).

Inflation forecasts for the UK suggest inflation is unlikely to increase above the 2% target – therefore little need for higher interest rates

- If inflation increases above the target (or is forecast to rise above the target) then the Bank of England are likely to increase interest rates.

- Higher interest rates increase the cost of borrowing and make saving more attractive. This tends to reduce consumer spending and investment and reduce the growth of aggregate demand. Therefore, economic growth tends to slow down and this reduces inflationary pressure. (see: The effect of increasing interest rates)

- If inflation is below the target, then they may cut interest rates to boost spending and economic growth.

- The MPC tries hard to predict future inflation by looking at many economic variables – inflation forecasts

Factors influencing inflation forecasts of Bank of England

- Wage rates – rising wages can cause both cost-push and demand-pull inflation.

- Rate of economic growth compared to long-run trend rate

- Commodity prices – rising oil prices may cause inflation.

- Consumer spending levels

- Investment levels

- Consumer confidence.

Other Important Variables

As well as trying to target inflation, the Bank of England considers other aspects of the economy. In particular, they need to consider the impact of monetary policy on economic growth and unemployment.

Therefore, it is possible that inflation can go above target, but they feel they need to keep interest rates low. e.g. currently, growth is fragile and unemployment high, this encourages the bank to keep interest rates low.

Type of Inflation

As we mentioned in different types of inflation, there are different measures of inflation. If CPI rises because of temporary factors like volatile energy prices or indirect taxes, this is likely to be less cause for concern.

However, if inflation occurs because the economy is overheating and there is rampant wage inflation – this presents a stronger case for raising interest rates to moderate economic growth and prevent boom and busts.

Difficulty of using interest rates

Often it is difficult to rely on interest rates to control the economy. To give just a few examples.

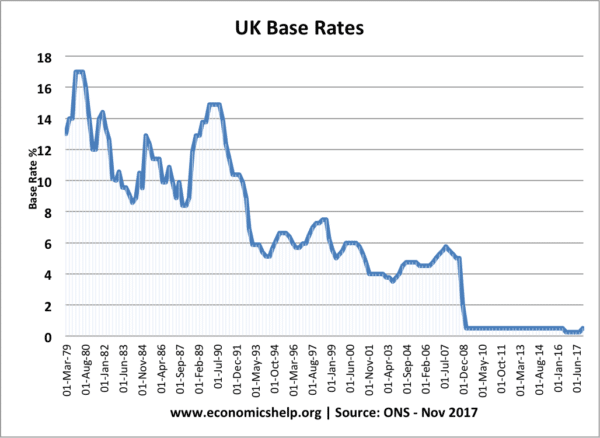

- Liquidity trap – zero interest rates may be insufficient to boost growth

- Cost-push inflation – high inflation and high unemployment means interest rates can’t target both

- Impact on asset prices. Low-interest rates may cause a boom in bank lending and asset prices. In the ‘great moderation’ of the 2000s, inflation was low, but, there was a boom in bank lending and asset prices. Arguably the economy needed more than just relying on interest rates.

Related

- An evaluation of MPC in controlling inflation

- How MPC set interest rates

- Understanding interest rates

- Natural interest rates

How Monetary policy works – at Bank of England

It is because there are different account holders with different interests ranging from individuals,firms and governments.

The lack of reference to supply in relation to demand and that increasing supply can help contain inflation is a massive, but all too frequent ommission.

The emphasis on wage inflation is absurd. Wages follow inflation, not the other way round.