Readers Question: How is the market of raw coffee determined on the world commodity markets?

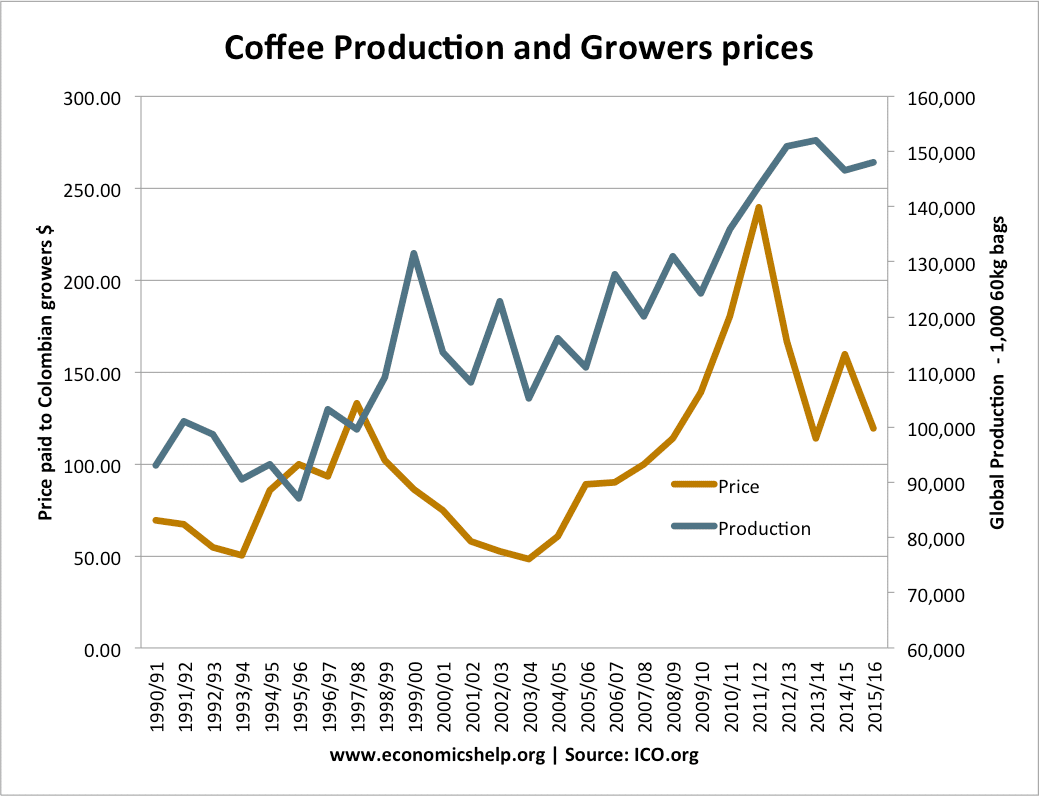

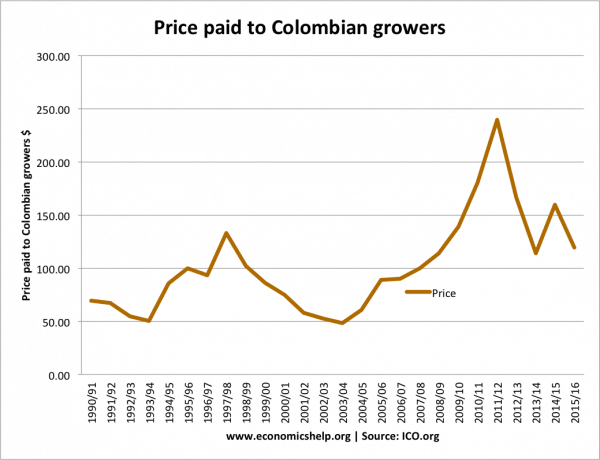

The price of raw coffee is determined by the basic principles of supply and demand.

Demand for coffee beans will be largely determined by the large coffee firms such as Nestle and Kenco. In turn their demand depends on the consumer demand for drinking coffee.

In recent years the demand for coffee has been increasing because:

- Coffee has become a more fashionable drink with an explosion in the number of specialist coffee houses, such as Starbucks and Cafe Nero.

- Coffee is increasingly seen as an alternative to alcohol, as drinking during lunch becomes less common.

- Rising incomes, is increasing demand for specialist coffees.

However, rising demand is not guaranteed to increase price because it also depends on supply.