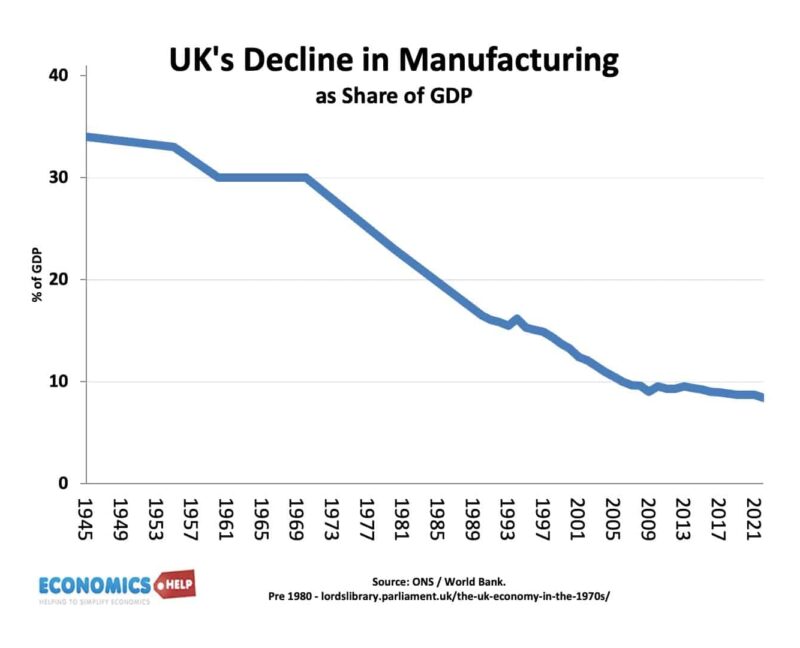

The UK was the first country to industrialise, but also one of the first to deindustrialise. UK manufacturing as a a share of GDP has fallen from 30% in 1970 to 8% in 2024. The UK is not unique in smaller share of manufacturing, but the decline has been relatively bigger than other countries.

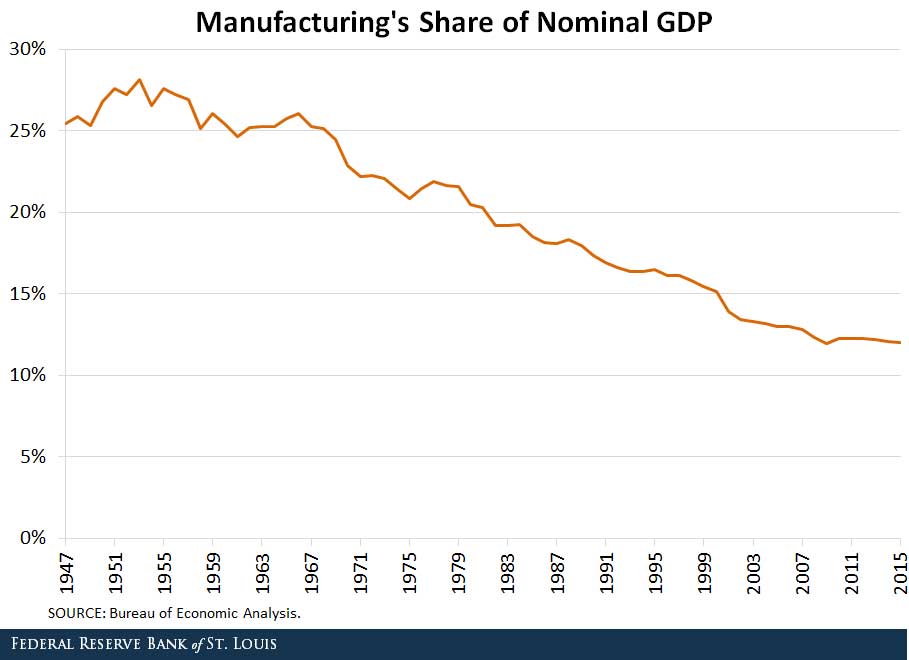

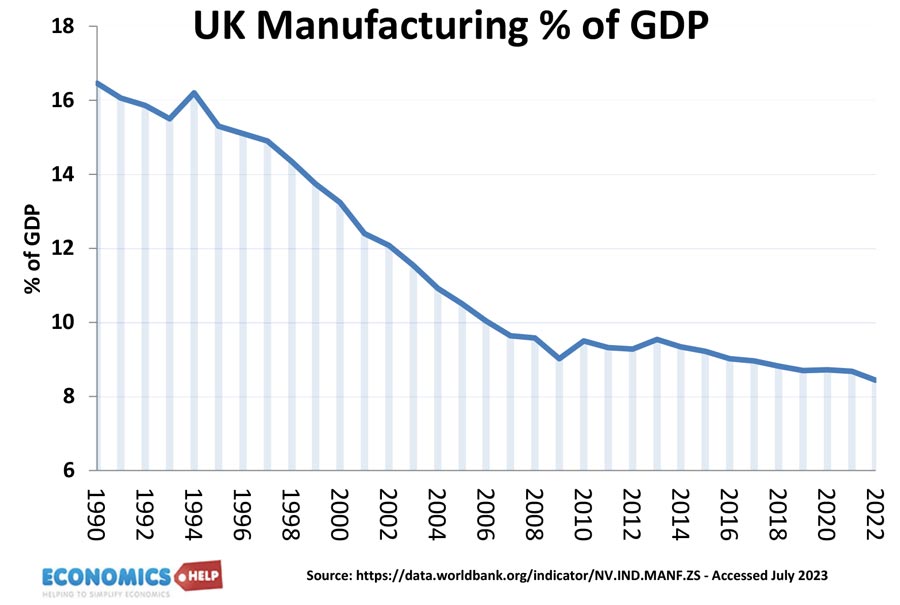

Manufacturing as a % of GDP

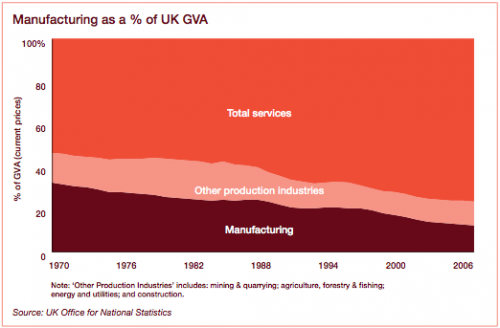

UK manufacturing has been in relative decline since the 1960s. Manufacturing as a share of real GDP has fallen from 30% in 1970 to 12% in 2010.

This shows that manufacturing as a share of GDP has fallen from over 32% of GDP in 1970 to 12% we see today.

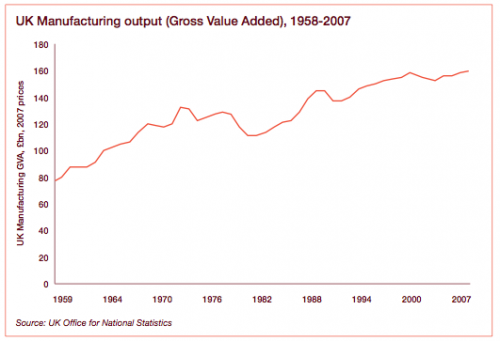

Manufacturing real output

Real industrial output increased over 40% between 1970 and 2000. In June 2010 manufacturing in the United Kingdom accounted for 8.2% of the workforce and 12% of the country’s national output

Source: PWC

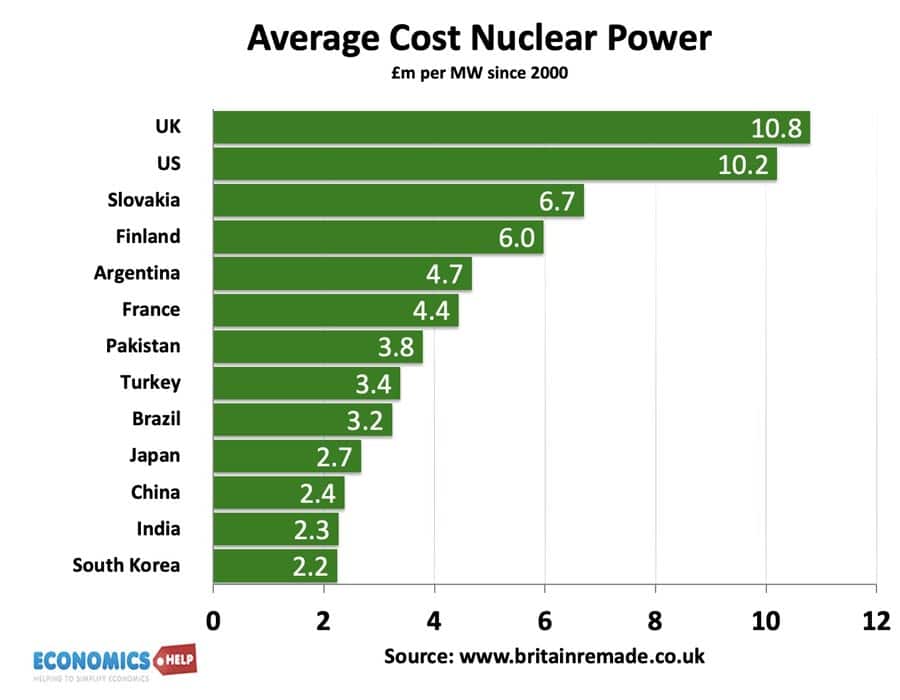

In 2008, the UK was still the 6th largest manufacturer by the output (source: UN Council for Trade and Development) 25% of UK manufacturing exports are high tech goods. (see what does UK produce?) In some industries, such as car production, aerospace and nuclear technology, the UK has shown strong growth in recent years. In other sectors, such as clothing and textiles, the UK has seen a sharp fall in output.