RPI, CPI and RPIX are three different measures for calculating inflation. To summarise

- CPI = headline rate (excludes mortgage interest payments, housing costs)

- RPI = Retail Price Index. Includes mortgage payments.

Source: ONS

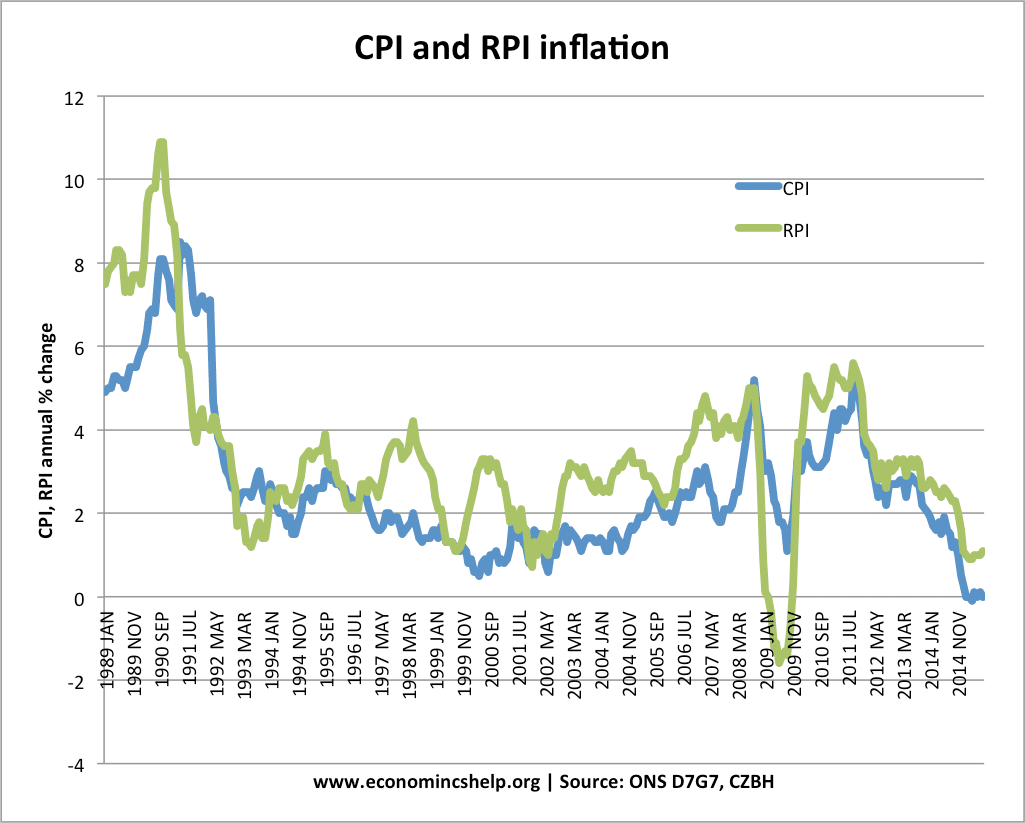

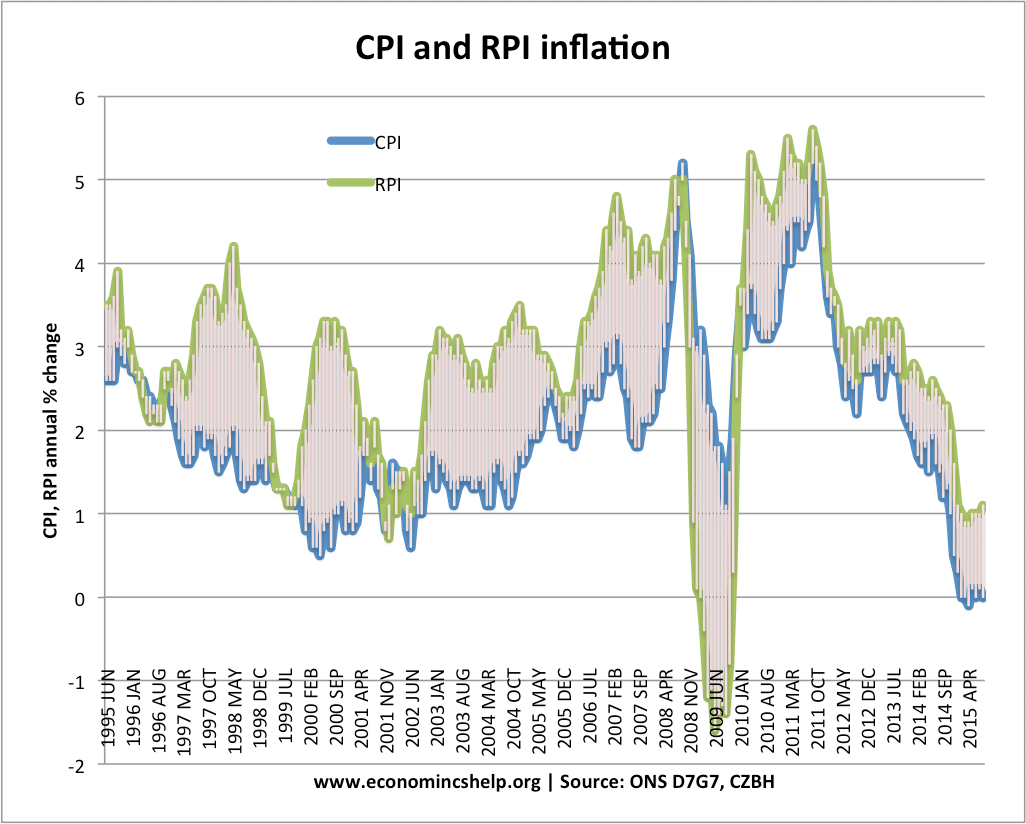

In 2009, the UK saw a cut in interest rates, and therefore, a fall in mortgage repayments. This caused RPI to become negative – whilst CPI remained positive.

The main inflation rate in the UK is now the CPI Consumer Price Index.

The CPI is based on the HCIP (Harmonised Consumer index prices) which measures inflation on internationally agreed standards throughout Europe.

- The RPI (Retail price index) includes mortgage interest payments. Thus changes in the interest rates affect the RPI. If interest rates are cut, it will reduce mortgage interest payments. Thus the RPI will fall but not the CPI.

- The RPI also includes council tax and some other housing costs not included in CPI

- The CPI includes some financial services not included in the RPI

- The CPI is based on a wider sample of the population for working out weights.

RPIX and RPI

- RPIX is the same as RPI minus mortgage interest payments.

- RPIX is closer to CPI but not exactly same.

RPIY (Core Inflation)

The RPIY measures core inflation this is RPIX minus taxes such as VAT and excise duty. Thus a cut in VAT would reduce RPI but not reduce core RPIY

Which is Most Accurate Definition of Inflation?

RPI is generally higher – especially in periods of interest rate rises.

It’s hard to say. However, I think it is more useful to look at underlying core inflation. For example, a large cut in interest rates causes a temporary fall in RPI, yet could lead to inflationary pressures in the long term.

- CPI tends to be a little lower than RPI (except when interest rates are cut like at moment)

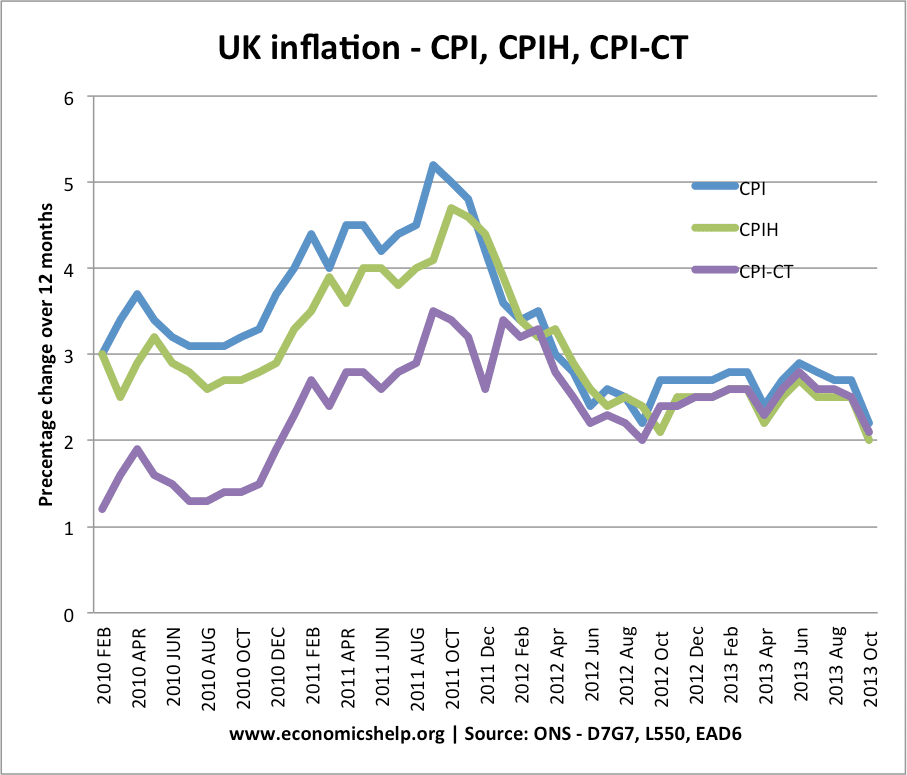

New measures of inflation – CPI, CPIH and CPIY

CPIH – CPIH It is based on CPI, plus it includes housing costs, such as mortgage interest payments. Owner occupiers cost (OOH) account for 12% of the CPIH weighting

CPIY – The CPI – Indirect taxes. This is the CPI measure but excludes the impact of indirect taxes such as VAT and excise duty.

CPI-CT. This is a similar principle to CPIY. CPI-CT holds indirect taxes rates constant at the rate prevailing at the start of the year.

See also notes on CPIY (basically CPI – indirect taxes)

- Definition inflation

- CPI and Core CPI

- RPI CPI at statistics.gov.uk

- Problems measuring inflation

Would it be wise for a pension fund to invest in the equities of a house builder given the current economic situation surrounding the housing/mortgage industry?

Absolutely! Would recommend Bitcoin as an alternative too!

Qualitatively, think and reckon 5 years in the future with UK’s housing bubble unwinding.

And the days of exporting of financial innovations and North Sea oil are over. Britain deserves leaders who understand how the macroeconomic system works. Hopefully Britain will find some.

Thank you for the concise description, very handy and helpful.

Intereting that the RPIX is now higher than than CPI for the first time since December, before mortages rates plunged in line with the falling bank rate – at least that is how I read it. RPIX, shown in a graph alongside CPI, provides a very useful guide. Add on the impact of an end to VAT soon and rising import prices reflecting the fall by 20% in the value of sterling over the past two years, and one gets a disturbing picture. Go on google to “Bank of England – Pension Fund”, and one can see why the bulk of the ibvestments are in index linked gilts. Where does that leave house prices? That must be something that should worry Mervyn King; some nortgages will become subprime. Then there is subprime Mark 2, companies bought by private equity companies relying on huge leverage, leading to interest payments that can’tt be met out of income.

this is cool man.

really helped me on my economics schoolwork.

thanks 🙂

Pat

Index linked government savings is based on RPI rather than CPI. As deflation has bottomed out it would seem a better time to invest in the current 3 or 5 year NSI certificates which pay 1% a year over the RPI index, tax free.

Assuming 3% inflation for the next 12 months the rate of 4% tax free is far better than any cash ISA.

Naturally one is speculating on the inflation figures, but the certificates do not take deflation into account , so you cant get less than you put in.

Given that mortgage and council tax payments represent a high proportion of most household, I think removing this and moving to CPI is less accurate and distorts inflation.

Is housing rent included in either of these indices? Very important for people who are unable to obtain a mortgage (often the poorest, and most vulnerable if the index is set too low)?

I would like to point out that some measures of evaluating inflation are different from others.

Yes! Inflation is not as simple as it looks. For example, the US (and likely the UK as well) uses a measure called “Hedonic” measurements where:

“take into account changes in the quality of goods in a process known as hedonic price adjustment. It is usually applied to hi-tech products such as computers and mobile phones. For example, a £1,000 computer you buy today might be twice as powerful as one you could have bought for the same price a year ago. To capture this change in quality, US statisticians ask what it would have cost to buy one of the same power back then (let’s say it would have cost £2,000 last year). This makes it look as if the price of the computer has halved, which has the knock-on effect of making the rate of inflation look lower than it actually is. And because GDP is adjusted for inflation, it affects those figures too and massages them upwards.”

This is a quote from Money Week which you can find through this link: http://bit.ly/uTXZ5E (no affiliation, info only).

I hope this helps.

For those of you who wonder about GDP – just take a look at how electricity consumption changes over the years for a country. The GDP figures can be massaged, but few statisticians think of fiddling the electricity consumption stats – it is a rough guide if you think the GP doesn’t look quite right.

Can you tell me what is the difference between the RPI series CHAW and the RPI all items index in the UK please