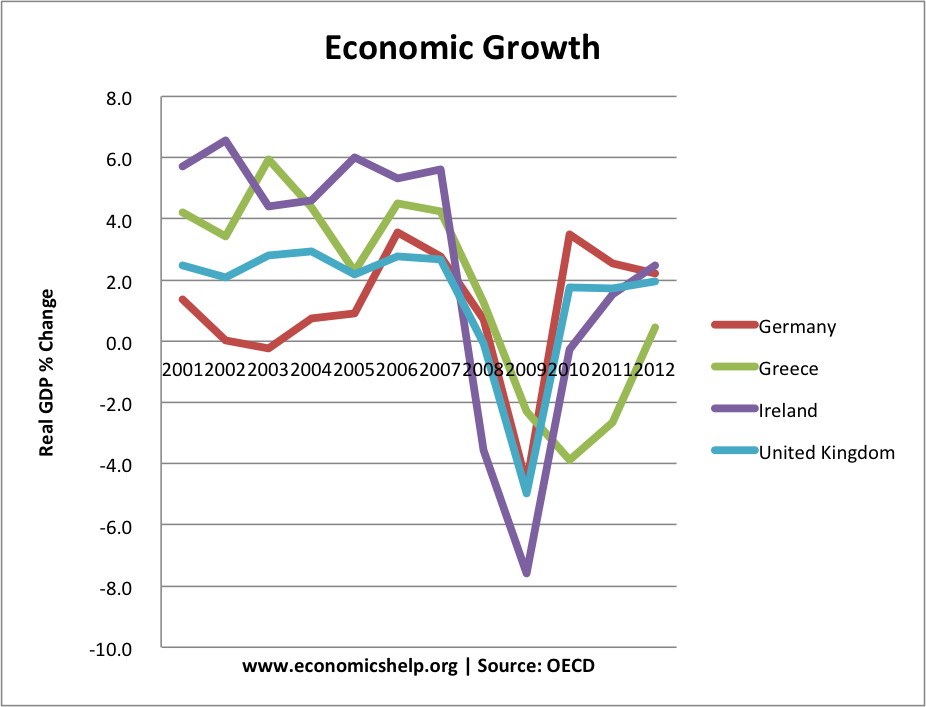

In 2007, EU economies, on the surface, seemed to be doing relatively well – with positive economic growth and low inflation. Public debt was often high, but (apart from Greece) it appeared to be manageable assuming a positive trend in economic growth.

However, the global credit crunch (see: Credit crunch explained) changed many things.

Impact of credit crisis

- Bank Loses. During the credit crunch, many commercial European banks lost money on their exposure to bad debts in US (e.g. subprime mortgage debt bundles)

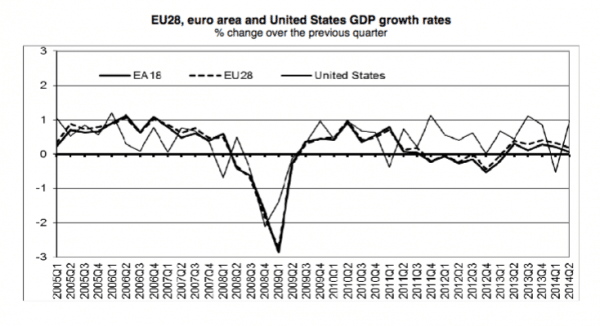

- Recession. The credit crunch caused a fall in bank lending and investment; this caused a serious recession (economic downturn). See: cause of recession

- Fall in House Prices. The recession and credit crunch also led to a fall in European house prices which increased the losses of many European banks.

- Recession caused a rapid rise in government debt. The recession caused a steep deterioration in government finances. When there is negative growth, the government receive less tax:

(less people working = less income tax; less people spending = less VAT; less company profits = less corporation tax e.t.c. )

(The government also have to spend more on unemployment benefits.)

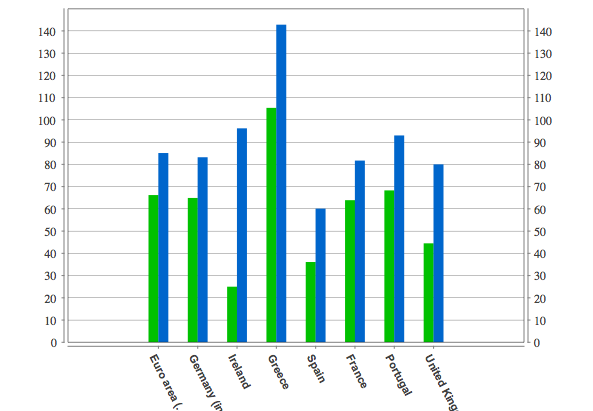

- Rise in Debt to GDP ratios. The most useful guide to levels of manageable debt is the debt to GDP ratio. Therefore, a fall in GDP and rise in debt means this will rise rapidly. For example, between, 2007 and 2011, UK public sector debt almost doubled from 36% of GDP to 61% of GDP (UK Debt – and that excludes financial sector bailout). Between 2007 and 2010, Irish government debt rose from 27% of GDP to over 90% of GDP (Irish debt).

Selected EU Debt 2007-2010

- Green – debt in 2007

- Blue – debt in 2010

- Facts on EU debt

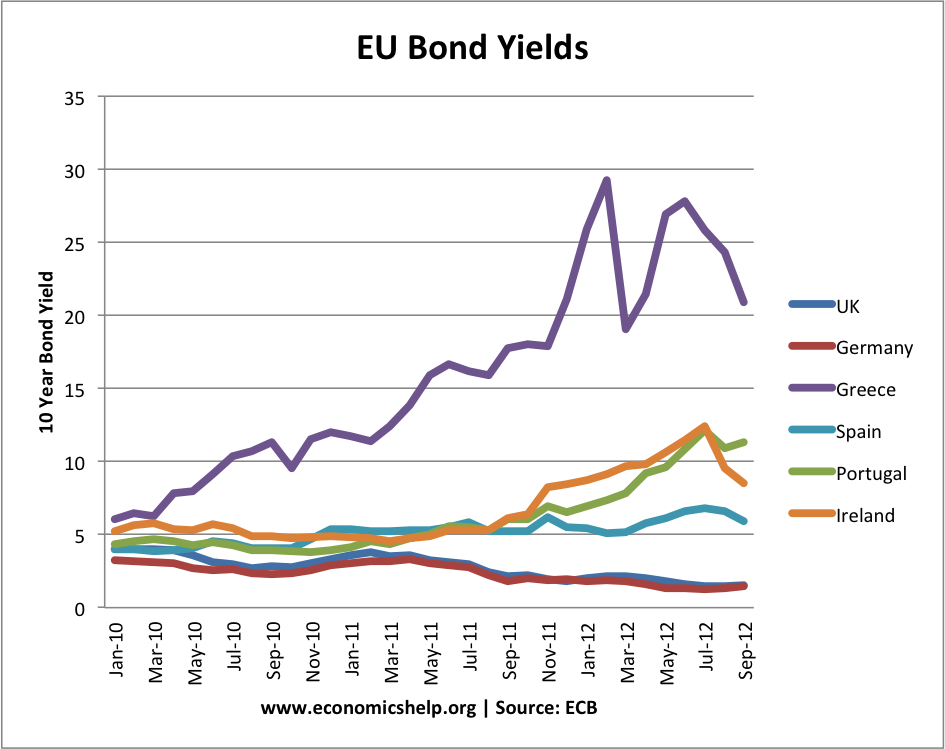

EU Bond Yields

- Markets had assumed Eurozone debt was safe. Investors assumed that with the backing of all Eurozone members there was an implicit guarantee that all Eurozone debt would be safe and had no risk of default. Therefore, investors were willing to hold debt at low-interest rates even though some countries had quite high debt levels (e.g. Greece, Italy). In a way, this perhaps discouraged countries like Greece from tackling their debt levels, (they were lulled into false sense of security).

- Increased Scepticism. However, after the credit crunch, investors became more sceptical and started to question European finances. Looking at Greece, they felt the size of public sector debt was too high given the state of the economy. People started to sell Greek bonds which pushes up interest rates) see: relationship between bonds and yields)

- No Strategy. Unfortunately, the EU had no effective strategy to deal with this sudden panic over debt levels. It became clear, the German taxpayer wasn’t so keen on underwriting Greek bonds. There was no fiscal union. The EU bailout never tackled fundamental problems. Therefore, markets realised that actually Euro debt wasn’t guaranteed. There was a real risk of debt default. This started selling more – leading to higher bond yields.

- No Lender of Last Resort. Usually, when investors sell bonds and it becomes difficult to ‘roll over debt’ – the Central bank of that country intervenes to buy government bonds. This can reassure markets, prevent liquidity shortages, keep bond rates low and avoid panic. But, the ECB made it very clear to markets it will not do this. (see: failures of ECB) Countries in the eurozone have no lender of last resort. Markets really dislike this as it increases the chance of a liquidity crisis becoming an actual default.

- For example, UK debt has risen faster than many Eurozone economies, yet there has been no rise in UK bonds yields. One reason investors are currently willing to hold UK bonds is that they know the Bank of England will intervene and buy bonds if necessary.

Uncompetitiveness

Eurozone countries with debt problems are also generally uncompetitive with a higher inflation rate and higher labour costs. This means there is less demand for their exports, higher current account deficit and lower economic growth. (The UK became uncompetitive, but being outside the Euro, the Pound could depreciate 20% restoring competitiveness. See more at Two speed Europe

Poor Prospects for Growth

People have been selling Greek and Italian bonds for two reasons. Firstly because of high structural debt, but also because of very poor prospects for growth. Countries facing debt crisis have to cut spending and implement austerity budgets. This causes lower growth, higher unemployment and lower tax revenues. However, they have nothing to stimulate economic growth.

- They can’t devalue to boost competitiveness (they are in the Euro)

- They can’t pursue expansionary monetary policy (ECB won’t pursue quantitative easing, and actually increased interest rates in 2011 because of inflation in Germany)

- They are only left with internal devaluation (trying to restore competitiveness through lower wages, increased competitiveness and supply side reforms. But, this can take years of high unemployment.

Individual Cases

Ireland’s debt crisis was mainly because the Irish Government had to bail out their own banks. The bank losses were massive and the Irish government needed a bailout to pay for their own bail-out

Greece. Greece had a very large debt problem even before joining Euro and before the credit crisis. The credit crisis exacerbated an already significant problem. The Greek economy was also fundamentally uncompetitive.

Italy’s debt crisis – long term structural problems. Very weak growth prospects. Political instability

Summary of Main Causes of Debt Crisis

- High structural debt before the crisis. Exacerbated by the ageing population in many European countries.

- Recession causing sharp rising in the budget deficit.

- Credit crunch causes losses for Commercial banks. Investors much more cautious and fearful of default in all types of debt.

- Southern European economies uncompetitive (higher labour costs) but can’t devalue to restore competitiveness. This causes lower growth and lower tax revenues in these countries.

- No Lender of last resort (like in UK and US) makes markets nervous of holding Eurozone debt.

- No effective bailout for a country like Italy.

- Fears of default raise bond yields, but this makes it much more expensive to pay interest on debt. e.g. cost of servicing Italian debt has risen meaning they will have to raise €650bn ($880bn) over next three years. It becomes a vicious spiral. Higher debt leads to higher interest rate costs making it more difficult to repay.

- It’s very difficult to leave the Euro

Update 2014

One issue has been helped. Action by the ECB has led to a fall in bond yields. This willingness to intervene in the bond market has calmed investors and led to lower bond yields. However, the economy remains stagnant with low growth.

Related

the problem with urezone is highly depend on tax as revenu and ,in contarting by using fiscal pocy problem to solve montary problem

The global economic crisis is biting everywhere. However, it seems that our politicians haven’t a clue how to deal with the many problems arising from the economic crisis. Maybe they need to turn to professional economic crisis specialists. For example, the Orlando Bisegna Index, specialists in the economic crisis, have helped various counties with debt problems, business failures and unemployment, so have helped the condition of families!