Nature of the UK economic recovery

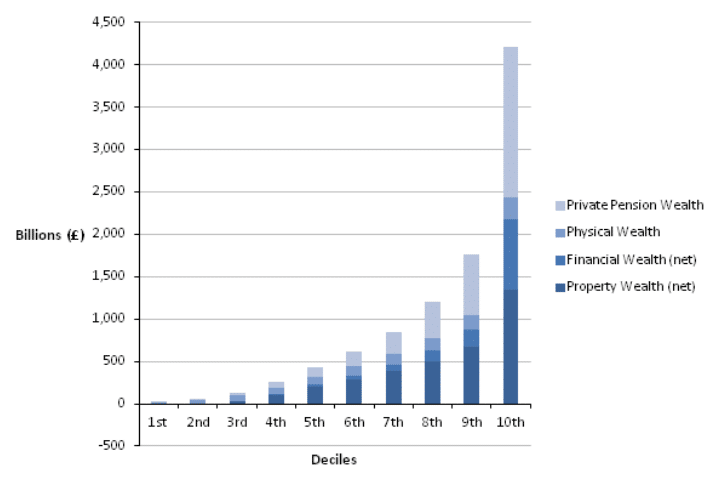

A look at the nature of the UK economic recovery. Is the recovery sustainable? Who has benefited the most from recovery? Which groups of people have not benefited from the recovery? In the past two years, the UK economy has posted relatively impressive growth figures. The UK posted annual growth of 2.6% between Q3 2014 …