Is it worth going to university anymore?

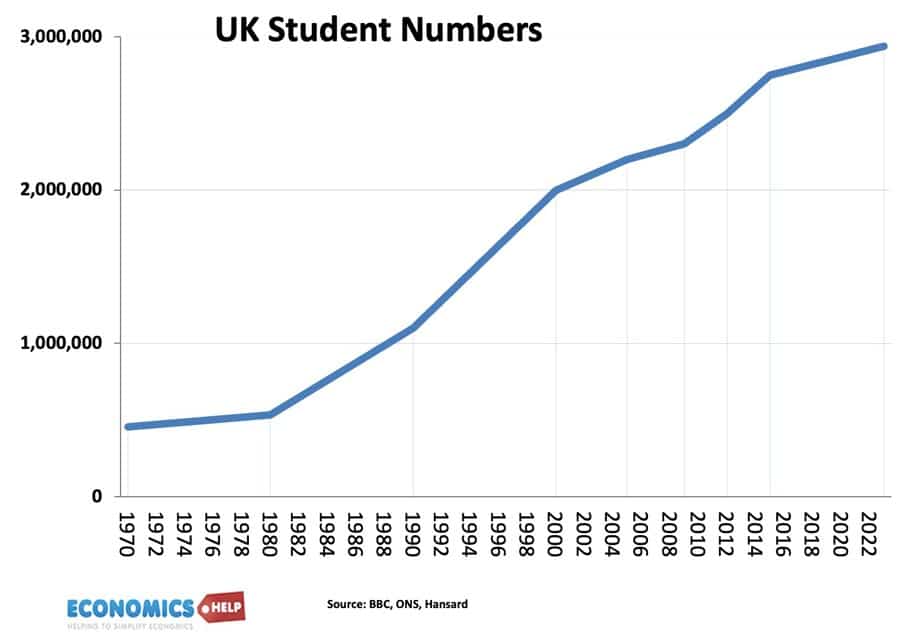

In 1999, Tony Blair made a pledge that 50% of young adults would go into higher education by the next century. And this is one government promise that has actually been achieved, Student numbers have risen, UCAS applications almost doubled. Students are told a degree is a passport to success, higher salary and cultural enrichment. …