Costs of Inflation

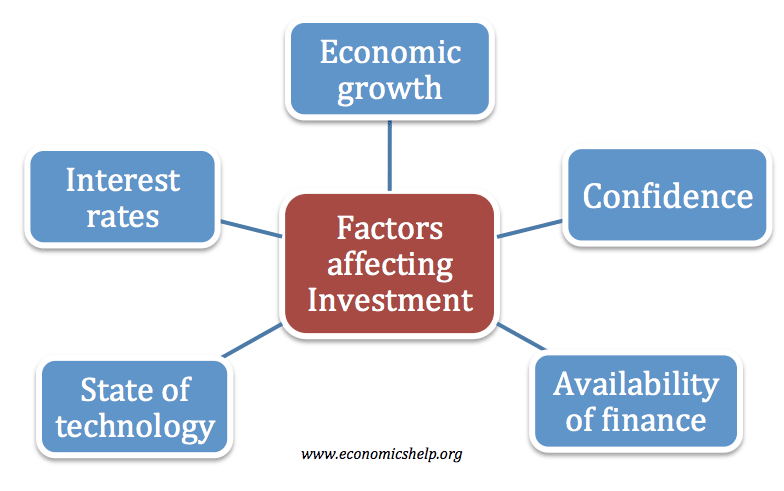

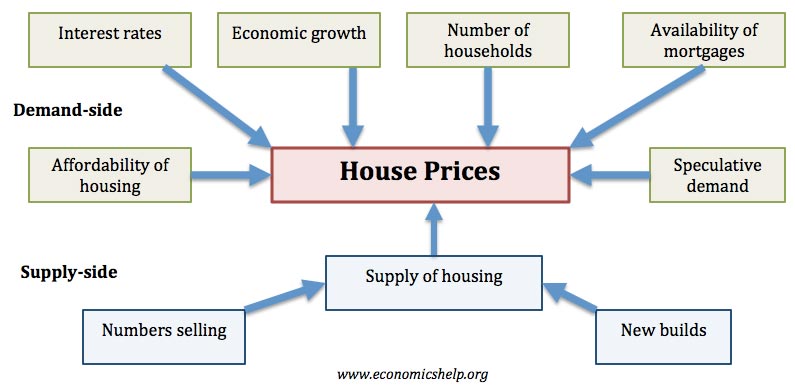

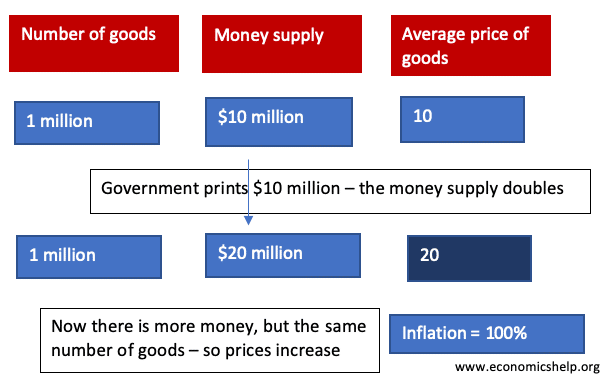

There are many costs associated with inflation; the volatility and uncertainty can lead to lower levels of investment and lower economic growth. For individuals, inflation can lead to a fall in the value of their savings and redistribute income in society from savers to lenders and those with assets. At extreme levels, inflation can destabilise …