One potential benefit of leaving the EU is the opportunity to radically change how we spend agricultural subsidies. The Common Agricultural Policy CAP is one of the great mistakes of the EU. Given the share of EU spending on agriculture, it is their flagship policy, yet the CAP has given a very poor return regarding economic and social welfare.

Unfortunately, the EU has become caught by powerful agricultural lobbies, and it has proved very difficult to wean Europe off these very extensive subsidies. There is no other industry which receives so much subsidy (and it is similar in the US). Yet, these subsidies have a very weak justification in terms of social benefits to society. CAP costs €59 billion per year.

Also, if the EU had shifted the budget of CAP into something more productive like regional policy, the EU would have been able to make a much bigger improvement to depressed areas of the EU and would be in a much stronger position – and perhaps popular.

The original CAP

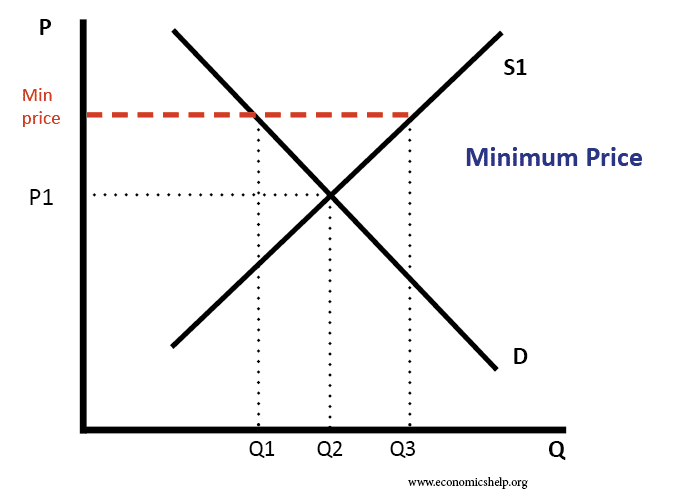

The original CAP was an attempt to stabilise farmers incomes by setting minimum prices for food. It was an economic failure. (Though it was a wonderful case-study for those wanting to teach an example of government failure.) Essentially, the original CAP:

- Minimum prices encouraged a large increase in supply, encouraging over-use of chemicals to enhance output.

- To maintain these minimum prices, the EU had to buy the surplus food, which was then stored, destroyed or sold very cheaply to developing markets.

- At the height of CAP, 70% of the EU budget was diverted into buying food we didn’t need.

- It also involved high tariffs on food imports – harming trade relations and reducing the income of farmers in other countries.

- The dumping of surplus food on world markets led to lower prices, and lower incomes for food producers and food exporters.

- It also distorted long-term economic trends, preventing the agricultural sector respond to changing demand and supply. It also encouraged farmers to expect and rely on government subsidies. Subsidies which have become politically very difficult to reduce.

- It was a classic example of a government policy which led to a deadweight welfare loss.

Reformed CAP

- Very slowly, the Common Agricultural Policy was slowly reformed. Target minimum prices have mostly been reduced or removed – allowing some reduction in tariffs and ending the food mountains. However, although CAP was reformed, the total cost of CAP continued to rise (though it did fall as a % of EU spending)

- The CAP was reformed by offering a different kind of subsidy, which included direct income payments to farmers. Essentially, people who owned agricultural land were given subsidies for having agricultural land.

- In fact, the perversity of this direct income subsidy scheme is that, in some areas, it encouraged farmers to cut down trees and make wildlife areas nominally agricultural land – to enable the farmers to be eligible for more subsidies.

- With no limit on farm subsidies, it has often been the richest landowners who have received the biggest cash handouts. With some estates receiving in the region of half a million pounds in CAP subsidies each year.

- It is one of the worst transfers of taxpayers money to wealthy landowners. It is only surprising there is not more outrage about the waste of taxpayers money.

I should add in recent years, the EU has attempted to make direct income payment supports dependent on certain criteria, e.g. ‘greening’ of farming. In 2013, the new ‘greening component of CAP’:

“rewards farmers for adopting and maintaining, as part of their everyday activities, a more sustainable use of agricultural land and caring for natural resources.” Direct payments at EU.

UK agricultural subsidies

Without having to achieve agreement with EU partners (e.g. countries with very powerful farming lobbies, like France), the UK has the opportunity to use the current £3 billion of agricultural subsidies in a much more efficient way. What principles should we have for future agricultural subsidies?

- Limit/abolish subsidies. There is no good reason for wealthy landowners to receive a very large subsidy just because they own a lot of land. The first thing is to cap any subsidy to prevent wealthy landowners gaining undue taxpayer subsidies. Currently, CAP subsidies go overwhelmingly to the largest farms.

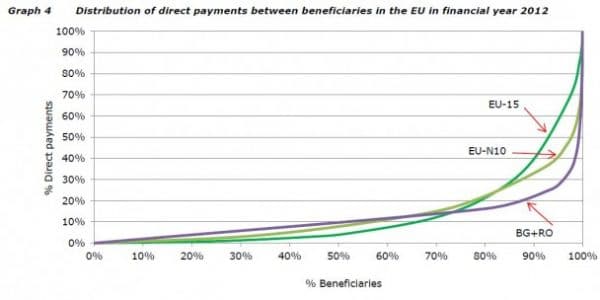

- In the EU-15, 20% of the farms with the largest payments share 80% of the total payments.

- There is a justification for offering subsidies to rural communities, if there is a clear external benefit of the subsidy, e.g. help reduce rural poverty.

- Rural communities may need subsidies to protect local traditions, e.g. subsidising dry stone walls, rather than cheaper barbed wire fence;

or it could involve subsidies to protect areas of outstanding natural beauty from development. - There is no reason why rural subsidies should only go to farmers. For example, there is a good case for subsidies to help young local people afford houses in the area they have grown up – rather than being priced out by demand for second-holiday homes.

- Environment. Any future subsidies should demonstrate a clear environmental benefit. Subsidies which reward farmers for cutting down trees to create more agricultural land is a negative externality. Recent flooding suggests that planting more trees by river banks can play a natural role in reducing flooding. There is a much better case for subsidies to reward landowners to plant trees in areas at risk of flooding.

- Subsidies don’t necessarily deal with the underlying problem. Many small farmers face intense financial pressure – from oversupply and monopsonist supermarkets who can put downward pressure on prices. However, giving subsidies doesn’t tackle these root problems of agriculture. In fact, agricultural subsidies could be seen as subsidising supermarkets monopsony power. Supermarkets pay low prices, farmers get low income, so the taxpayer sends subsidies to farmers to make up the difference.

Related

- Problems of agriculture – market failure

- Milking taxpayers US subsidies to landowners in the US at Economist.com

- Farming subsidies – George Monbiot

Everyone talks about subsidies as if they are completely normal,desirable and beneficial,they are not.

They push prices up (allowing the political class to bleat about the poor),they enrich one group at the expense of taxpayers,they should be abolished.

What on earth are you on about, food has never been so cheap

Exactly. But add in your contribution to the subsidy to your food and suddenly it’s not so cheap.

Very well described situation in EU. I am a farmer from South West Finland and I share the opinion, that subsidies do not work as they should. Bigger farms have more subsidies and do actions which are not so effective in social terms at all. Also the environmental issues are tackle often by false bookkeeping. As simple as that.

Why subsidise them at all??

Let them eat what they grow and sell the surplus.Stop all subsidies to the farmers…generally they have nice places to live and they ruin the countryside.The NFU is a strong lobby but as with the Foot and mouth outbreak of the 90,s they stopped access to the countryside which cost the tourism business billions for a small benefit to the agri business…foot and mouth slows the production cycle..a cold/flu for cows.Farmers ruin the countryside!!

Again someone who knows nothing about farming , I agree as a farmer we should not get any subsidies , but they are there to make food production more affordable to the general public, as for where people live what on earth are you talking about, some farms are of generations of ancestors that live in those places. As for ruining the countryside , I think your making it up my man

I witnessed the wholesale destruction of thousands of acres of hedgerows and orchards as a farmworker in the 70’s 80’s.

I’m not making that up.

As I understand this was the result of the EEC tinkering.

No – it was not due to EEC tinkering. Hedgerows were removed to reduce farming costs by increasing field size. Fruit was imported from countries where is was produced more cheaply than in the UK e.g., S. Africa, Parts of Latin America.

Leaving the EU will increase these tendencies or simply lead to farms going bankrupt.

Where I grew up there were no male farmers. All the farmers were women for some reason.

All the men were industrial workers. Professional snow shovellers during the summer months, they were adaptable, readily making the change to shovelling wheat in winter.

There always seemed to be shortages of snow and wheat at the appropriate times, so it’s a good thing they were able to collect pogey.

Sadly, the government never came through with the price supports for the rocks heaved up every spring thaw on our corner of the Canadian shield. I guess every agricultural policy has its weak points.

A lot of people seem to very keen to live on imported food and knock out the British farmer.

£40 per year to pay for cheaper food for all. Thats the point of subsidies. Without expect your grocery bill to come to a lot more than that.

I am for farming subsidies, but please stop giving it to so called farmers who do not deserve it. Much better control is needed.

I agree all farmers should be means tested, and paid accordingly.

How much does a Welsh farmer receive in EU subsidy for 1 sheep?

They don’t receive money for sheep and haven’t done for quite a lot of years.

Hi

I was a soft fruit grower producing strawberries early in

March 1990 without receiving any subsidies.I had a profitable business, until cheap fruit imported from

the EU undercut my price by half. Following in their footsteps was the supermarkets .My main customers the greengrocers and wholesale market did eventuaiiy

cease trading in2000 ,followed by myself.

The reason we have EU subsidies in the first place is because developed countries have a ‘comparative advantage’. This means that developed countries are better at producing food.

This is because of a number of reasons. First is access to a well developed transport, energy and water infrastructure. Then, there is the accessibility of powerful farming equipment such as tractors and combine harvesters which greatly increase output. There is also the climate, as European countries have far more arable land suited to specific native crops (such as wheat, corn, coffee, barley etc).

Subsidies are necessary to keep farmers competitive. In the UK, a report from DEFRA (Department for Environment, Food and Rural affairs) estimated that 55% of the average farmers income came from these EU subsidies. The times reports that while English farmers earned £35,000 on average, only £2,000 came from the sale of agriculture. The rest, EU subsidies.

https://fullfact.org/economy/farming-subsidies-uk/

If the EU subsidies where to be abolished, then it is possible that food prices could skyrocket from where they are now. 50% of the UK’s food comes from UK farmers. 30% comes from the EU, totalling 80% of food consumed in the UK having come from the EU. If the subsidies were to be removed, then farmers would have to raise the prices of their food by at least 30-50% to make ends meet. Thats if it is even possible, as many farmers have contracts with supermarkets and agri-conglomerates which dictate the prices of food. Farmers would either go bankrupt, or have to charge significantly more for their food.

This could make them noncompetitive with foreign suppliers of food. In order to help this, the EU could raise significantly higher tariffs on imported food goods to help make farmers more competitive. On the other hand, the EU could lower the tariffs and buy the majority of its food from outside of the EU. This is however means that the EU can no longer directly regulate the way food is produced, having potential implications for food safety or the environment. On top of that, there would be an increased cost as a result of shipping and other means of transport, as well as tariffs in other countries. Because of the reduction in local competition, foreign exporters of food could raise their own prices to make more profit.

Regardless, in both cases the outcome is ultimately bad for the consumer. Food will either be significantly more expensive, or will be slightly more expensive but of lower safety quality and potentially farmed using environmentally destructive methods. This means that the average family has to spend more on food, having devastating impacts on the lowest earners in society. Furthermore, this means that there is less disposable income available to spend on consumer products, meaning that the whole economy could slow down.

This is why we have farming subsidies, and they exist in every developed country for this reason.

I agree, the existing CAP has issues and is in bad need of reform. It has been done before, however, which raises the argument that you can do it again. We do not need to leave the EU to achieve a better agricultural policy. Because of the size of the common market and the vast resources available to the EU, it makes more economic sense to reform the existing CAP then to leave and reinvent our own agricultural subsidies.

Well said James

“This is why we have farming subsidies..”

No, we have farming subsidies to support inefficient farming in certain parts of Europe and to pay large landowners in this country money they neither need nor deserve. The EU CAP is and always has been a classic example of total failure in Government policy. It doesn’t need to be reformed, it needs to be abolished.

I don’t see whats inefficient about automation.

Hi

Hoping somebody can help. Can somebody explain how a tenant on a plot of land 3.78 acres could have claimed the old single subsidy payment when no crops were grown and no animals kept? I ve tried to find information in regard to this payment online but cannot as this payment has been replaced.

Thanks in advance