Economic defeatism is a situation where policy makers accept an economic situation which is well below potential. Another form of defeatism is to see some problems as intractable and concentrate on dealing with side issues.

Economic defeatism is contagious because it can set the tone for the whole economy, making it even more difficult to resolve the situation.

Example of economic defeatism

The response to the great depression. Liquidate the banks!

As Andrew Mellon famously advised Herbert Hoover at the onset of the great depression.

“liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate… it will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.” Hoover, Herbert (1952). Memoirs. Hollis and Carter. p. 30.

This isn’t so much economic defeatism, but revelling in depression. Yet, it is most striking reminder of how embrace of liquidation can create economic misery.

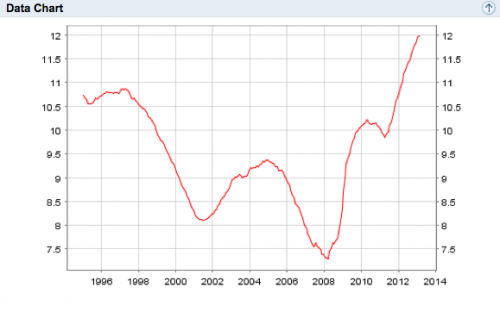

Europe 2008-13

Throughout the great recession, the EU have shown little ability, willingness or enthusiasm for decisive action to deal with growing unemployment and the prolonged recession. Instead, policy makers have focused on the necessity of sticking to fiscal targets, arguing there is no option but to deal with growing government debt. The consequence is that the EU have made little efforts to deal with the recession, and are at risk of experiencing a lost decade. Instead, there have been vague talks of supply side reforms and hopes that fiscal austerity will provide a stronger framework for future recovery. (see also: confidence fairy)

An alternative view. The alternative view would be to see the EU unemployment rate as unnaturally high and see the figure as something that can and should be reduced. Loose monetary policy, the willingness of ECB to buy bonds and less damaging fiscal policy could all reduce unemployment and create more signs of growth. With this focus on growth and full employment, European economies would be in much stronger position to deal with the ”less important’ macroeconomic objective of government borrowing.

UK post 2010 and double dip recession

A strong element of the Conservative manifesto during 2010 election was (understandably) saying how bad the economy was. The problem was that after the election this continued rhetoric of impending ‘economic crisis’ became self-fulfilling. By concentrating on the perceived ‘dangers’ of government debt, the new coalition government magnified a small problem. The cuts imposed on the budget may have been relatively small, but it was enough to contribute towards the double dip recession. The negative talk also reduced consumer confidence. If the government is saying how bad the economy – expect deep spending cuts, job losses and wage freezes – it is not surprising consumers cut back on spending and increased their saving.

We can’t afford it.

Suppose, there is a £1billion government investment in public infrastructure, which would give a net benefit of £1.5 billion – there is a strong case for government financing this spending by tax or borrowing. In the long term, the economy will benefit from the investment. If the government don’t invest, there will be market failure. Private enterprise will not provide sufficient roads and rail links because the profit motive doesn’t work for public goods. If the government is willing to under take the investment, the economy will benefit from increased capacity, increased growth and higher future tax revenues. Another way of thinking about this issue is can we afford not to? Can we afford to waste £billions in lost output because of chronic congestion?

In the great recession of 2008-13, many governments (outside Eurozone) saw record low bond yields making government borrowing very cheap. There was a high demand for lending to the government, but this was not taken up because the mantra was – we can’t afford it.

It’s too hard to collect tax

There is a feeling that the world is nearly broke. Around the world governments, banks and private investors are dealing with record levels of debt. But, equally, there are huge sums of corporate savings. Some multinationals are making record levels of profit. Google has a cash pile of $50bn (2012). Apple has a cash pile of $145bn (2013)

Yet, these multinationals are adept at avoiding paying corporation tax. If there is a stronger collective international will, government finances could be improved and the cash piles could be put to more productive use than sitting in Bermuda bank accounts.

Related

Another example is that daft idea you hear over and over from Austrians, namely that recessions are necessary so as to get rid of uneconomic firms or what they like to call “malinvestments”. The truth of course is that hundreds of uneconomic firms in the UK close down every day, even in normal times and even during a boom, and hundreds of new ones start up. But the latter is too complicated an idea for Austrians.