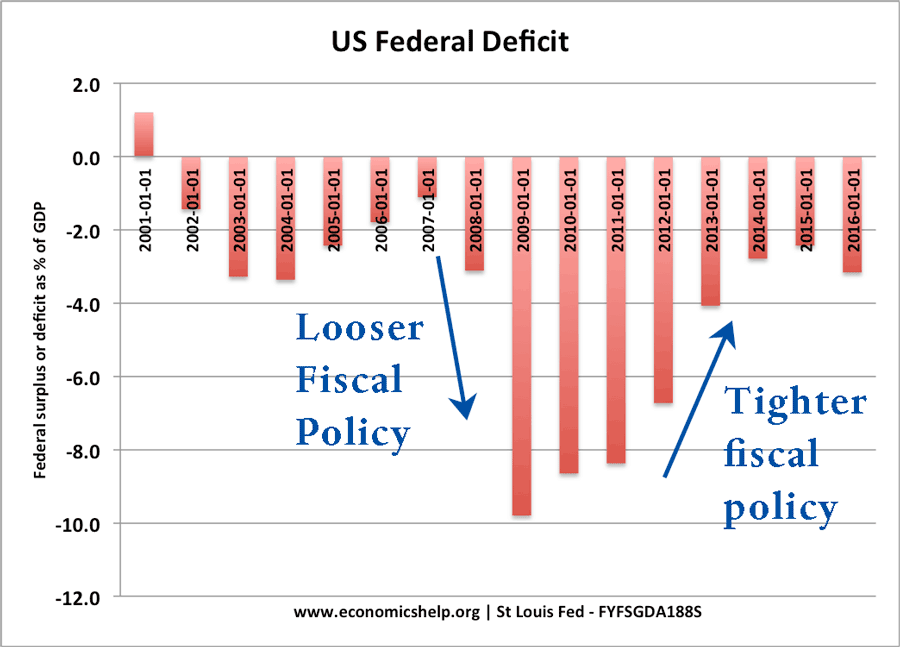

Flexible fiscal and monetary policy

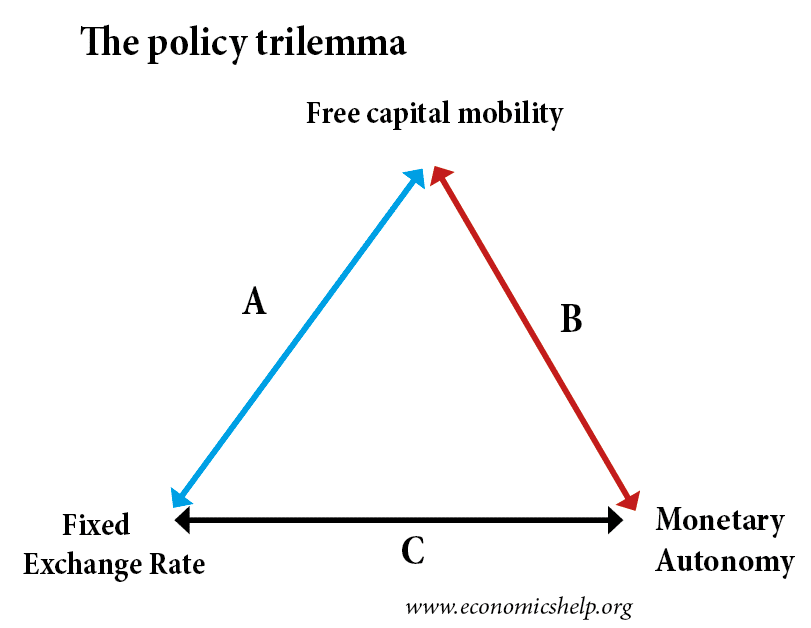

A good post by Simon Wren Lewis on future UK macroeconomic policy – learning from the experience of the past few years. – Bold macroeconomic policy for a new government. Essentially, it involves committing to a more flexible fiscal policy which can take into account the different requirements of liquidity trap (ZLB). Monetary policy should …