History of UK Housing

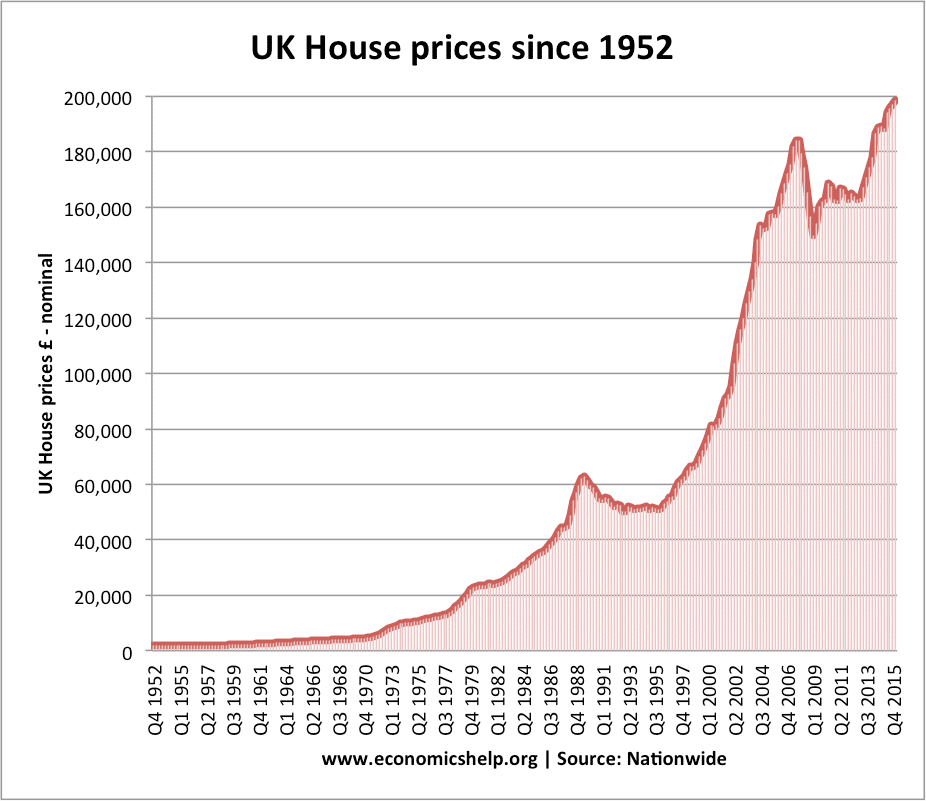

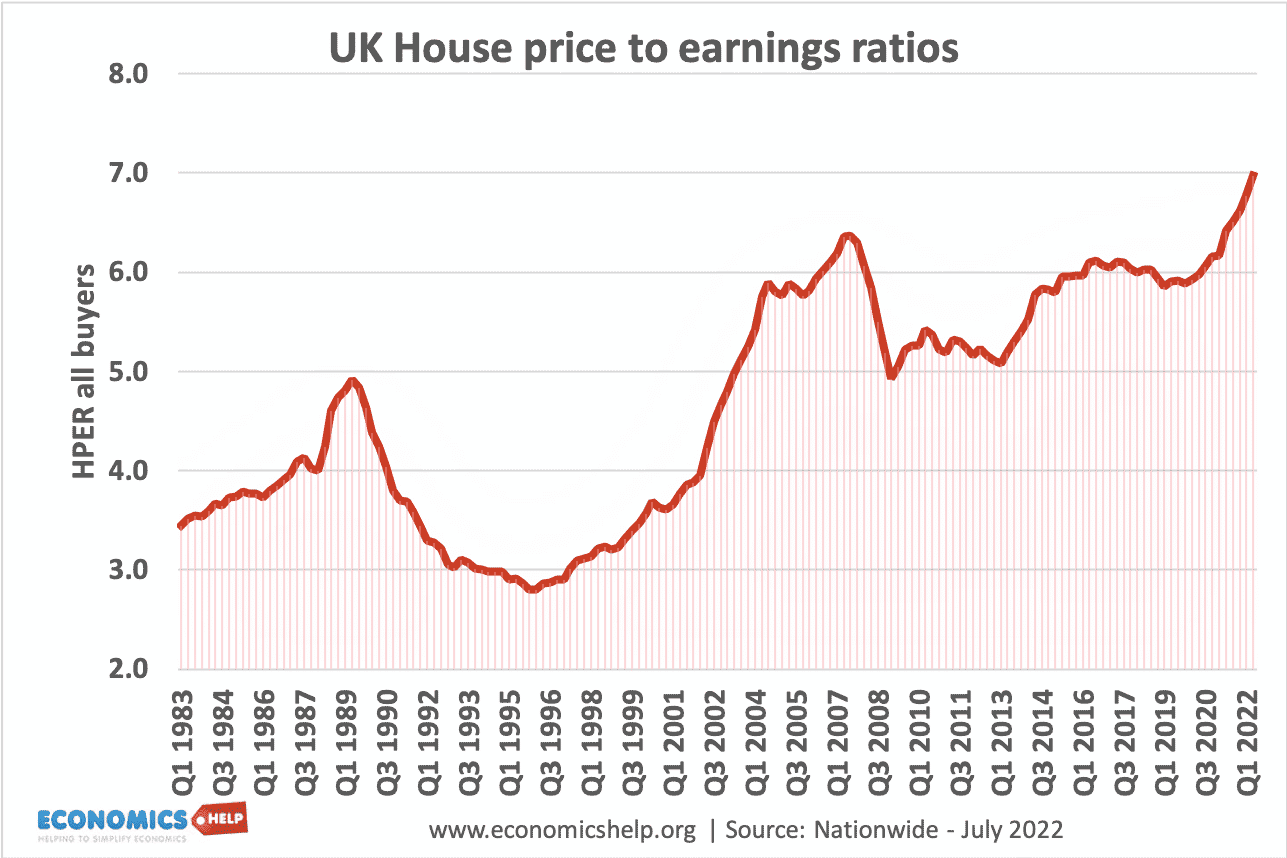

A look at the major trends in UK housing in the past century, including the trends on housing tenure, house prices and the supply of new houses. Victorian housing The Industrial Revolution saw rapid growth in inner cities as people flocked to the city for new factory jobs. This accommodation was often hurriedly built by …