New Keynesianism refers to a branch of Keynesian economics which places greater stress on microeconomic foundations to explain macro-economic disequilibrium. A key element of new Keynesianism is the role of wage rigidities and price rigidities to explain the persistence of unemployment and macro economic disequilibrium.

New Keynesianism combines elements of traditional Keynesianism (sometimes referred to as old Keynesianism) with classical theory.

Elements of New Keynesianism

- Many markets are imperfectly competitive (have a degree of monopoly power). Therefore firms have the ability to set prices, and firms may often be reluctant to cut prices – leading to price rigidity.

- Many labour markets are imperfect. In particular, wages can be ‘sticky downwards’ e.g. both unions and firms both resist nominal wage cuts.

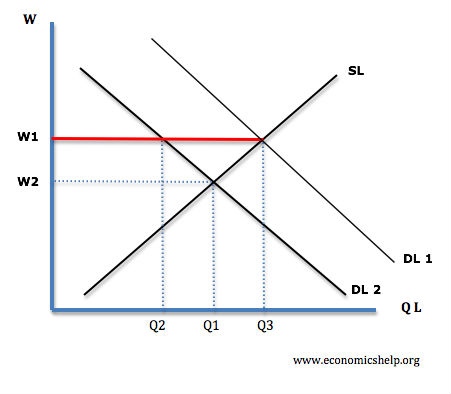

- If there is a shock to the economy, such as a short-term fall in demand, markets don’t clear, and we end up with real wage unemployment.

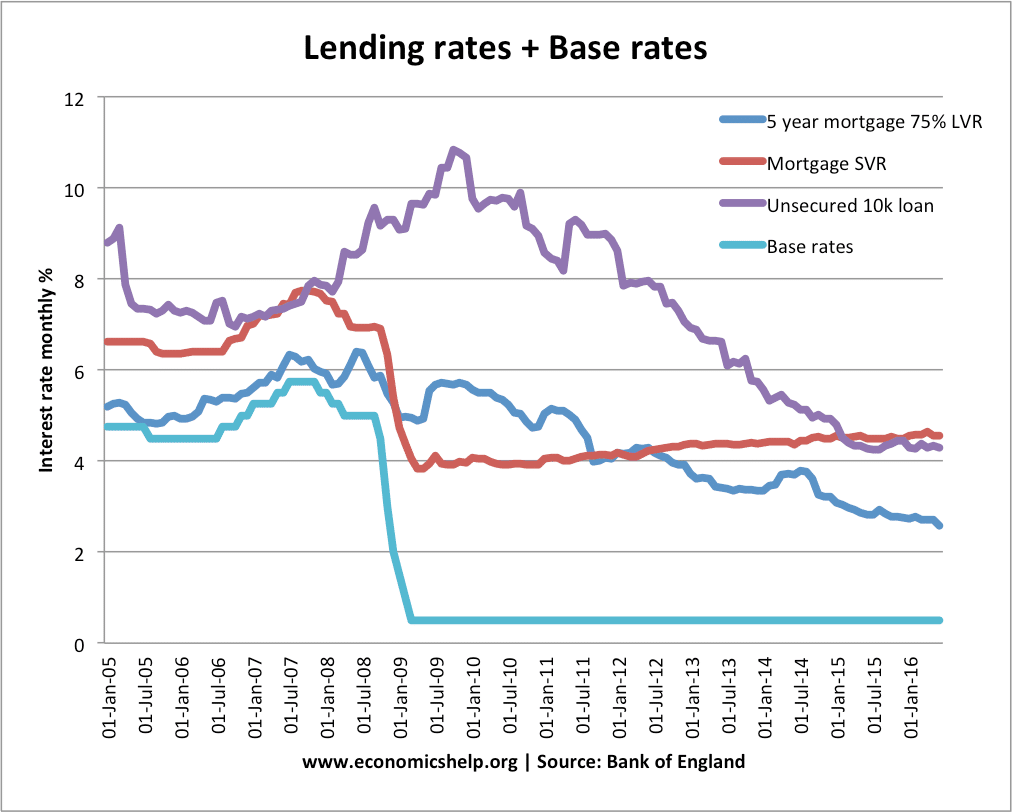

- Real interest rates may depart from the ‘natural interest rate’. The job of monetary authorities is to restore the correct interest rate to avoid macro-economic instability.

This diagram shows how a fall in demand for labour causes unemployment – if there are wage rigidities which keep wages at W1 and not fall to W2.

- New Keynesians believe there is a role for monetary and fiscal policy to play a role in stabilising the economy and reducing unemployment. However, they tend to favour monetary policy.

- New Keynesians place a greater emphasis on development models from microeconomic behaviour to predict macro-economic outcomes. These models are known as Dynamic stochastic general equilibrium (DSGE).

- A very simplified understanding of these models could be gained from the basic Taylor rule – The Taylor rule suggests the optimal interest rates given the rate of inflation and the output gap.

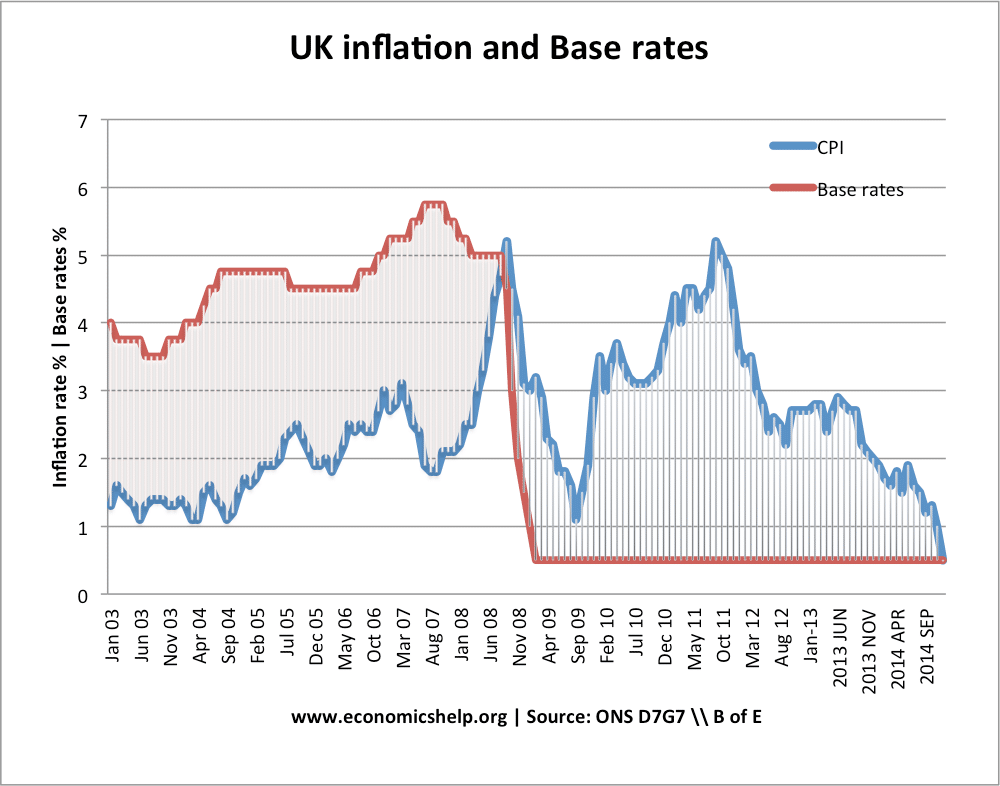

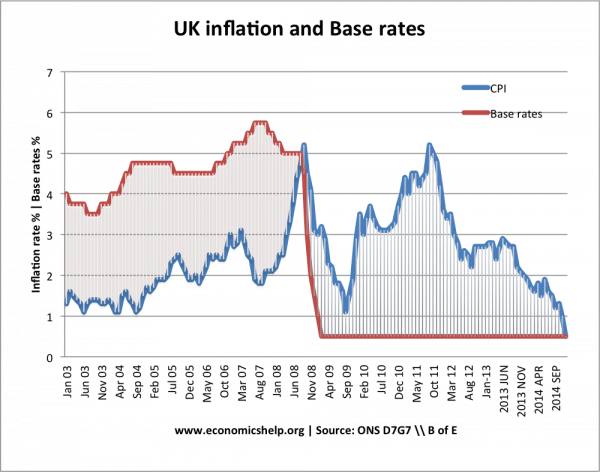

- Some New Keynesian models, e.g. by Blanchard have stressed aiming at low inflation (e.g. optimal inflation target of 2%) These models state that targeting the optimal inflation rate also leads to an optimal rate of growth and unemployment. (This is sometimes known as the divine coincidence, though the breakdown of the great moderation has undermined the predominance of low inflation targetting.