The qualities of a good tax

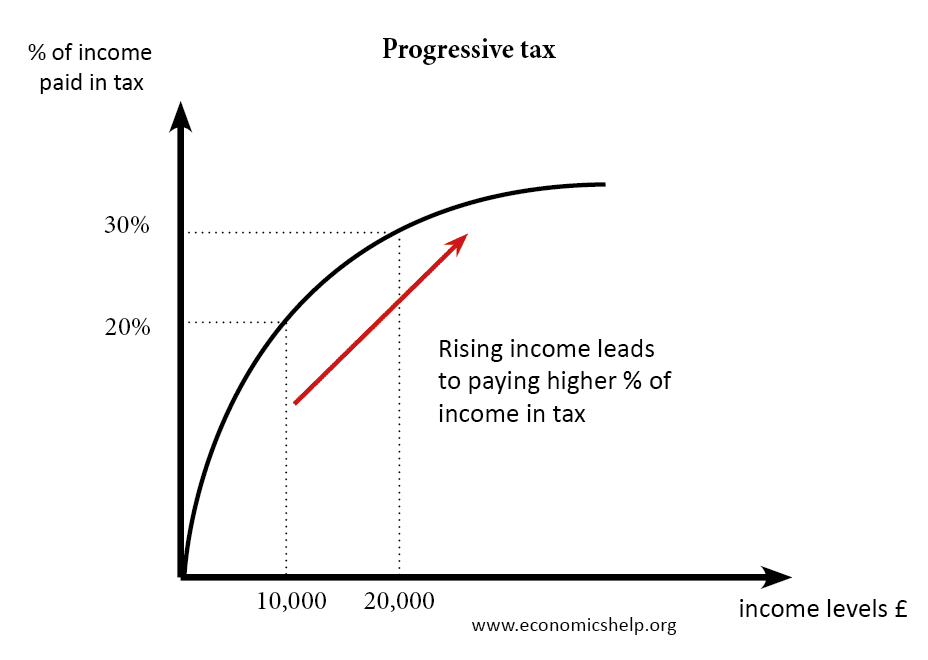

There are different ways for the government to raise tax revenue. While tax is often unpopular, economists set criteria for what makes a ‘good’ and ‘fair’ tax. This includes – fairness, easy to collect, non-distortionary and increases social welfare. Principles of a good tax include Vertical equity – Fair. Vertical equity is concerned with setting …