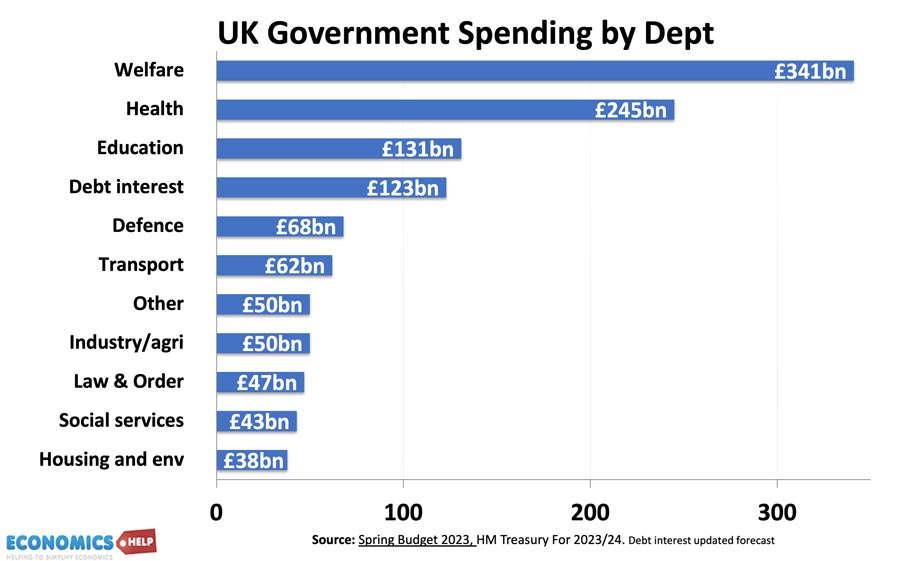

Readers Question: What does the Government spend its money on?

The government spends money for a variety of reasons:

- Reduce inequality (welfare payments like unemployment benefit).

- Provide public goods (fire, police, national defence)

- Provide important public services like education and health (merit goods)

- Debt interest payments.

- Transport

- Military spending

UK public sector spending 2023-24

In the UK, the biggest department for public money is social security. This takes almost a quarter of all public spending. It goes on financing a variety of benefits (State pensions, public sector pensions, housing benefits, income support, disability/incapacity benefits, unemployment benefits).

EU spending is £14.7bn (2014). Net spending £9.9bn. See more at the cost of EU

See also: Public Spending at UK Gov

Main areas of Government Spending 2015

- Public Pensions £150 billion

- Sickness and disability £40bn

- Old age pensions £107bn

- National Health Care + £133 billion

- State Education + £90 billion

- Secondary education – £25bn

- University education – £11bn

- local education spending – £48bn

- Defence + £46 billion

- Social Security + £110 billion

- State Protection + £30 billion

- Transport + £20 billion

- Railway – £5.2bn

- Roads – £3bn

- Local transport – £9bn

- General Government + £14 billion

- Executive and legislative – £5.9bn

- Other Public Services + £86 billion

- Social housing – £1.2bn

- Waste management – £9bn

- Public Sector Interest + £52 billion

Cost of EU

- Gross payment to EU – £17.2bn

- Net payment to EU – £8.6bn

- FT – EU cost

Total Spending = £731 billion

- Source: UK Public Spending