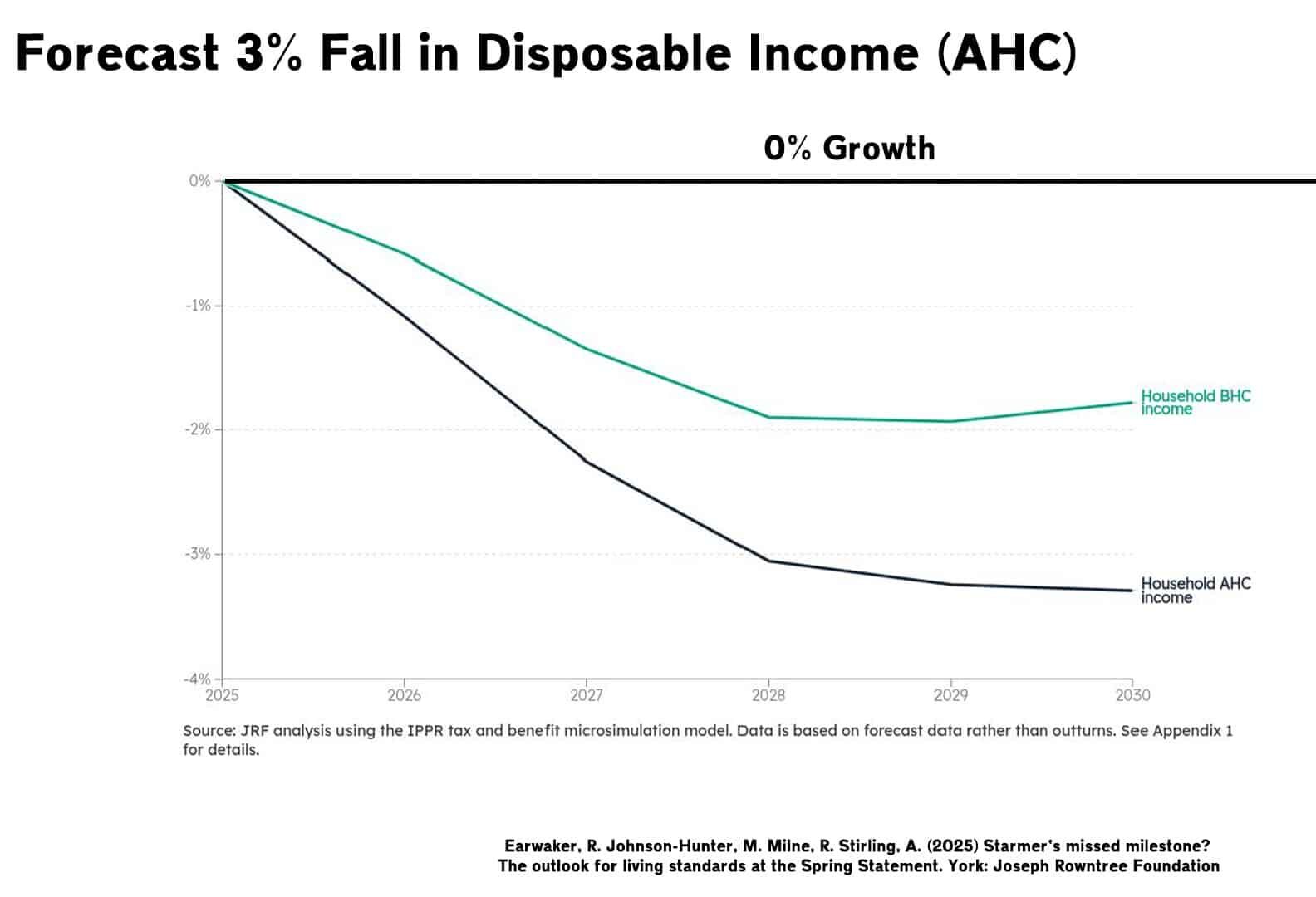

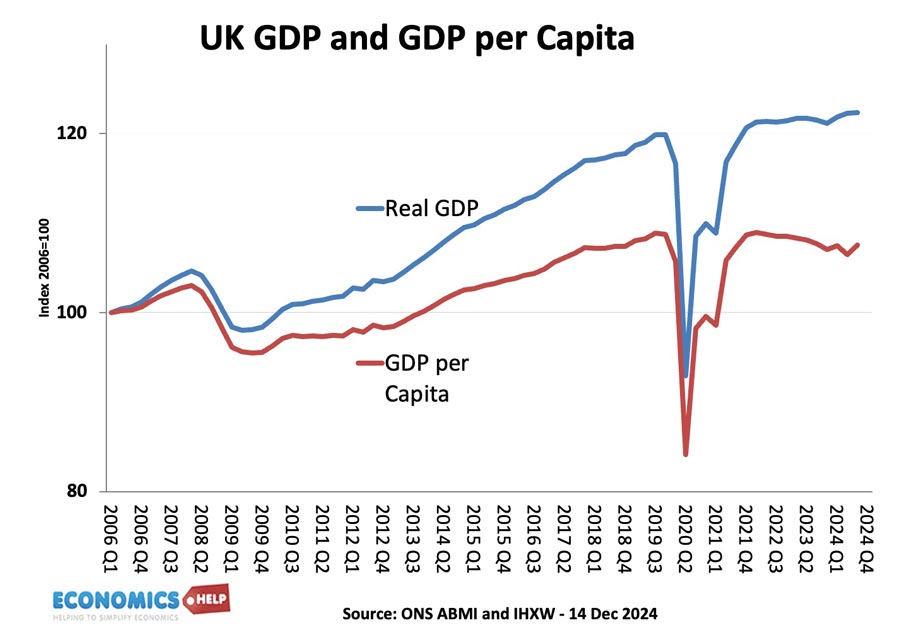

UK is Set to be Poorer by 2030

UK Households Set to be POORER by 2030Watch this video on YouTube After 15 years of stagnating living standards, a new report suggests that after housing costs, real disposable income are likely to continue falling for the next five years. The decline will be felt by all income groups, but those on benefits, poorer households, …