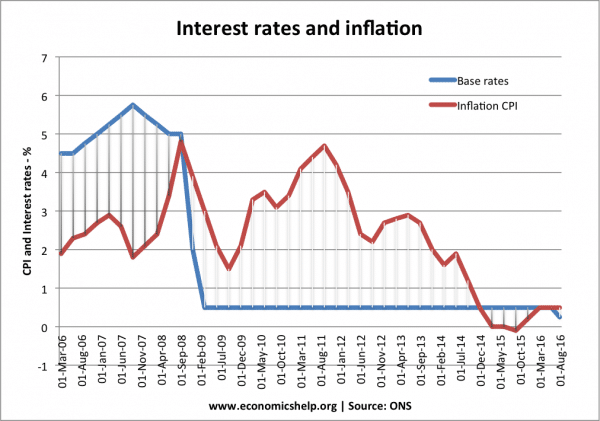

Interest rates have been cut to a record low of 0.25% – essentially due to grim economic news from the short-run demand side shock of Brexit.

Economic theory states that in normal circumstances, lower interest rates should boost aggregate demand (AD).

To give a quick recap, lower interest rates should in theory:

- Reduce the incentive to save – increasing consumer spending

- Cheaper borrowing costs – encourage investment and spending

- Lower mortgage interest payments. – increase disposable income and can cause a rise in consumer spending.

- Rising asset prices. Lower interest rates make it more attractive to buy assets such as housing. This wealth effect can increase spending.

- Depreciation in the exchange rate. Lower interest rates tend to cause outflows of hot money – reduce the exchange rate and boost export demand.

For more detail on effects of interest rate cuts see: Effect of lower interest rates

However, to what extent will a cut in base rates from 0.5 to 0.25% increase demand, given the state of UK economy in August 2016?

Some factors that will influence the effectiveness of this interest rate cut:

- Ultra low interest rates will reduce the income of savers. Savers have been squeezed by a long period of low interest rates – often with negative real interest rates. This further cut in interest rates will give many savers (often pensioners) less disposable income.

- Low confidence. It is hoped cutting interest rates is a way to boost confidence for consumers and business, and in normal circumstances lower interest rates would be welcomed. However, with interest rates already so low, people may see this as a sign of desperation. For example, people may ask – why do we need lower interest rates than in the depths of the 2008/09 recession?

- Will people want to borrow more? The cut in interest rates during 2009, didn’t see an immediate growth in lending because – banks didn’t want to lend, and consumers were reluctant to borrow. The financial state of banks is better than 2009, but the same reluctance to lend and borrow could persist in 2016 and 2017.

- The cost of borrowing is already low, but the main deterrent is not the cost of borrowing – but uncertainty of business.

- It can take up to 18 months for an interest rate cut to feed through into the economy (e.g. people on fixed rate mortgages)

- The funding for lending scheme is intended to make sure banks actually pass the base rate cut on to consumers. The rationale for this is to protect bank profit margins from ultra low interest rates.

Mortgage payments

The real winners from a cut in interest rates are mortgage owners, who could see a £22 a month cut in their average monthly repayment bill. This is a significant increase in disposable income during a time of stagnant wages.

Quantitative easing

In addition to base rate cut, the Bank of England have also announced further quantitative easing, which includes:

- £100bn subsidy to lenders’ funding costs through a “Term Funding Scheme”

- £60bn in electronic cash into the economy to buy government bonds, extending the existing quantitative easing (QE) programme to £435bn in total

- £10bn in electronic cash will be created to buy corporate bonds from firms “making a material contribution to the UK economy”

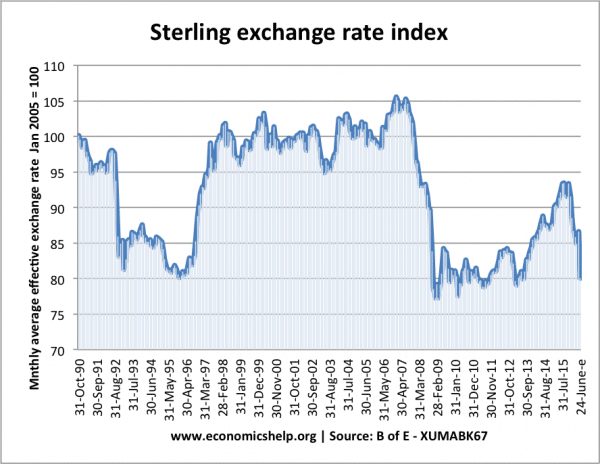

Exchange rate impact

The monetary easing is also complemented by a fall in the value of Sterling. A 10% fall in sterling should make exports cheaper and imports more expensive. Typically, we would expect this to see an improvement in aggregate demand. However, empirical evidence from past few years suggest the expansionary impact of a depreciation may be muted. This is because:

- Weak global growth, especially in Europe. A big question is whether the Eurozone’s recent recovery continues or whether it is hampered by contagion effects of Brexit.

- Demand for many of UK exports has proved to be quite price inelastic. This explains why past depreciations have only seen a limited improvement in the current account.

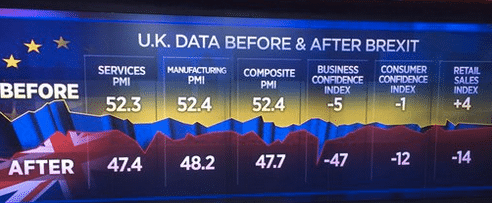

How bad is the economy?

Many forward looking indicators have shown a sharp drop since Brexit. It remains to be seen whether these are temporary blips or an indication of a prolonged decline. The Bank of England stated they have taken a relatively optimistic view of these data.

Is Brexit just about uncertainty?

An important question is whether the short-run costs of Brexit are largely around uncertainty. If it is just an uncertainty effect, you would expect he negative impact of Brexit to be short lived. In an optimistic scenario, we could even see a mini-boom when uncertainty ends and delayed projects come back on tap. However, others argue Brexit implies more than just uncertainty, but real challenges to business and especially exporters.

- Loss of access to full single market will discourage inward investment from abroad.

- Trade is likely to be more difficult outside the Single Market.

- Firms also worry about access to flexible migrant labour.

If the UK struggles to get the best of both worlds and ends up with some curtailment to Single Market access, then it could adversely affect the long-term prospects for business. In this case, the short run uncertainty could lead to more medium term declines in investment.

See: Are short-run costs of Brexit exaggerated?

Fiscal policy?

Another issue for the success of monetary policy is what happens to fiscal policy. For example, if the government committed itself to reducing budget deficit during this economic downturn, there would be a negative impact on aggregate demand. However, if government took other option to increase budget deficit, pursuing expansionary fiscal policy (e.g. finance public sector investment at low interest rates), then it would make the monetary policy more effective.

There is a saying monetary policy cannot operate fully in a vacuum, fiscal stimulus, with real investment decisions by government could be a trigger for consumers and firms to take advantage of the lower interest rates.

Related

Quantitive easing will mean money is worth less than it was, so you need more of it to buy things. So yes you may have more pounds in your wages, but it doesn’t make a difference cause everything will have changed value.

When in 2009 the Labour party started £ 375 Billion of quantitive easing to save the world economy from an unanticipated subprime crisis, the Conservatives were quick to blame the Labour party of financial miss-management. But when in 2016 the conservatives inject £ 70 Billion of quantitive easing (19% of the above figure) for some reason, it almost goes unnoticed.