Readers Question: Evaluate the view that the most effective way to reduce poverty is to increase significantly the state pension.

Pensioners account for a growing % of the population; therefore inequality and poverty amongst pensioners is becoming a significant cause of relative poverty in the UK.

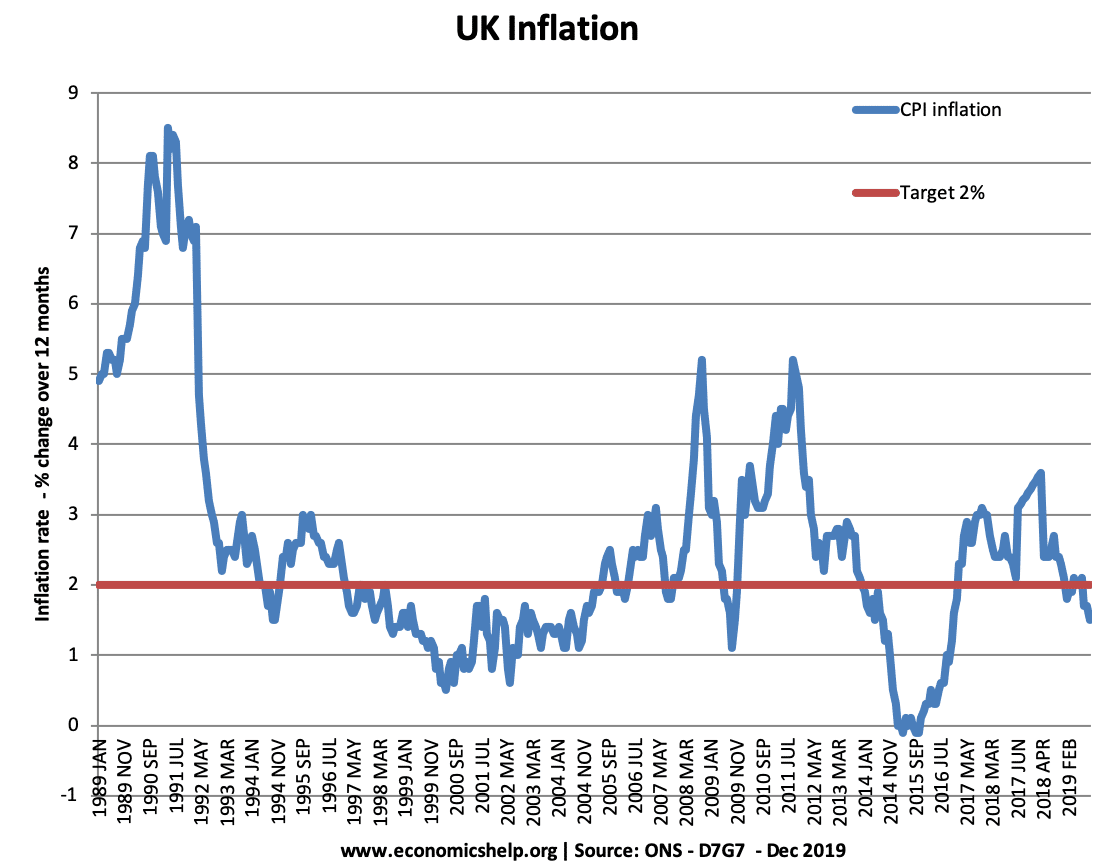

For several years, the state pension has been index-linked. This means increased in line with inflation. However, this increase means it has fallen behind average wages and therefore relative poverty between pensioners and workers has increased. Increasing the state pension is a guaranteed way to reduce relative poverty between pensioners and those in work.

Minimum Income Guarantee. Rather than increase the state pension, the government have relied on using means-tested benefits to increase the incomes of old people. This means pensioners who rely only on state pensioners can receive a top-up benefit. This is cheaper than increasing the universal state pension. However, it has significant disadvantages. Relying on means-tested pensions to reduce poverty creates a disincentive for people to save for a private pension. Therefore, in the long run, it may encourage people to be dependent on state benefits.

Cost of increasing state pension

A major problem is that UK pension spending is rising rapidly. Not just in real terms, but as a percentage of GDP. This means a higher share of tax revenue needs to go on pensions, leaving less for other areas, such as health care and education.

How UK Pension spending as a % of GDP has increased in recent decades.

Therefore, with an ageing population, you could make a strong case that the economy cannot afford to increase state pension. This is because there is a declining tax base to pay for an increasingly old population. Arguably a higher state pension would require higher income tax and higher income tax would reduce incentives to work.

Incentive effects

If the government increase the basic state pension, it doesn’t reduce the incentive to save for a private pension. This is important for providing a long term solution to the pension crisis.

Alternatives to just raising state pension

To avoid this the government could look to increase the state retirement age to 70 for both men and women. This means that they will be able to afford a higher basic pension, but people will have to wait longer before they receive it.

Also worth mentioning that some pensioners are relatively well off, especially those who have paid off their houses and have private pensions.

The Council tax should be changed as this takes a high % of income from pensioners.

Readers Question: Asses the impact of a decline in state pensions on income distribution, wages and income inequality for people aged 60 or above?

Firstly, the ‘decline in state pension’ actually means they have fallen relative to wages. For several years, state pensions were index-linked – increased in line with inflation. Therefore, in real terms, they stayed the same (although, some may argue the inflation rate for pensioners is higher than the official CPI method, therefore they are actually worse off in real terms)

Also, pensioners have been entitled to an increased number of means-tested benefits.

Having said that. These are the effects of a relative decline in state pensions.

1. Those who rely on state pensions have seen a relative fall in income; leading to an increase in income inequality within society.

- Evaluation with an increase in the number of people over 60, this has become a more significant cause of relative poverty in the UK.