Reader’s Question: Why does printing money cause inflation? Does this always occur?

Summary

- If the money supply increases faster than output then, ceteris paribus, inflation will occur.

- If a government prints extra money, households will have more cash and more money to spend on goods. But, if the amount of goods stays the same, the extra cash will just cause firms to put up prices.

Explanation of why printing money causes inflation

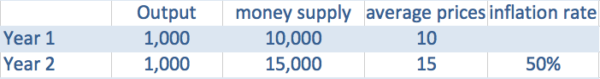

- Suppose the economy produces 1,000 units of output.

- Suppose the money supply (number of notes and coins) = $10,000

- This means that the average price of the output produced will be (10,000/1000) = $10

- Suppose then that the government prints an extra $5,000 notes creating a total money supply of $15,000; but, the output of the economy stays at 1,000 units.

- Effectively, people have more cash, but, the number of goods is the same. Because people have more cash, they are willing to spend more to buy the goods in the economy.

- Ceteris paribus, the price of the 1,000 units will increase to $15 (15,000/1000). The price has increased, but, the quantity of output stays the same.

- People are not better off, and the value of money has decreased; e.g. A $10 note buys fewer goods than previously.

Therefore, if the money supply is increased, but, the output stays the same, everything will just become more expensive. The increase in national income will be purely monetary (nominal)

If output increases by 5% and the money supply increases by 7%. Then inflation will be roughly 2%.

The Quantity Theory of Money

The Quantity theory of money seeks to establish this connection with the formula MV=PY. Where

- M= Money supply,

- V= Velocity of circulation (how many times money changes hands)

- P= Price level

- Y= National Income (T = number of transactions)

If we assume V and Y are constant in the short-term, then increasing the money supply will lead to an increase in the price level.

Printing money and devaluation

If a country prints money and causes inflation, then, ceteris paribus, the currency will devalue against other currencies.

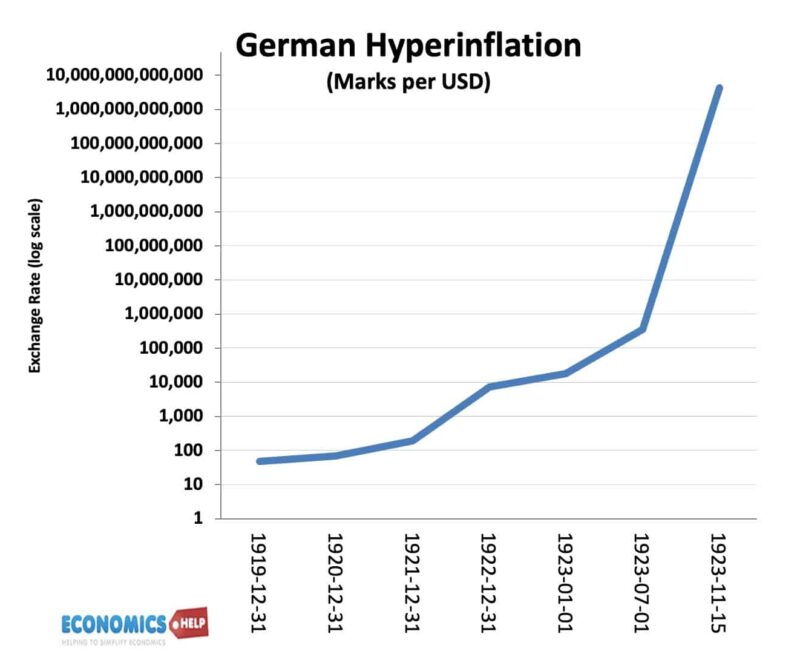

- For example, the hyperinflation in Germany of 1922-23, caused the German D-Mark to devalue against the currencies that didn’t have inflation.

- The reason is that with the German currency buying fewer goods, you need more German D-Marks to buy the same quantity of US goods.

Examples of inflation caused by an excess supply of money

- US Confederacy 1861-64. During the Civil War, the Confederacy printed more paper money. In May 1861, they printed $20 million notes. By the end of 1864, the amount of notes printed had increased to $1 billion. It caused an inflation rate of 700% by April 1864. By the end of the Civil War, the inflation rate was hitting over 5,000% as people lost confidence in the currency.[“Inflation in US confederacy. Encyclopedia.com]

- Germany 1922-23. In 1921 one dollar was worth 90 Marks. By November 1923, the US dollar was worth 4,210,500,000,000 German marks – reflecting the hyperinflation and loss in value of the German currency.

Evaluation – Link between money supply and inflation in the real world

- It is possible that if the government printed money, people could just decide to save the extra money and therefore, prices wouldn’t automatically rise.

- It is also possible that increasing the money supply could stimulate more output. For example, in a recession, there is unemployment of resources and a lack of demand. If a government prints more money and households start spending more, this may encourage firms to start increasing output and investing in future capacity, which helps to cause an increase in real output. Therefore, the link between increasing money supply and inflation will be weaker.

- Also in the real world, it is hard to measure the money supply (there are many different measures from M0 narrow money to M4 wide money)

However, the above provides a rough explanation why printing money usually reduces the value of money causing prices to increase.

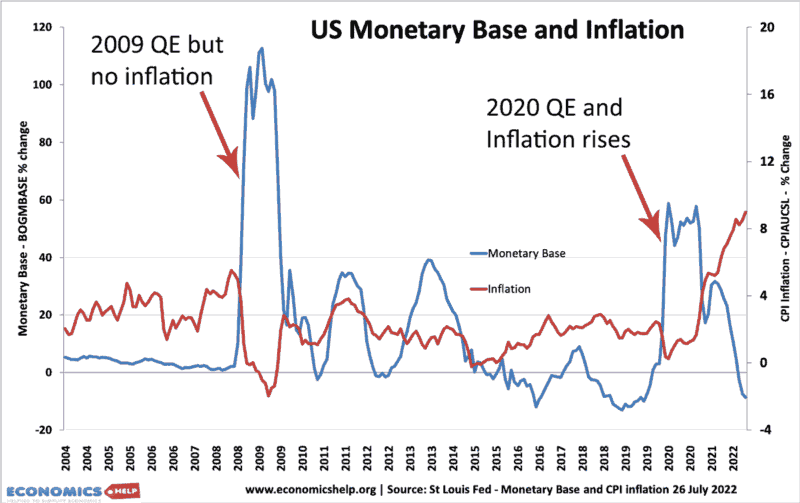

Does Quantitative Easing cause inflation?

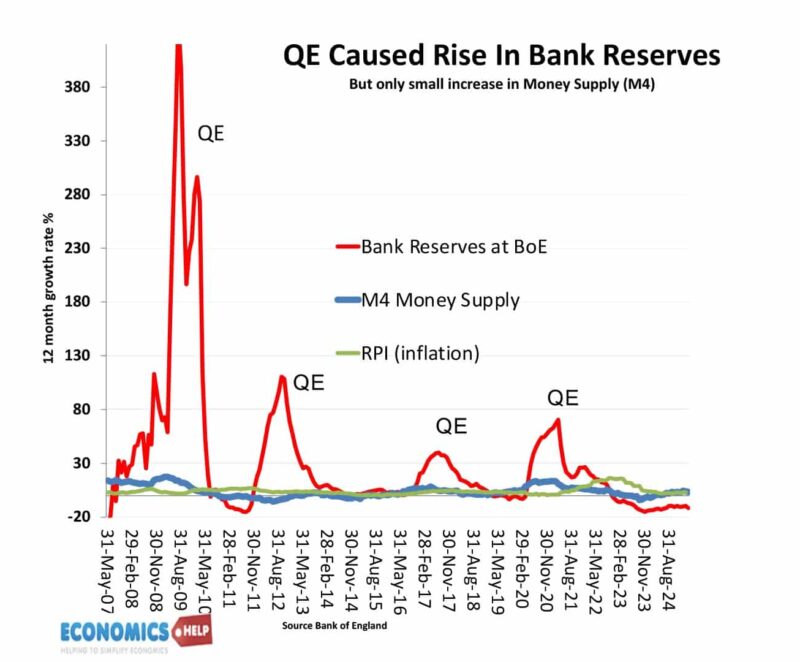

Quantitative easing involves Central Banks creating money electronically and buying bonds from commercial banks. (This is not printing money, though, it is causing a large increase in the monetary base (M1). However, this does not necessarily lead to increase in broader money supply M4. It depends on the actions of commercial banks. If they just keep the excess financial reserves, impact on inflation is limited. Don’t forget in a modern economy, it is commercial banks who create most of the money supply through lending. The amount of notes and coins in circulation is around 3% of total M4 money supply

QE – no inflation – then inflation

By 2015, the US monetary base had increased 600%, but the consumer price index has only increased 15%, an average inflation rate of 2%. It was the same in the UK, inflation remained relatively low, despite the Central Bank creating all this extra money. However, 13 years after quantitative easing started, we did see the return of inflation. So was it just a delayed effect or was something else causing inflation?

QE

When a central Bank creates money and buys bonds. It doesn’t actually print money. The important thing to understand is that it creates money for commercial banks who now hold more cash reserves with the Central Bank. But, here’s the really important question: between 2009 and 2015, did the Central Bank create any money in your bank account? The answer was no. So on the one hand there is more money created in the economy, but it was not really reaching the average household. Some argue that quantitative easing helped fuel asset inflation. Because of all these cash reserves, banks were more willing to lend mortgages and more able to invest in stocks. Certainly, UK house prices rose in this period. But, there were also other factors pushing up house prices, mainly the ultra-low interest rates.

This is the money supply in the UK. The monetary base includes reserves held in the Bank of England. M4 is the broader money supply which includes all the notes and coins plus different types of bank accounts. Basically, quantitative easing didn’t have much influence on this broader money supply. Which is why quantitative easing can have a very limited impact on inflation.

Further reading

Printing money does not cause inflation.

http://research.stlouisfed.org/fred2/graph/fredgraph.png

As you can see printing money and inflation are completely independent and show zero correlation.

It’s just a gimmick to keep people from talking about the real issue. Massive accumulation of wealth in the hands of the elite rich. The far right have completely hijacked our government.

“Because people have more cash, they are willing to spend more to buy the goods in the economy.”

No they aren’t!

I just don’t get who finds out “Oh shit there’s more notes in circulation now” and so…tells(?) the shopkeepers to start charging more/the suppliers to the shopkeepers/etc etc…it doesn’t make logical sense to me.

Basically, why do some people have to have less money than others for an economy to work!?

When governments print more money, they usually infuse the fresh cash into the economy by increasing the wages of its workers or by servicing its local debts, to name a couple of ways. The former will right away give more money to people to spend. On the other hand, the later will encourage banks to lower interest rates to increase outtakes of loans, which translates again to more money to spend.

The simple example given to explain how printing more money causes inflation is very good. Hope to be back again soon to look into other topics. Thanks a lot!

I thought of an analogy and wondered if I am correct.

Suppose there is a concert venue that seats 10,000 people. On one day, the Rolling Stones are scheduled to perform there. Tickets are nominally $50, but since the venue is likely to sell out, scalpers buy them up. Lets assume that Rolling Stones fans have lots of disposable income. So prices quickly rise. This represents the economy at full employment with too much money chasing too few goods.

Now suppose The Fluorescent Leech and Eddie are playing the same venue the following week. I’d love to see them in concert and have no problem paying $50 for the ticket. But the venue will never sell out. Flo and Eddie are just not that popular. If a scalper bought up tickets and tried to raise the price, it doesn’t matter how rich I am, I have no reason to pay more for the ticket. This is analogous to the economy far below capacity. More money in circulation does not increase the price, but instead stimulates more production. (Schedule another group to play with Flo and Eddie to draw in additional fans, for instance.)

If I am right, then printing money to put people to work when unemployment is very high will put people to work without raising prices very much at all.

Is that right?

Inflation occurs when too much money chases too few goods and services. If you increase the money supply and the amount of goods stay constant, prices increase because of the competition to buy

That is a very good quoting of scripture and verse Eric. Just because we religiously repeat things over and over does not actually make them true. Where is your data and evidence to support this?

No where is it chiseled in stone that just because, in this example, the government prints another $5,000 the cost of those output units must therefore increase along with it to $15,000. (I have an American keyboard with no pound key so I’m using dollars.)

That increase of cost/price takes place only in the minds of people. Prices don’t have to go up. Greed alone drives the price. I never went along with my economics professors teaching the old supply/demand scheme. It doesn’t have to happen.

When I was in business I disproved that notion. For the thirteen years I was in business my price stayed level no matter the demand for my services. When demand fell off I never had a sale nor when it increased I never raised my price per unit. And I didn’t go broke. I got old, retired and closed my business.

Folks, it doesn’t have to happen. It is only greed which takes place within the human mind that causes money problems.

Very true.

1 Suppose the economy produces a 1,000 units of output.

2 Suppose the money supply (number of notes and coins) = £10,000

3 This means that the average price of the output produced will be £10 (10,000/1000)

Hi, you lost me right at 3. Why does the money supply relate to the price of goods? I am assuming money supply is all the bills in circulation (like in my wallet or in a cash register). Does this equation assume that every bill in circulation is spent on 1 thing?

Its actually a very rough example of what it approximately should be, as the prices are quite dependent on consumer’s incomes/the country’s money supply. Because, as a matter of common sense, no one would charge the same price for the same good in different countries, for example: USA would charge 2$ for Race chips while countries such as South korea would charge 1$. This is all due to the difference in income and money supply of those countries.

From my understanding, Majority of governments don’t print money. They get money priinted for them by the banks. Every government on earth is in debt therefore every piece of currency weather it’s coins, cash, or credit on a computer screen is handed to government entities with interest considering that, that government spends more then it collects from it’s populous. Hence why currently bigger indebted governments are now clamping down on their defecits. Our governments are ultimately just entities like corporations and/or you and I burrowing from the big bad perpetual debt machine. Paying back the world’s debt is ever impossible with the current monetary policies in place. However, there still are country’s in the world that print their own money just like the western world once did…. One of those country’s is China, and this is exactly the reason why China is in a much better position economically then any other country on earth including and especially the USA. We need to as a people clamp down on our governments and demand nationalization of our monetary systems. Without nationalizing monetary systems debt will forever be hanging over our heads and will accumulate ever more so over our children’s.

, Good be with you and yours

Well said. I hope that one day those well-intentioned, yet delusional occupiers wake up to realize that their governments & central banking policies are the root cause of their economic misfortunes. Perhaps that will be one step closer to a revolution that will make a real change. Our ignorance to truth is our own prison.

i wish it was not 7 years later so you could see this. when the gov pay back some of the money its owes to the banks what happens to it? do they burn it or do they spend it?

I would rather the xbox to run out of supply before you (the federal reserve) give authorizatoin to print more notes which aren’t really worth much. I agree with “Looney Tunes,” if every transaction is virtual, where does the paper dollar comes into play. Is it safe to say that the American dollar is a fallacy? If its virtual, it really doesn’t exist.

why do some central banks issue large quantities of money if they know that doing it will cause inflation?

It doesn’t always cause inflation. e.g. 2009-2010 big increase in money supply but no inflation.

If there is more money chasing the same amount of goods,why will firms put up prices ?