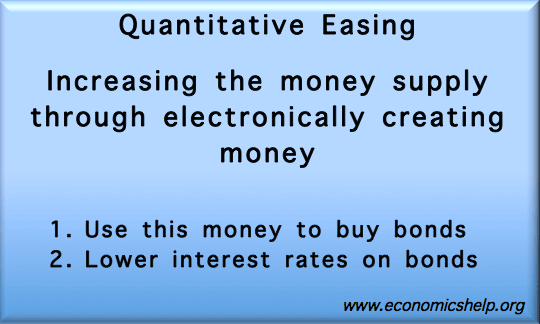

Definition Quantitative Easing. This involves the Central Bank increasing the money supply and using these electronically created funds to buy government bonds or other securities.

Quantitative easing is a form of expansionary monetary policy. It is usually used in a liquidity trap – when base interest rates cannot be cut any further.

Aim of Quantitative Easing

The aim of quantitative easing is to:

- Increase economic activity – Q.E. aims to encourage bank lending, investment and therefore help improve the rate of economic growth.

- Higher inflation rate. Quantitative easing may also be used to avoid the prospect of deflation

- Lower interest rates on assets

How Quantitative Easing Works

- The Central Bank creates money electronically. (This is a similar effect to printing money, except they are increasing bank reserves which don’t need to be printed in the form of cash)

- The Central Bank uses these extra reserves to buy various securities. These include government bond and corporate bonds.

Buying these securities achieves two things:

- Increased liquidity. Banks sell assets (bonds) for cash. Therefore banks see an increase in their liquidity (cash reserves). In theory, the bank will then be more willing to lend to customers. This lending will be important for increasing investment and consumer spending.

- Lower interest rates. Buying assets reduce their interest rate. Lower interest rates on these securities may also encourage banks to lend rather than keep securities which are paying low interest. Higher lending should help improve economic growth.

- Increase bank lending leading to higher investment. This should stimulate economic growth

- Increase inflation. Quantitative easing may be pursued when there is underlying core-inflation close to 0%. 0% inflation and deflation can lead to lower spending and economic growth. Therefore, aiming for a higher inflation rate can encourage spending.